To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Waking up this morning, Bitcoin is back at $112K and has bounced over 3% from the weekend low. The question now is simple: is the low in?

On Saturday, altcoins managed a brief relief rally while Bitcoin was still finding its footing around $109K. But late last night, BTC finally caught up. Since 11pm, 10 of the last 11 hourly candles have been green, locking in a much-needed higher low and shifting short-term momentum back in favour of the bulls.

Sentiment has seen a sharp reversal. On Friday night, the Fear & Greed Index was on the edge of extreme fear. Today, it has climbed to 50, sitting in neutral territory. That kind of improvement in just a couple of days is incredibly promising and supports the idea that we may have seen the low and could now be on the way up.

Last week’s drop was largely driven by liquidations and manipulation around options expiry. These are not sustainable drivers and more often than not, moves caused by them are quickly reversed. As we continue to stress during these pullbacks and periods of panic, these are the times that often present the best opportunities to pick up undervalued altcoins that have been hit hard during the selloff.

This weekend has once again proved the point. Ethereum is up nearly 8% from its low, Solana is up almost 10%, and Hyperliquid, which took the biggest hit last week due to the Aster release, has bounced nearly 20%. While these names have rallied over the weekend, they are still trading below their prices from earlier this month and could still be seen as undervalued, sitting within a clear accumulation window.

As September comes to a close, Bitcoin remains green on the month despite the volatility and historical underperformance often seen during this period. It has flushed out billions of dollars in overleveraged positions and that cleanout should be viewed as a positive development. It clears the runway for more natural price action and sets Bitcoin up for what could be a very bullish final quarter of 2025.

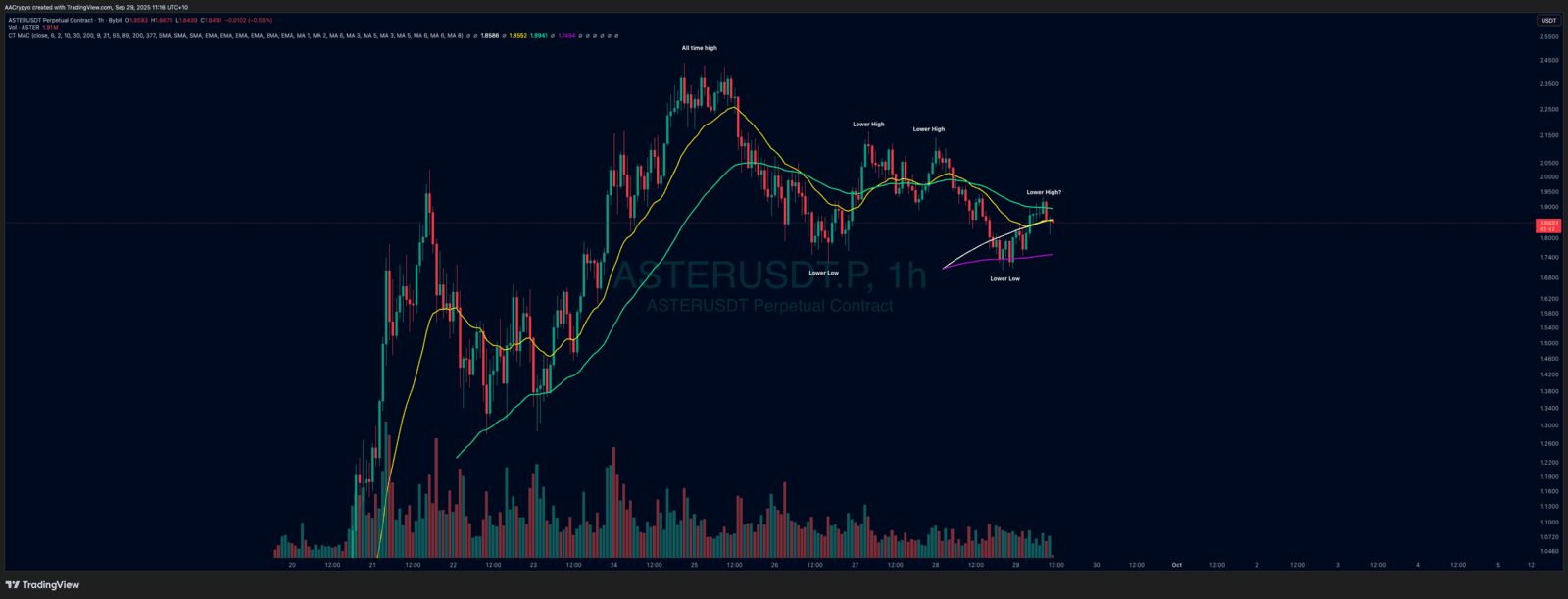

Stormrake Spotlight: Aster (ASTER) ($1.84)

Stormrake Spotlight: Aster (ASTER) ($1.84)