To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

The much-anticipated Crypto Week is already failing to deliver on what many expected. We were meant to see three bills aimed at crypto legislation pass and provide much-needed clarity within the space: the GENIUS Act, the CLARITY Act and the Anti-CBDC Act.

Overnight we saw the first vote occur, but the US House failed to advance all three bills with a vote of 196-223. Most Republicans voted in favour, but the no votes came predominantly from Democrats, with even some Republicans dissenting. Rep. Marjorie Taylor Greene, one of the Republicans who voted no, argued that the legislation didn’t go far enough to prevent the creation of a US CBDC. Greene posted on X following the vote:

“I just voted NO on the Rule for the GENIUS Act because it does not include a ban on Central Bank Digital Currency and because Speaker Johnson did not allow us to submit amendments to the GENIUS Act. Americans do not want a government-controlled Central Bank Digital Currency. Republicans have a duty to ban CBDC.”

There is still a push from Trump to get the GENIUS Act through and on his desk for signing this week. This means that instead of passing all three bills at once, they may now go through individually, providing a better chance of success.

Bitcoin has pulled back as a result, yet the move wasn’t felt evenly across the market. Bitcoin is down nearly 5% from its high on Monday, while Ethereum has pushed to new highs, up over 2% with Bitcoin down nearly 2% over the last 24 hours. Sui also continues to show strength, up nearly 5% over the same period. It’s a mixed bag considering Bitcoin’s price action, but this pullback is nothing to worry about — it should be seen as an opportunity for those looking to accumulate during a bull market dip. It also highlights the resilience within the altcoin market at the moment.

In other news, inflation data was released overnight. Core CPI month-on-month fell by 0.1%, headline CPI month-on-month came in as expected, and headline CPI year-on-year rose by 0.1%. With an interest rate decision due in two weeks, the probability of no cut now sits at 97.4%.

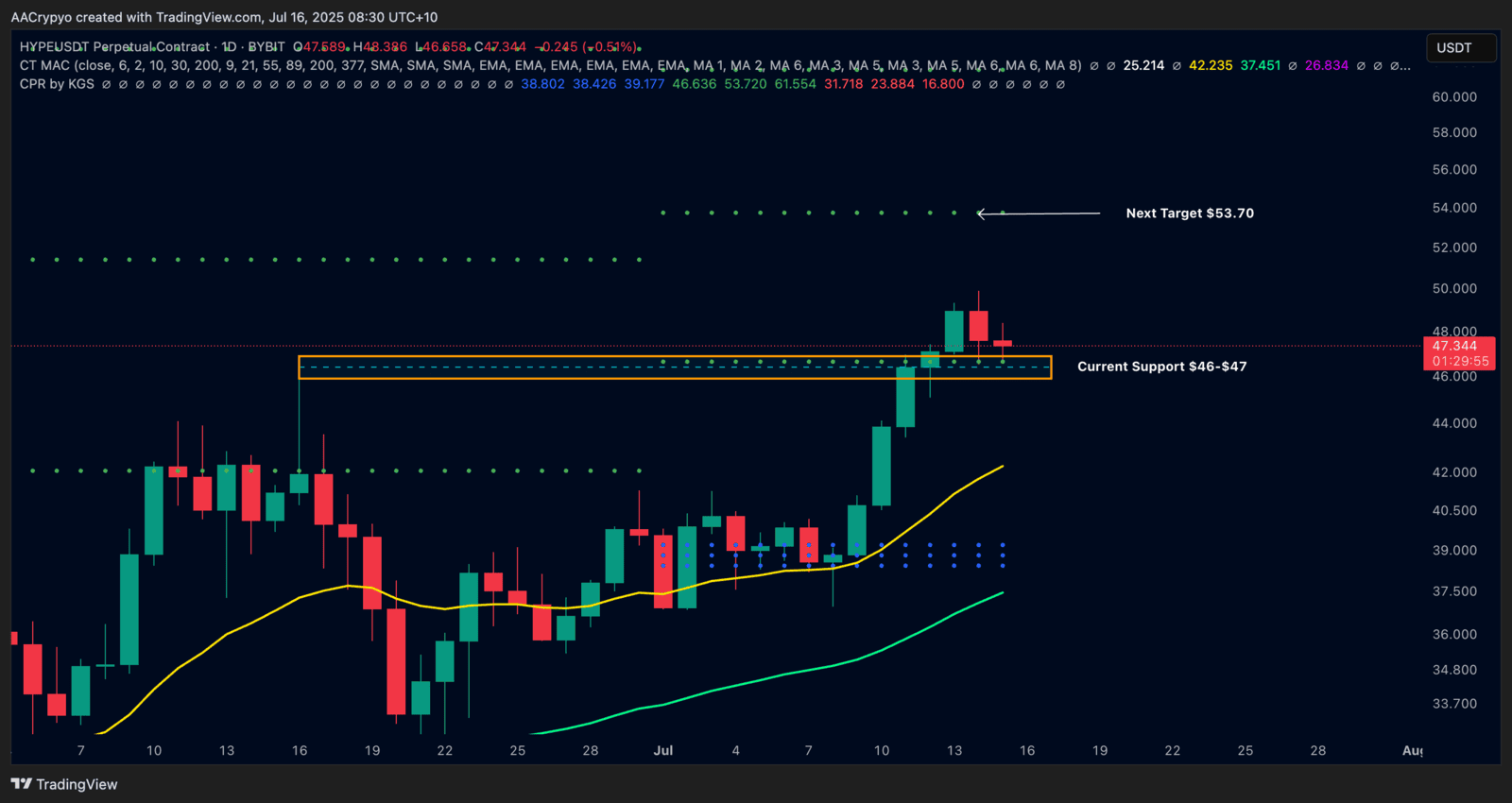

Stormrake Spotlight: Hyperliquid (HYPE) ($47.46)

Stormrake Spotlight: Hyperliquid (HYPE) ($47.46)