To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Just a month ago Bitcoin had dropped to $80,000 and many were expecting lower prices. The bears had reached exhaustion, giving the bulls a chance to form a floor and potentially flip 2025 back into the green. While that floor has held, the bulls have not been able to reclaim the year. Every rally has failed and Bitcoin has spent most of this month consolidating around $88,000.

With two of December’s biggest macro events now behind us, the US Federal Reserve rate cut and the Bank of Japan rate hike, neither managed to shake Bitcoin from its range. Buyers remain sidelined, sellers have eased off, and consolidation looks set to continue.

This Friday or Saturday marks the final Bitcoin options expiry of 2025.

Options are financial contracts that allow traders to speculate on where they believe Bitcoin will be priced by a specific date. This is known as the strike price. They give the holder the right but not the obligation to buy or sell Bitcoin at that strike price before expiry.

When a large number of contracts expire at the same time, markets often see a rise in volatility as positions are closed, settled or rolled into new maturities.

Options are commonly used for hedging. For example, if someone holds spot Bitcoin but expects price to fall, they may buy a put or sell a call to protect the downside. This allows them to maintain exposure while still capturing value from a potential decline. That is just one strategy. Others include positioning for higher prices, lower prices, or changes in volatility.

As the final expiry of the year approaches, increased price movement is likely. Over $23 billion worth of Bitcoin options contracts are set to expire, making this one of the largest expiries of the year. A large amount of open interest is clustered around a max pain zone between $96,000 and $98,000. This is the price range where the highest number of contracts would expire worthless.

This does not make the event inherently bullish or bearish, but it does raise the likelihood of volatility. Traders may attempt to push price in favour of their contract direction. While bulls may try to lift price toward the $96,000 to $98,000 area, the broader market structure still leans bearish, meaning any upside move may face resistance.

In summary, expect volatility but not necessarily a clear directional move.

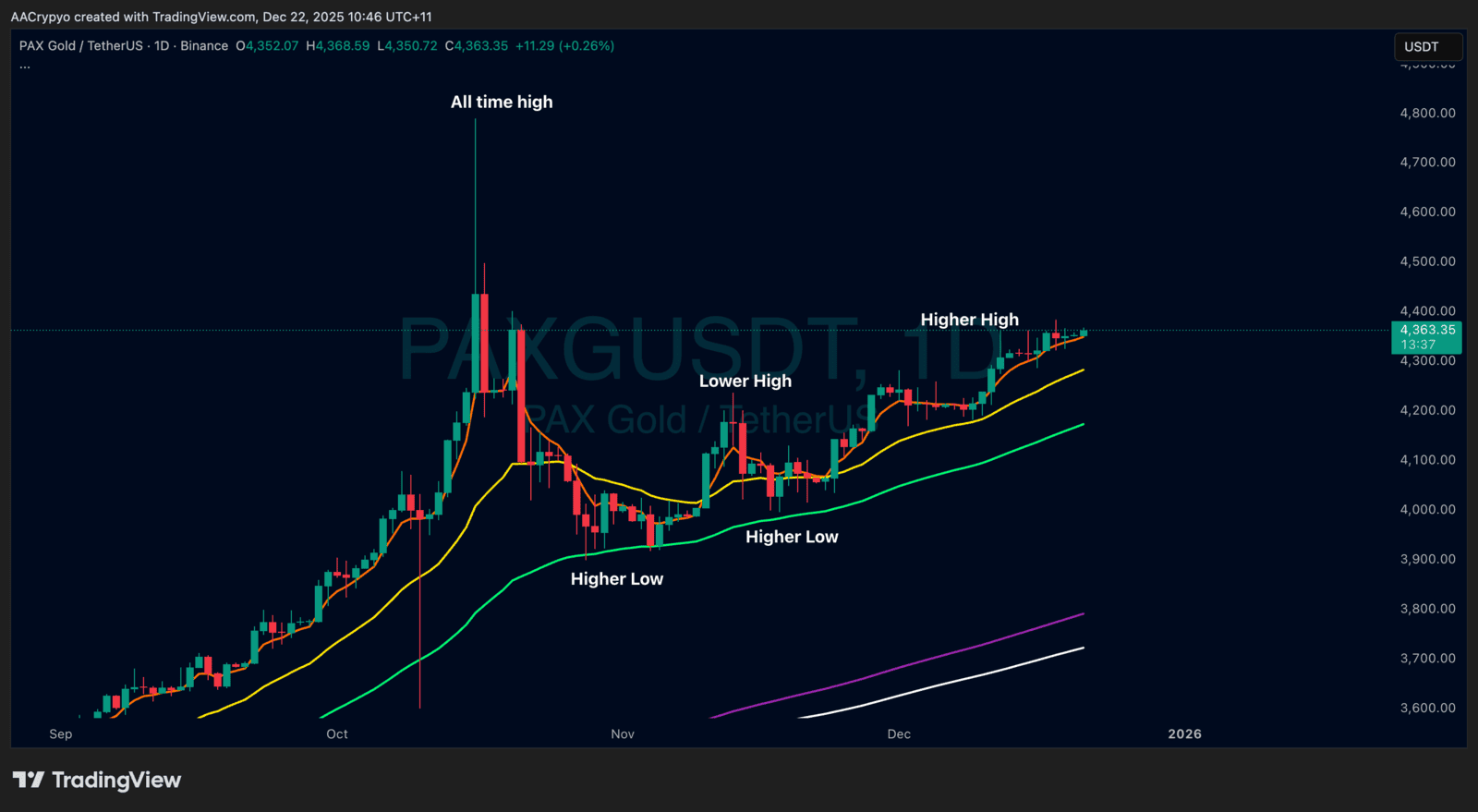

Stormrake Spotlight: Pax Gold (PAXG) ($4,363)

Stormrake Spotlight: Pax Gold (PAXG) ($4,363)