To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

When it comes to macro data, Bitcoin is not always directly affected. However, there are a handful of releases that consistently influence price action, with inflation data being the most widely followed. That said, studies and historical analysis show that Bitcoin has displayed its strongest correlation with the US ISM Manufacturing PMI.

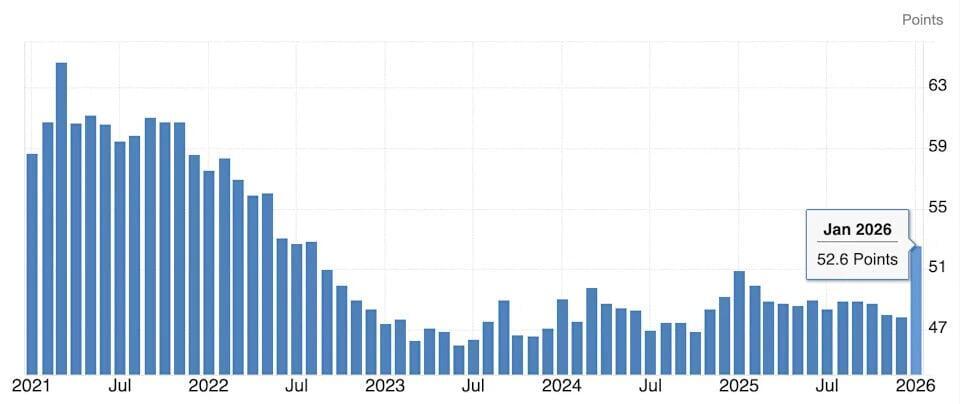

The ISM Manufacturing PMI is a monthly economic indicator that measures the health of the US manufacturing sector. A reading above 50 signals expansion, while a reading below 50 indicates contraction.