To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

November has not started well for any asset class. Both risk on and risk off markets are trading lower as sentiment takes a clear step back. Bitcoin has fallen below $100K and is down nearly 5%, gold is down close to 2%, and the S&P 500 is off by over 1%. With both ends of the spectrum falling, the question is simple: where is capital rotating?

Amid growing fears of an AI and tech bubble in traditional markets, investors are skipping the usual shift into gold and moving straight back into the US dollar. The DXY is now trading at its highest level since August and looks set to break higher as concerns of a broader market correction intensify. Of the Magnificent Seven, only Apple managed to stay in the green overnight.

With Bitcoin trading at its lowest level since June, there is a clear lack of buying interest from the broader market. The risk off pivot has been damaging to Bitcoin’s bullish outlook. Instead, we are seeing a rotation into the dollar and a tightening of liquidity, which is being worsened by the ongoing US government shutdown.

Now into its 36th day, the shutdown is the longest in US history. It has halted economic data releases and disrupted the Treasury General Account (TGA), which handles the spending and distribution of government funds. Around 60 to 70 million Americans are being affected — including those dependent on food stamps, government contractors, essential workers and many more. As the cost of living rises and income dries up, many are being forced to sell their assets to cover basic expenses. With crypto being a 24 hour liquid market, it has been an obvious target for these sell offs, contributing to consistent downward pressure.

The TGA build up has pulled approximately $700 billion from markets since October. When the shutdown eventually ends, we can expect these funds to flow back into the market, which should include renewed strength in the crypto space.

This is the type of environment where smart money starts quietly accumulating Bitcoin and undervalued altcoins.

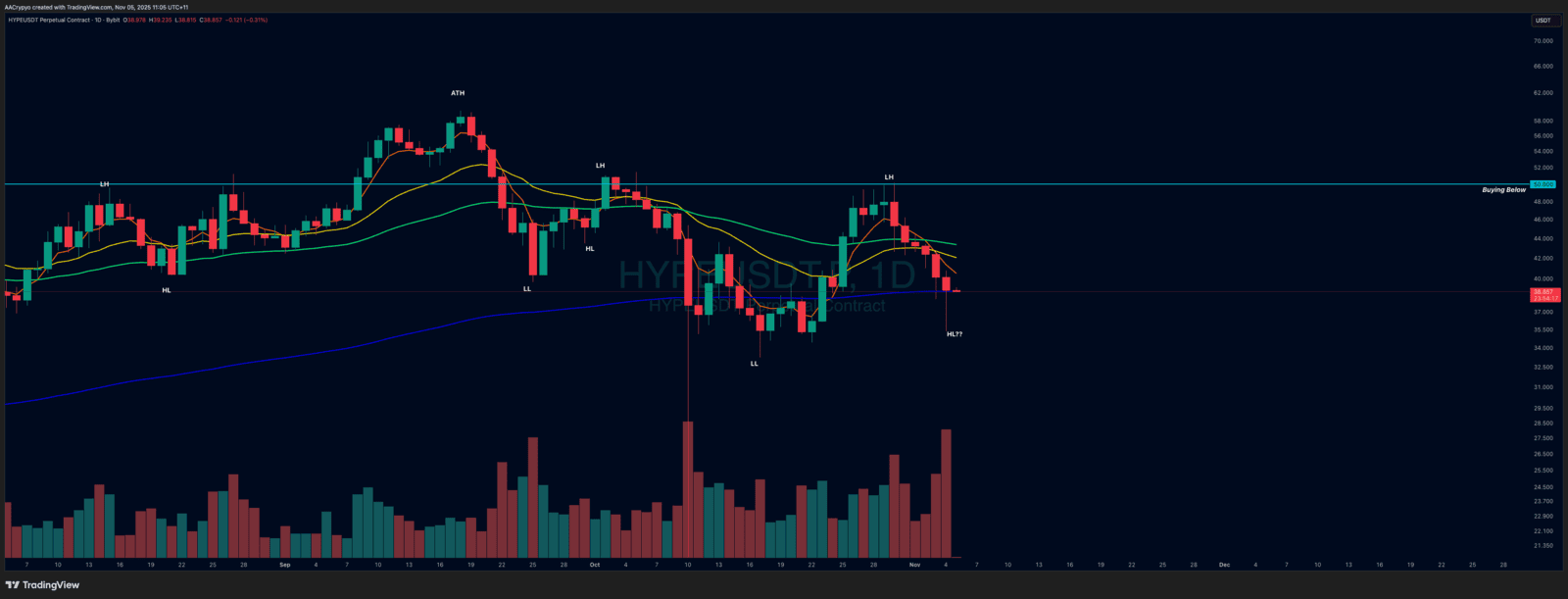

Stormrake Spotlight: Hyperliquid (HYPE) ($39.86)

Stormrake Spotlight: Hyperliquid (HYPE) ($39.86)