To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Just 24 hours after printing a new all-time high at $126K, Bitcoin has seen its first meaningful pullback since the rally began at $109K. It dropped nearly 5% from the high, but has since bounced and is now trading around $122K. BTC is down 2% on the day, recovering from a low of $120.5K. So, is the pullback done?

This is the pullback we have been expecting and what Bitcoin needed. The run from $109K to $126K came with virtually no correction, and this pause acts as a healthy reset for the market. Over $500 million in leveraged positions have been wiped out, clearing excess risk before it builds into something more dangerous. The fact it is happening now, rather than later in a more extended move, reduces the risk of a sharper correction down the line.

While there is a chance the pullback continues, there is a strong argument that the low is in. Bulls may now look to regain control and make another attempt at the highs. That said, a dip to $118K would still sit comfortably within the bullish structure we highlighted earlier this week.

This was not just a crypto-specific move either. The S&P 500 snapped its seven-day winning streak, Nasdaq closed lower, and even Silver pulled back, which was surprising given Gold pushed higher in a clear risk-off move. Markets are starting to price in growing uncertainty surrounding the US government shutdown and broader macro concerns. While the shutdown itself did not move markets when it occurred, investors are increasingly unsure about the potential fallout and what lies ahead in terms of policy and economic data.

We now enter the macro-heavy part of the week. Jerome Powell is set to speak tomorrow night and we will finish the week with two sets of unemployment data. Volatility may continue, but for now this is still just a pullback.

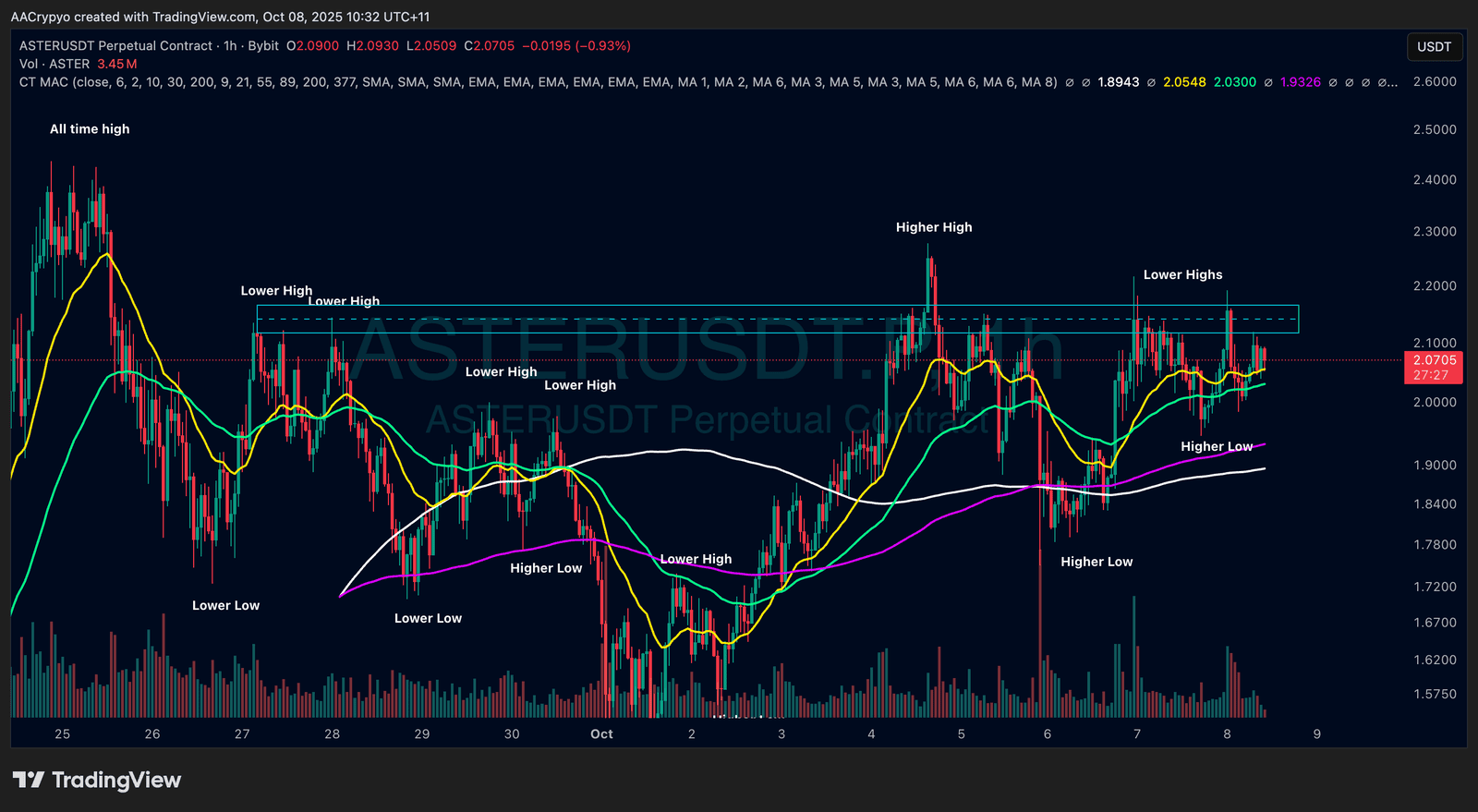

Stormrake Spotlight: Aster (ASTER) ($2.07)

Stormrake Spotlight: Aster (ASTER) ($2.07)