To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Overnight, we saw the first federal crypto bill officially signed into law in the United States, with Trump putting pen to paper on the GENIUS Act. It marks a major step forward for crypto regulation and a clear signal of growing adoption.

While signing the bill, Trump praised cryptocurrency, saying it "has gone up more than any stock" and is "only going further" under his administration. “You're gonna do really well.” Coinbase CEO Brian Armstrong, who has worked closely with Trump over the past year, expects more crypto-focused legislation to follow. He called the GENIUS Act “the official start of the financial revolution in the US.”

In another sign of growing institutional adoption, asset manager Charles Schwab (who oversee over $10 trillion in assets) announced they will soon launch Bitcoin and Ethereum trading services.

Former Twitter founder and long-term Bitcoin investor Jack Dorsey’s company Block (which supports peer-to-peer Bitcoin payments) is set to join the S&P 500. While not a direct blockchain or crypto-native firm, its inclusion marks another bullish step for adoption, now making its way into traditional financial powerhouses.

Yet despite all the bullishness around adoption, the price action didn’t follow through. Bitcoin is back below $118K after failing to sustain a move above $120K and retest the all-time high. XRP, which had rallied nearly 15% the previous day, gave back some gains and closed down 2%. Still, Ethereum shrugged off the pressure and ended the session 2% in the green — showing some resilience amid mixed sentiment across majors.

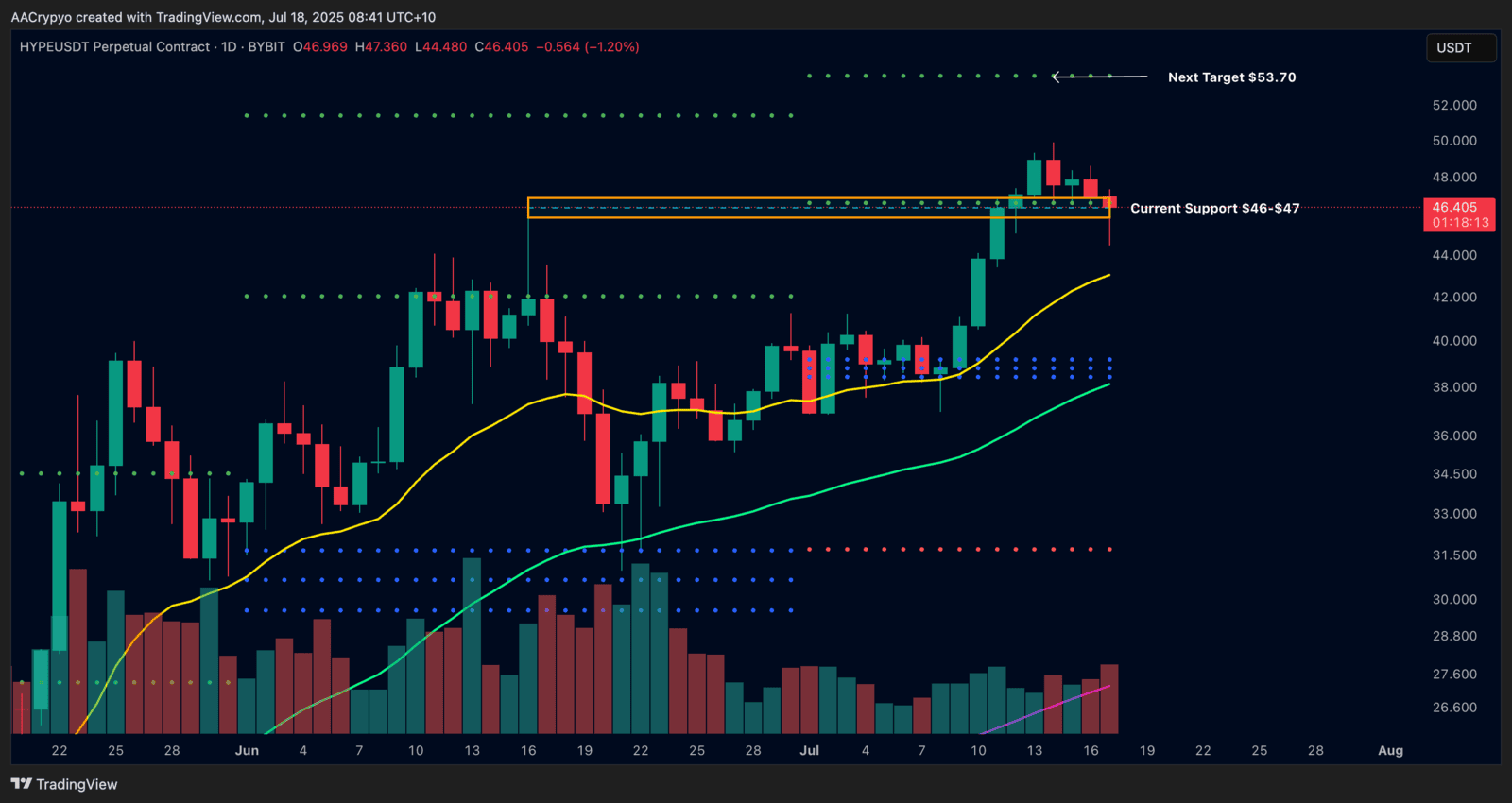

Stormrake Spotlight: Hyperliquid (HYPE) ($46.39)

Stormrake Spotlight: Hyperliquid (HYPE) ($46.39)