To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

The last time we saw stimulus checks hit the general population, risk-on markets soared to new all-time highs following a black swan event in Covid. Bitcoin went from $3K to $69K, the S&P 500 moved from 2,200 to 4,800, and now the US President has proposed a new round of stimulus payouts in the form of ‘Tariff Dividends’.

Tariff Dividends would see $2,000 distributed to everyone except high-income individuals in an attempt to reduce the $37 trillion debt and encourage domestic investment. Combine this with the likely reopening of the US government this month, which should see the Treasury General Account resume payments to employees, contractors and benefit recipients, and we could see a major influx of cash re-enter the economy. While some of this will go towards cost of living, there will be those who previously sold off investments to cover expenses who may now look to reaccumulate, which in turn could push asset prices higher.

Bitcoin has not only held the range we identified yesterday but has broken above $104K, which is a strong signal for the bulls. Bitcoin is up over 2% and altcoins are performing even better. We are not fully back just yet, but this is a promising sign, especially with the announcement of potential stimulus checks, which tend to favour risk-on assets. As Bitcoin is still in its correction phase, it is an opportune time to pick up some BTC and select altcoins before funds begin flowing back into the system.

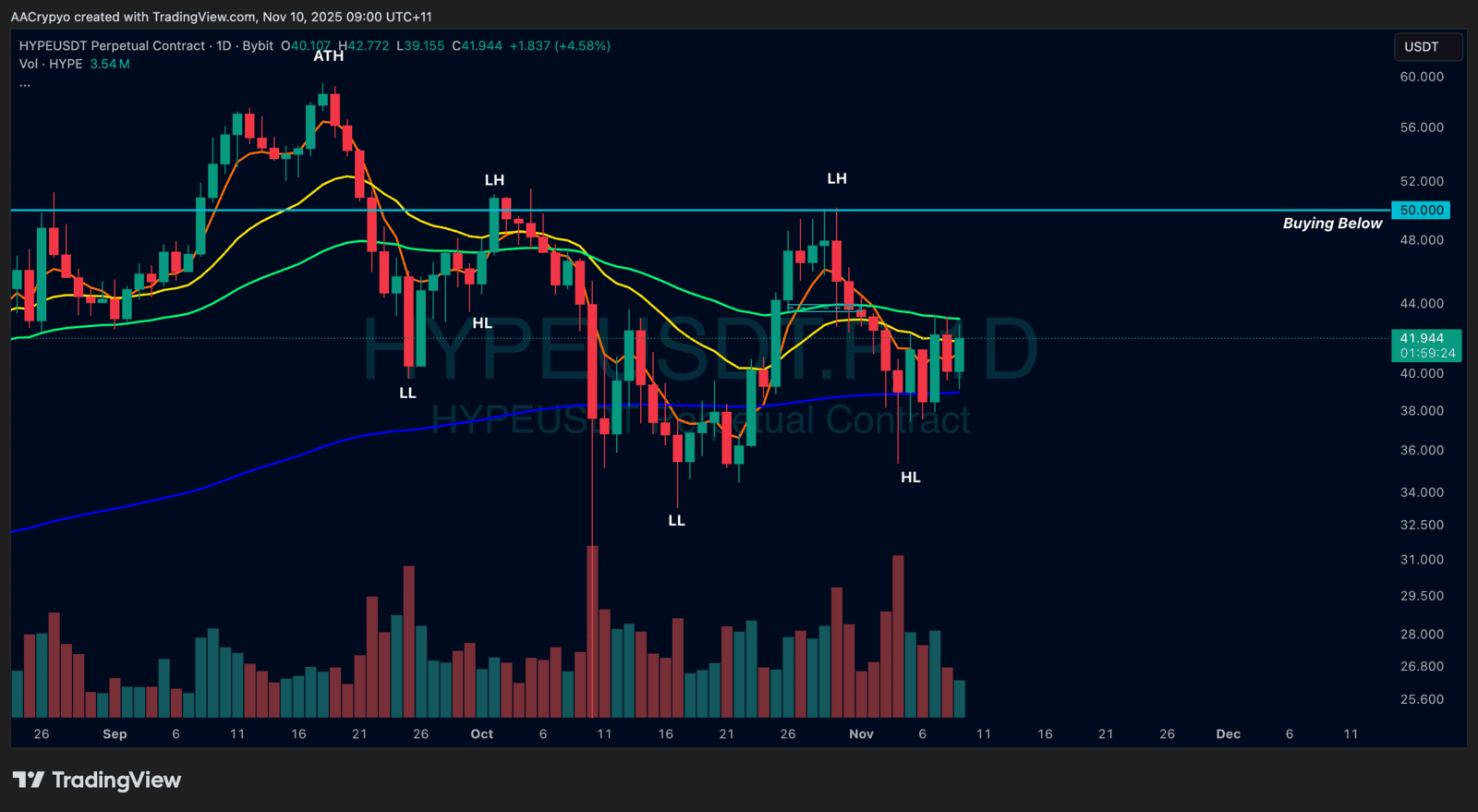

Stormrake Spotlight: Hyperliquid (HYPE) ($41.96)

Stormrake Spotlight: Hyperliquid (HYPE) ($41.96)