To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Risk on and bullish flows remain extremely strong but continue to stay focused within the traditional space. Silver has dominated the past 24 hours, up over 3% and printing fresh highs. Gold is up more than 1% and edging back toward its all time high. At this point, the opening of every note could be a copy and paste — the S&P500 and Nasdaq have once again posted new all time highs and continue to lead.

Meanwhile Bitcoin waits patiently for risk on appetite to rotate out of traditional markets and into digital assets. BTC lost just over 1% yesterday and remains stuck in its consolidation range, while altcoins also pulled back, with the total altcoin market down more than 2%.

Heading into the weekend, we can expect more ranging and chop for Bitcoin as markets digest the bullish catalyst of the first rate cut of the year. The crypto market continues to wait for flows to move out of the traditional space and back into crypto. While we wait, Bitcoin should hold its consolidation but still favor the bulls into the back end of the month. A new all time high before the end of September is not out of the question, especially as we head into what should be an incredibly bullish Q4.

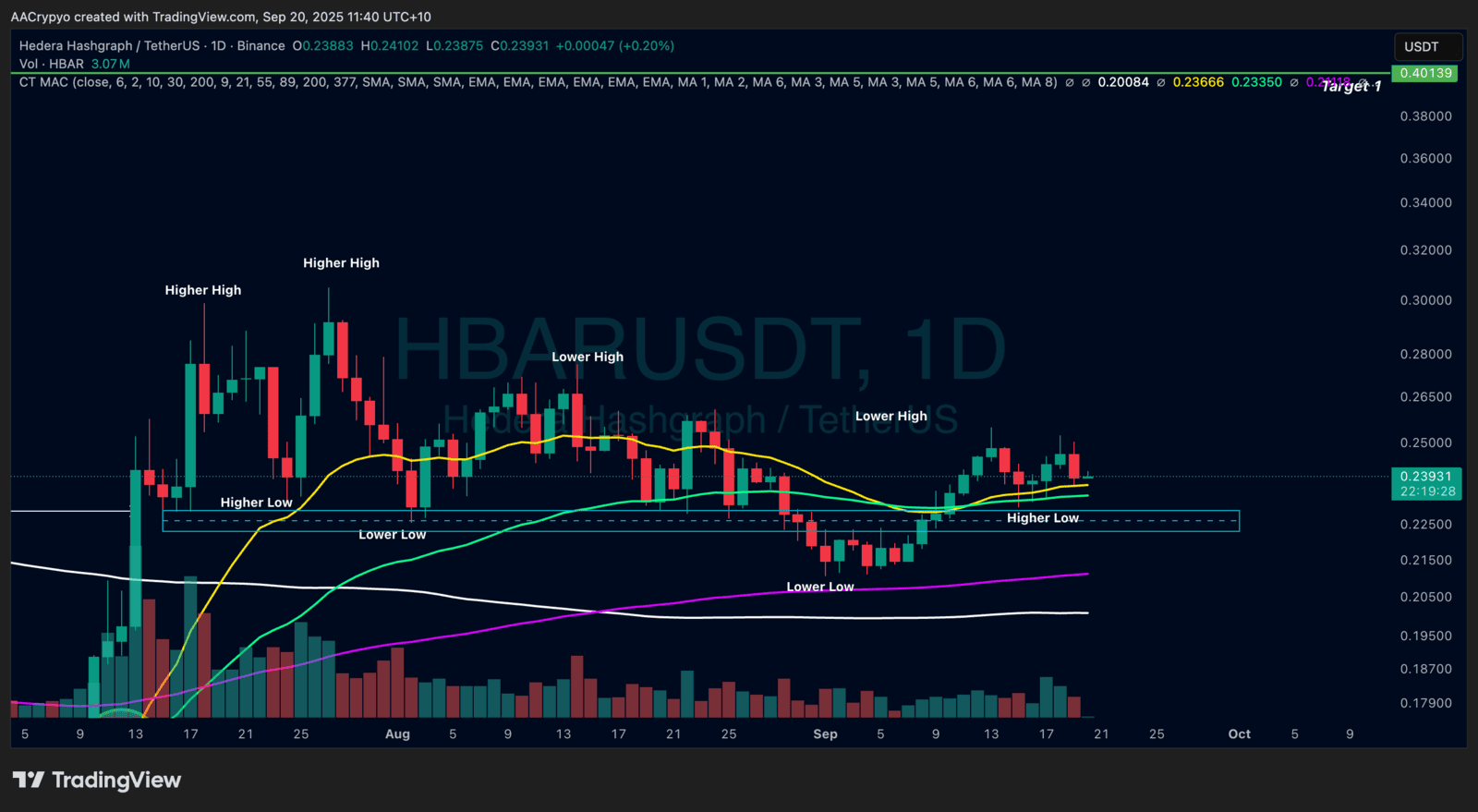

Stormrake Spotlight: Hedera (HBAR) ($0.239)

Stormrake Spotlight: Hedera (HBAR) ($0.239)