To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Bitcoin has bounced back over the last 24 hours and is now retesting $120K, but it's Ethereum that continues to dominate and steal the show. Bitcoin’s lack of price movement since setting its all-time high could be a result of investors rotating into Ethereum and other altcoins.

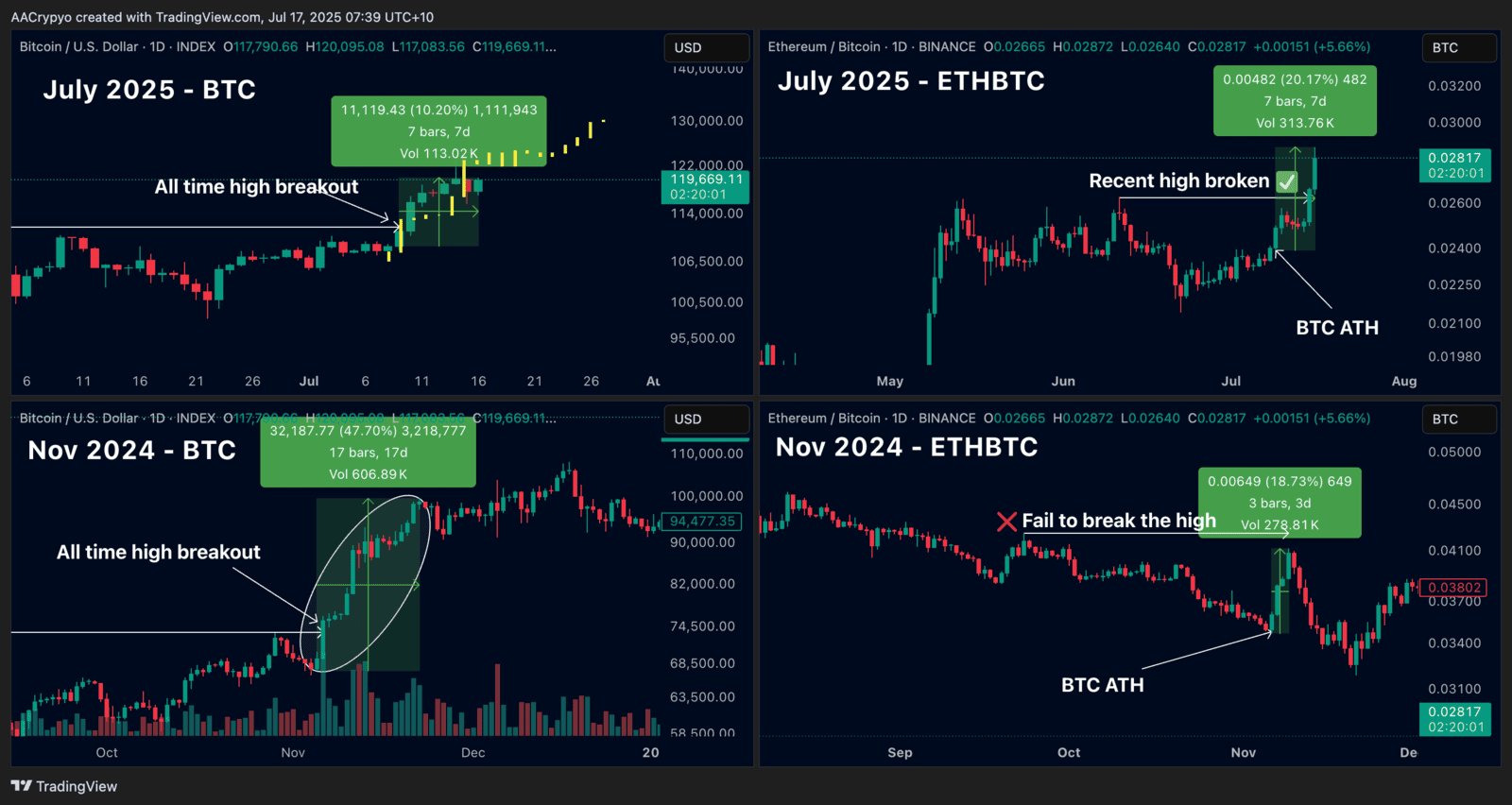

The last time we saw a similar breakout in Bitcoin was back in November, following Trump’s election victory. At the time, Bitcoin was hovering just below its all-time high and struggling to break above $74K — until post-election momentum kicked off a major rally, pushing the price nearly 50% higher over the following weeks. We’re now seeing a similar setup. While this move isn’t quite as large, Bitcoin had again been consolidating beneath its all-time high before finally breaking out and continuing higher.

Bitcoin did pull back slightly, dropping almost 5% from its all-time high on Monday. But we saw something similar in November too. After six consecutive bullish days, Bitcoin retraced around 5% from its then all-time high at $89.6K back to $85K before rallying further over the next week and a half. The current structure is tracking closely — Bitcoin dipped from $123K to $115.7K, offering an opportunity for active traders to accumulate during the pullback. If this rally continues to follow November’s pattern, albeit on a smaller scale, we could see Bitcoin pushing toward $130K in the coming weeks.