To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Bitcoin sentiment has officially slipped into fear after dropping back below $113K. Timelines on social media have turned bearish, with almost every major X profile calling the top, saying we’re entering a bear market, and posting the classic “see you next cycle”. Many are comparing this move to the 2021 top. Is there some validity to that argument? Of course. But it’s important to remember that most of what you see online is built for engagement. The more dramatic the post, the more interaction it generates.

There’s no denying the short-term outlook for Bitcoin is bearish. This pullback came just days after a new all-time high, and the fact that the new high was only marginally above the previous one has added fuel to the bear case. Still, the higher time frame remains intact. Bullish momentum is clearly fading and bears are gaining confidence, but structure remains bullish as long as price holds above the early August low at $112K. Until that level breaks and we get a confirmed shift in market structure, there’s no real cause for panic.

This wasn’t just a crypto-led drop either. While crypto has pulled back more sharply, traditional risk-on markets also had a tough session. The S&P 500 and Nasdaq both suffered their worst day in nearly three weeks.

The bigger picture hasn’t changed for now. These are the moments when conviction pays off. Emotional decisions in markets almost always lead to poor outcomes. Traditional markets are still trading close to all-time highs. The core drivers of the bull run are still in place — rising global liquidity, easing inflation, and the expectation of rate cuts. It’s difficult to call for a proper bear market in these conditions.

For those looking to take advantage of the dip, now may be the time to start planning entries. Bidding at key support levels that are likely to attract smart money is a proven strategy. Consider using parcels instead of deploying full size. That allows you to stay flexible in case price pushes lower, while also giving room to scale into strength if bulls regain control.

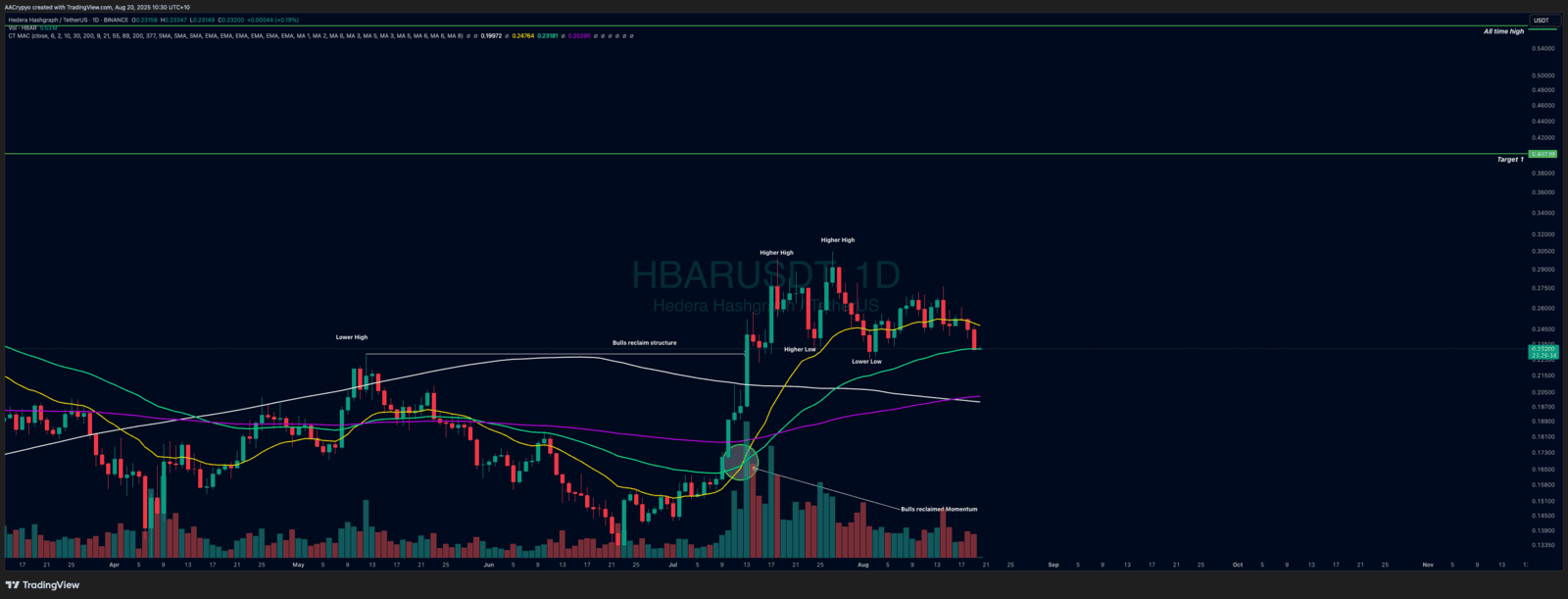

Stormrake Spotlight: Hedera (HBAR) ($0.232)

Stormrake Spotlight: Hedera (HBAR) ($0.232)