To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Bitcoin is still waiting for that risk-on flow to properly enter the space. While crypto investors remain patient, gold continues to slide, losing another 1.61% over the last day. That capital flow instead keeps finding its way into traditional markets. The S&P 500 is now trading at fresh all-time highs, up 0.52%, and the Nasdaq keeps pushing deeper into record territory after another bullish session.

Bitcoin itself moved just $94 from open to close. The altcoin market cap edged higher while Bitcoin dominance dipped slightly, though it still sits near multi-year highs. Despite the muted price action, sentiment remains firmly in the greed zone with a reading of 65. Meanwhile, Bitcoin ETF inflows have been steady, which could be an early signal of what is to come.

Overnight, Trump called Bitcoin “amazing”, praising it for creating jobs and taking “a lot of pressure off the dollar” and saying it is “a great thing for our country.” He was not the only one to show support. The Crypto Czar David Sacks said “July will be a big month.” With ETF flows quietly climbing and key figures voicing their support, sitting on the sidelines now could mean missing what July may bring for Bitcoin.

In tariff news, Treasury Secretary Bessent confirmed a deal between China and the US. China will face a 30% tariff from the US, while Chinese tariffs on US goods stand at 10%. Trump also announced he is terminating all trade talks with Canada.

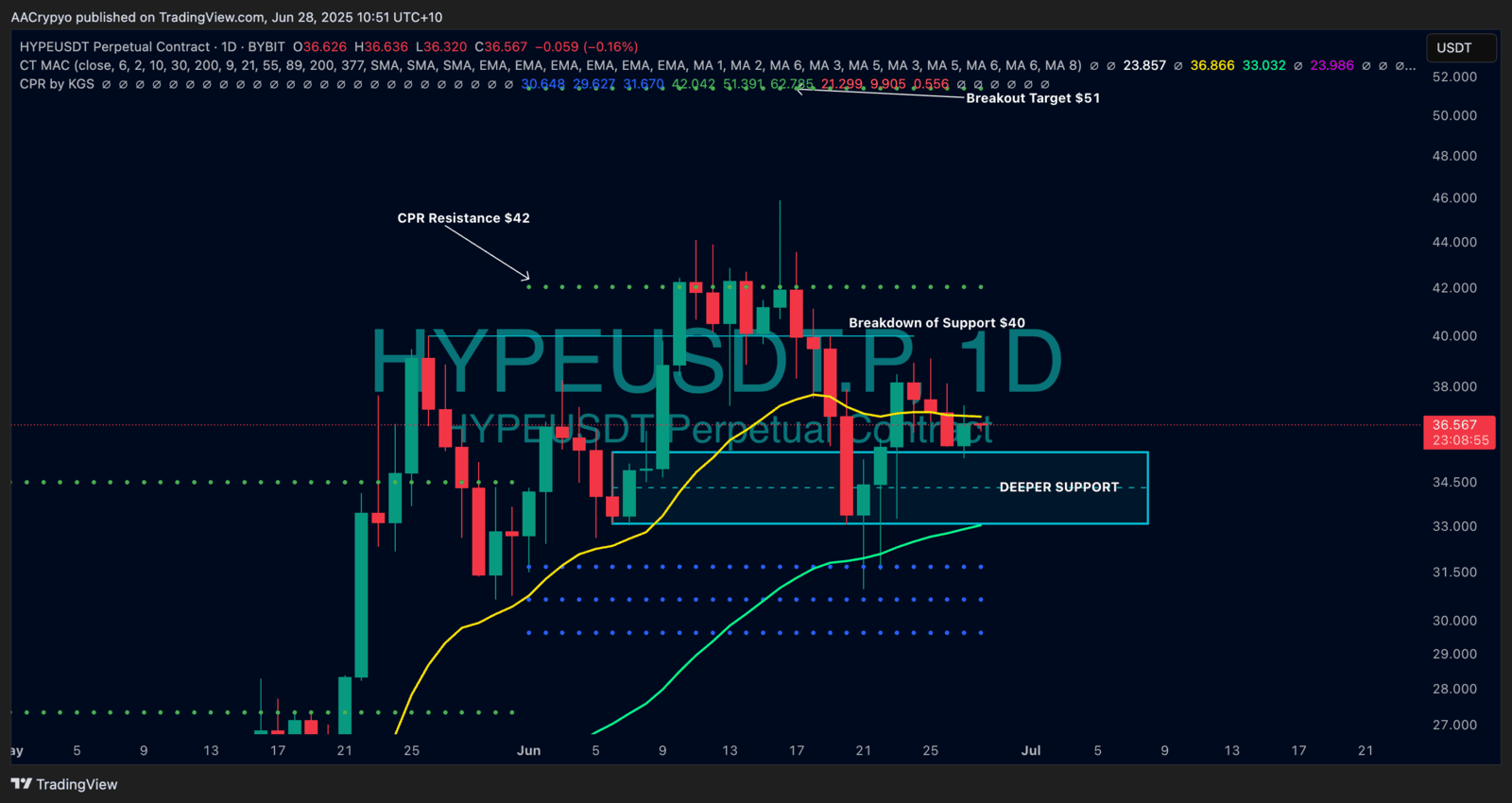

Stormrake Spotlight: Hyperliquid (HYPE) ($36.55)

Stormrake Spotlight: Hyperliquid (HYPE) ($36.55)