To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Last night Bitcoin was influenced by macro data and earnings from the traditional markets, which weighed on two of the main drivers of risk on sentiment. The FOMC and NVIDIA are two of the most influential forces in risk on markets. The FOMC dictates interest rates and NVIDIA, now the largest company in the market, has a major influence on how risk assets move.

FOMC Minutes

This morning’s release of the FOMC minutes covered everything discussed at last month’s interest rate meeting. We saw a 25 bps cut followed by Powell’s unexpectedly hawkish press conference. The minutes showed a 10 to 2 vote in favour of a 25 bps cut, with one member wanting no cut and another calling for a more aggressive 50 bps cut. The discussions were far more divided than the vote suggests.

Officials disagreed on what poses the greater risk, whether it is weakness in the labour market or persistent inflation. The government shutdown also complicated matters, with Powell describing the situation as like driving in the fog because key data was not being released during that period.

The minutes have injected fresh uncertainty into the path forward. Overnight the probabilities for December’s rate decision flipped. Markets now imply a 67% chance of no change and a 33% chance of another 25 bps cut. Yesterday, before the minutes were released, markets were pricing a 55% likelihood of a cut.

This represents a sharp turnaround from a couple of months ago when markets expected three cuts totalling 75 bps across the final two meetings. We now look set to get only one cut for the entire year. This is quite remarkable considering that late last year many investors expected as many as five. Rates will have to come down eventually so it is not the end of the world for risk on assets that usually benefit from lower rates. This year has simply been weighed down by tariffs, macro uncertainty and most recently the government shutdown.

NVIDIA Earnings

Traditional markets focused on NVIDIA’s earnings and as expected they exceeded forecasts. The stock rallied nearly 2% during the session and added another 3% in after hours trading once the results were released.

This lifted futures for both the S&P 500 and the Nasdaq. Both appear set to break their short term down trend and potentially resume a bullish move. The earnings result also eased concerns that the artificial intelligence bubble is about to burst.

Bitcoin Reaction

Bitcoin has not shared in the broader risk on rally. It once again retested the key level at $88,888 and once again it held. This is a constructive sign for the bulls and may offer short term support and a temporary bottom.

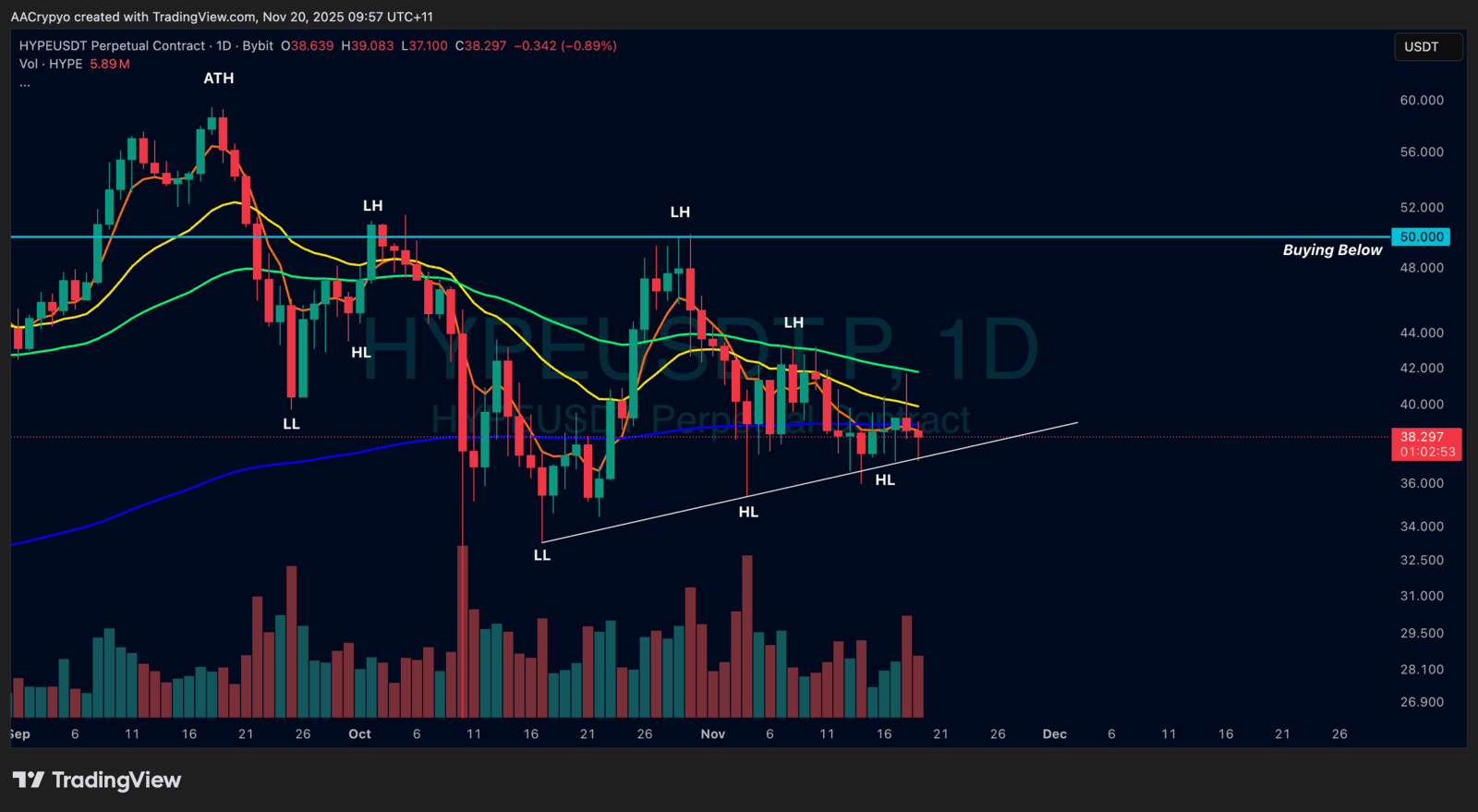

Stormrake Spotlight: Hyperliquid (HYPE) ($38.29)

Stormrake Spotlight: Hyperliquid (HYPE) ($38.29)