Macro Crosscurrents and Precious Metals Volatility

The last several sessions have delivered significant moves across asset classes. Precious metals, which had been trending strongly, have experienced sharp reversals. Silver in particular saw extreme short term volatility, with forced deleveraging evident across leveraged positions. Gold has also corrected meaningfully from recent highs.

These moves do not invalidate the role of precious metals. We remain constructive on gold and silver as long term hedges against currency debasement and systemic instability. Their role as monetary assets has endured for centuries.

However, the recent price action highlights structural characteristics that investors must understand:

1. Liquidity and execution are not uniform

Physical bullion markets do not operate with continuous price discovery and instant settlement in the way digitally native markets do. In periods of stress, spreads widen, dealer capacity becomes constrained, and transaction timelines extend. Investors relying on rapid execution may find the practical process slower than expected.

2. Paper price discovery vs physical settlement

Precious metals pricing is largely discovered in derivative and futures markets, while a large portion of investors hold physical product. This creates a structural disconnect between price formation and settlement mechanics during volatile periods.

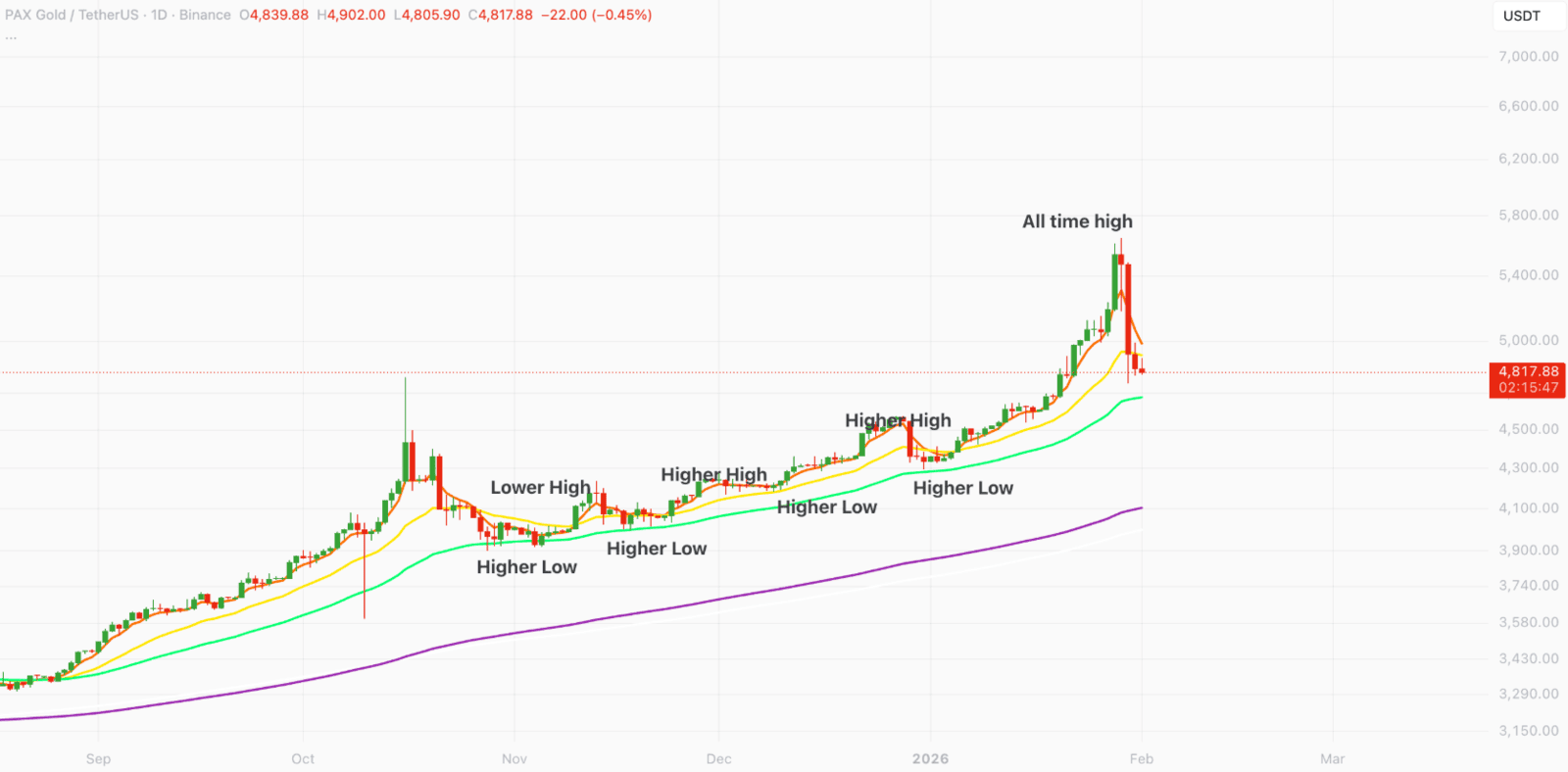

3. Parabolic advances carry reversal risk

When any asset appreciates rapidly over a short timeframe, positioning becomes crowded and leverage increases. Corrections in such environments tend to be sharp. This is not a criticism of the asset class. It is a function of market structure.

None of this suggests metals cannot stabilise or recover. Markets rarely move in straight lines. The point is risk management. Investors entering after extended rallies face a different risk profile than those accumulating over long cycles.

Relative Structure: Bitcoin in the Current Cycle

While metals have been correcting from strength, Bitcoin is in a different phase of its cycle. A meaningful portion of speculative excess was already cleared during earlier drawdowns. From a positioning perspective, this shifts the risk-reward profile.

Bitcoin’s market structure offers characteristics that differ from physical commodities:

Continuous global trading

Instant settlement and transferability

Deepening institutional liquidity

Increasing integration into portfolio allocation frameworks

These features do not eliminate volatility. They change how liquidity and execution behave under stress.

The current environment is therefore less about asset tribalism and more about structure and timing. Precious metals continue to serve a role as monetary hedges. Bitcoin increasingly functions as a digitally native counterpart with different settlement and liquidity mechanics.

For disciplined investors, the opportunity lies in allocation, not ideology. Assets move in cycles. Capital should be managed accordingly.

Key Takeaways

Corrections reward structure, not impulse

Precious metals remain valid hedges but exhibit execution and market structure limitations during stress

Parabolic moves increase reversal risk across all asset classes

Bitcoin is correcting from prior excess rather than from recent euphoria

Staged capital deployment remains the most rational approach

Markets are not about being early or late. They are about managing probability and preserving optionality. Invest accordingly.

Stormrake Spotlight: Pax Gold (PAXG) ($4,819)