To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Bitcoin has dropped back below $90K as bears continue to defend the yearly open. It was a red session across the crypto market yesterday, with Bitcoin down nearly 3% and altcoins taking even heavier hits.

Risk-on sentiment is softening and shifting back toward equilibrium as investors prepare for next week’s interest rate decision. There is currently an 87% chance of a 25 bps cut. While markets are largely pricing it in, that does not mean the week ahead will be calm. Volatility is almost certain.

For the first time in five months, US consumer sentiment has improved. The metric surveys the public’s outlook on personal finances and the wider economy. A rise in sentiment is generally a positive signal and often comes before a lift in consumer spending, which puts more money into the system.

Following the recent FUD around Michael Saylor’s strategy after CEO Phong Le said they would consider selling Bitcoin as a last resort, MicroStrategy has responded. They have raised $1.44 billion and created a reserve to draw from for dividend obligations, which was the core concern. The company managed to raise 21 months’ worth of dividend obligations in just eight and a half days. This is a clear effort to push back against the speculation and prove their ability to raise capital even during a Bitcoin down cycle.

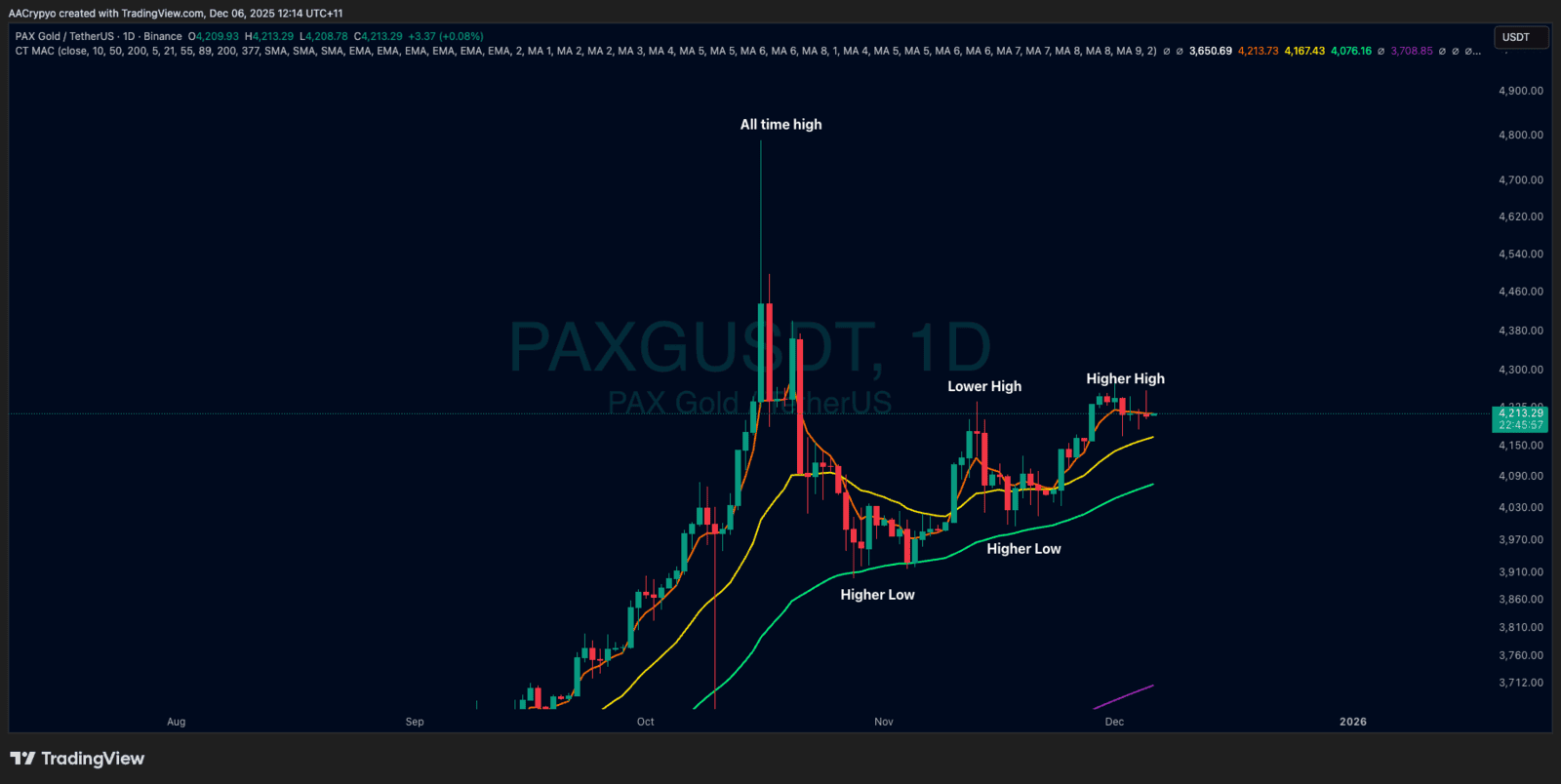

Stormrake Spotlight: Pax Gold (PAXG) ($4,213)

Stormrake Spotlight: Pax Gold (PAXG) ($4,213)