Bitcoin has just had its worst day since the October 10 liquidations. It closed over 5% down and is now trading below $95K, where the majority of the selling is taking place. Major altcoins are also in the red but have not fallen as much as Bitcoin over the last 24 hours. That is not a sign of altcoin outperformance. Zoom out and you will see altcoins have struggled for most of the year. Do not get distracted by short periods where they fall less than Bitcoin.

Yesterday we highlighted the yearly open at $93.5K as the next level of interest. We have almost reached that level, much quicker than expected, which speaks to the strength of the bears and the current lack of confidence across the crypto market. Bitcoin ETFs continue to see outflows and sentiment is near record lows. The Fear and Greed Index is sitting at 10, one of the lowest readings ever recorded.

Historically, when the index hits 10 or lower, it often marks the bottom or a bottom forming within the next few months.

Historical Fear and Greed readings at 10 or lower:

Present day (10): Bitcoin at $95K

27 February (10): Bitcoin at $85K, bottomed at $75K in April

June 2022 (7): Bitcoin around $25K, bottomed at $15K in November

May to July 2021 (multiple readings of 10): Bitcoin ranged from $30K to $36K before bottoming in July

March 2020 (10): Bitcoin at $6K and bottomed in the same month

Over the last five years, each time the index has reached 10 or lower, a bottom has formed that month or within the next few months. That does not guarantee $95K is the bottom. We may continue lower and the current momentum suggests that we do. But it is a strong signal that the bottom could be forming over the next few months. This is not the time to panic with the crowd. If anything, it is a time to start thinking about accumulation.

Bitcoin has now fallen back below the weekly 50/55 EMA. This is a key structural indicator of whether the market is in a bull or bear phase. It is the first time price has moved below it since April 7. Back then we saw an intraweek reversal and Bitcoin went on to hit new all time highs in the months that followed. This week’s candle closes Monday at 11am. For Bitcoin to avoid closing below the 50/55 EMA and potentially confirming a bearish trend, it must reclaim around $99K before then. We will revisit this after the close on Monday to assess what it means going forward.

It is an interesting time. Sentiment is at one of the lowest points in five years, a strong contrarian signal that usually suggests a bottom is close. But the technical structure is weak and the bears are clearly in control. Both sides have a case. We are now waiting to see who takes control...

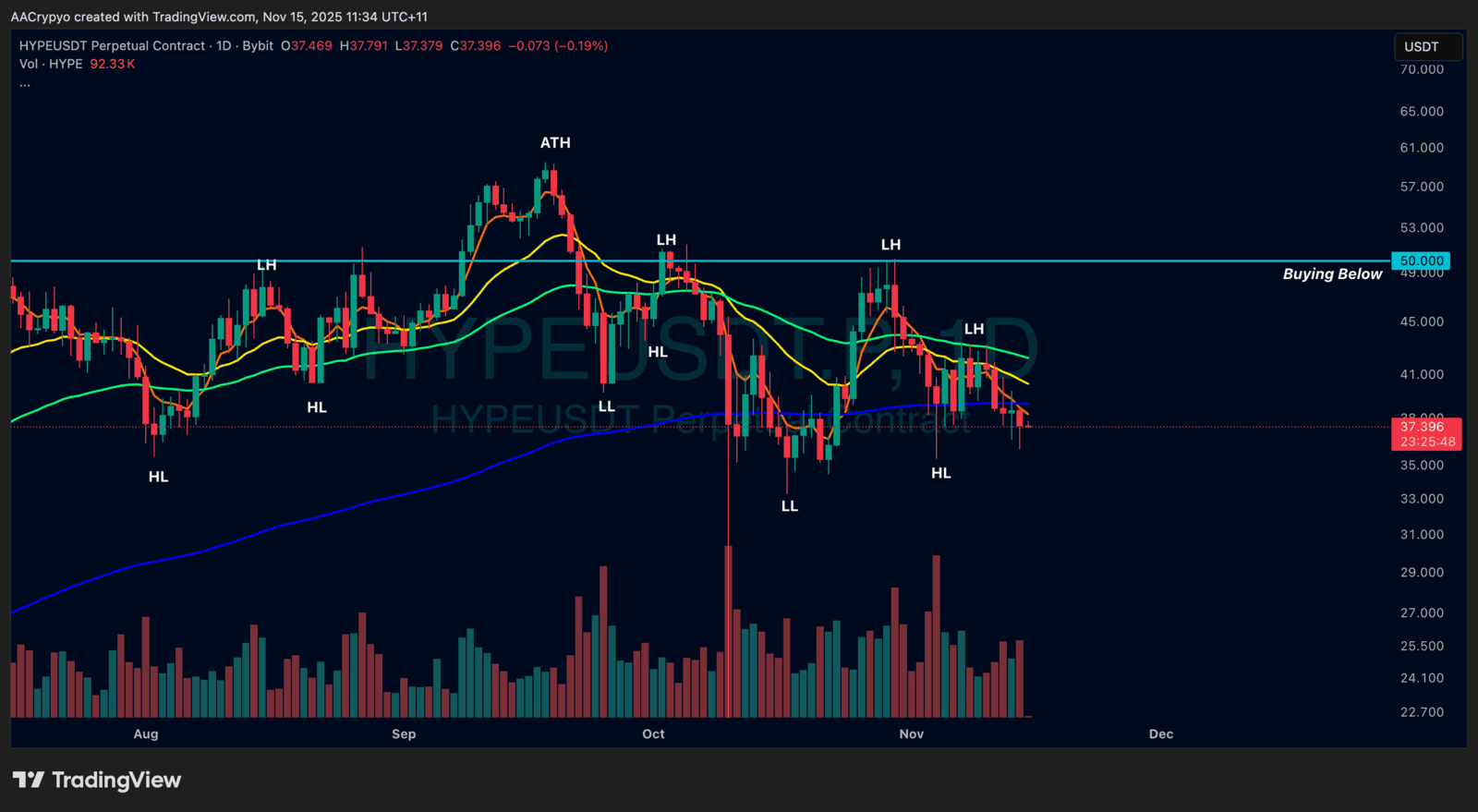

Stormrake Spotlight: Hyperliquid (HYPE) ($37.38)