To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Bitcoin has now posted its second consecutive red day, closing down just 1.10%. In contrast, traditional markets continue to rally as earnings season kicks off, with Nvidia taking control and pushing indices to fresh all-time highs. Risk appetite is building across the board, and while equities are pushing higher, gold has come under heavy pressure. It’s now down over 10% from its all-time high set just last week, officially entering correction territory.

There are generally three phases of negative price action in traditional markets: a pullback, a correction and a bear market. A pullback is typically short and shallow, with price retracing between 0 and 10%. A correction lasts longer, often several weeks, with a retracement between 10 and 20%. A bear market starts once losses exceed 20% and tends to last months at a minimum. Gold now sits firmly in that correction range. It’s a sharp contrast given it was printing new highs just over a week ago, but this doesn’t necessarily signal the end of its rally. After such strong performance this year, a retracement of this kind looks like profit taking and rotation rather than a structural shift.

Despite the decline, gold remains up nearly 50% year-to-date. Smart money appears to be rotating out of defensive assets and into risk, with macro conditions showing signs of stabilising and geopolitical tensions cooling. The shift is being reinforced by Nvidia, which announced a series of key partnerships during the US session including Palantir, Nokia, the US Department of Energy, Samsung and Hyundai. Nvidia rose nearly 5% on the day, while some of its partners posted significant gains, Nokia climbed over 20%.

The broader takeaway is that markets are decisively risk-on, but that flow is concentrated in the traditional space for now. Crypto remains largely sidelined. Since the 11 October liquidation event, spot Bitcoin ETFs have continued to see net outflows. Until ETF inflows return and retail steps back in, crypto is unlikely to benefit from the current macro tailwinds.

Markets are now looking ahead to tomorrow’s FOMC interest rate decision (5am AEST). There is a 99.5% probability of a 25bps cut and just a 0.5% chance of a 50bps cut. The 25bps move is fully priced in, so it’s unlikely to move markets on its own. However, if the Fed surprises with a 50bps cut, expect risk assets to rocket higher. On the flip side, a hawkish surprise or a hold would likely trigger a broader pullback, sending flows back into gold. While both scenarios are unlikely, it’s important to be aware of the full range of outcomes.

As mentioned yesterday, the more important event will be Powell’s press conference, 30 minutes after the rate decision. His tone, dovish or hawkish, will set the direction for markets heading into year-end and could provide clarity on the final rate decision in December.

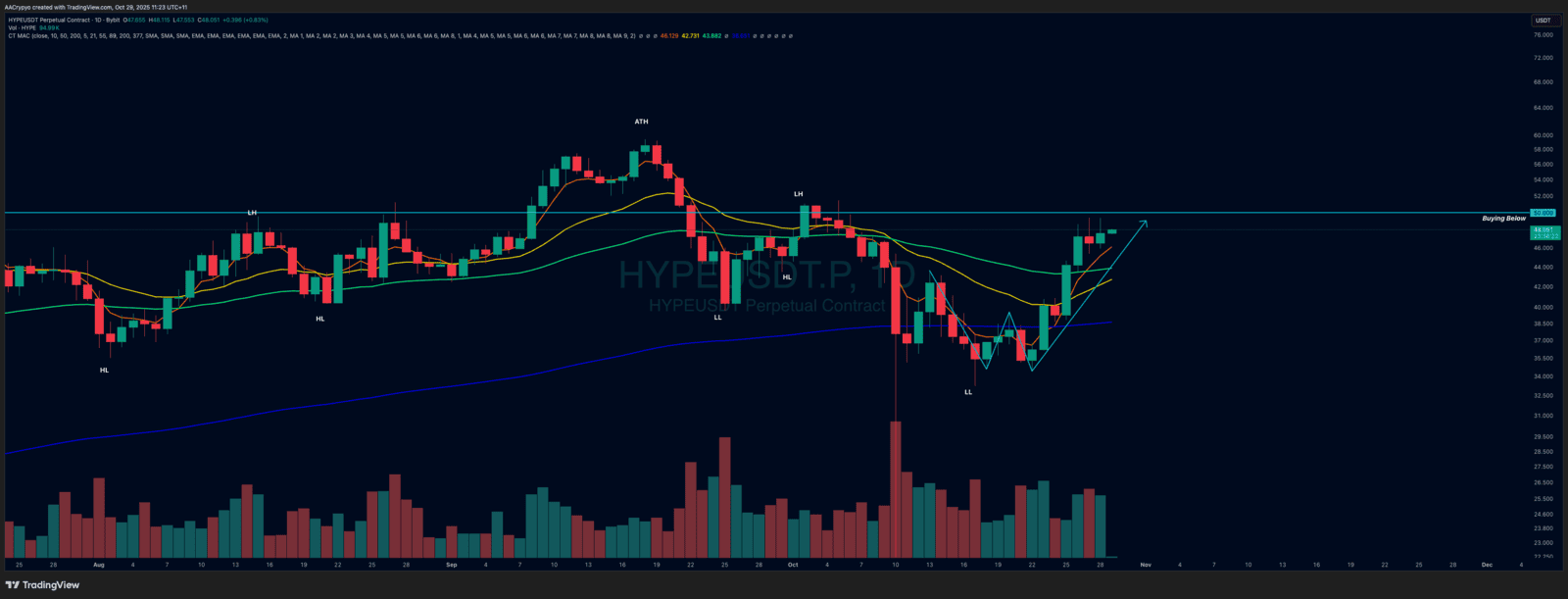

Bitcoin’s slight pullback has been felt across altcoins, with most of the market trading lower. Ethereum is back below $4,000 and down over 3%. Solana is below $200 and down more than 2%. Hedera (HBAR) was the outlier, up over 5% after its spot ETF went live and saw its first day of trading. Hyperliquid (HYPE) also stood out, closing green and continuing to show relative strength against the broader market.

Stormrake Spotlight: Hyperliquid (HYPE) ($48.05)

Stormrake Spotlight: Hyperliquid (HYPE) ($48.05)