To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

All risk-on markets turned slightly red overnight as tensions between the US and Russia escalated, with Trump pressuring Putin to reach a peace deal and threatening further sanctions on Moscow.

Earlier this month, Trump gave Putin 50 days to secure a peace agreement or face “severe tariffs.” Overnight, he cut that window to just 10–12 days amid mounting White House frustration, following reports that Russia has repeatedly avoided ceasefire proposals.

If a ceasefire between Russia and Ukraine is not reached within the next fortnight, Trump is expected to expand sanctions to any countries trading with Russia. This could pull China into the crossfire. Despite largely maintaining neutrality throughout the war in Eastern Europe, China remains Russia’s largest trading partner and has already been engaged in tariff disputes with the US since January.

Markets responded to the escalation with risk assets sliding. Bitcoin slipped back after briefly trading above $119,000, moving to the middle of its current range. Traditional indices followed suit, with the S&P 500 and Nasdaq both closing lower, while crude oil surged nearly 3.5% on the prospect of broader sanctions.

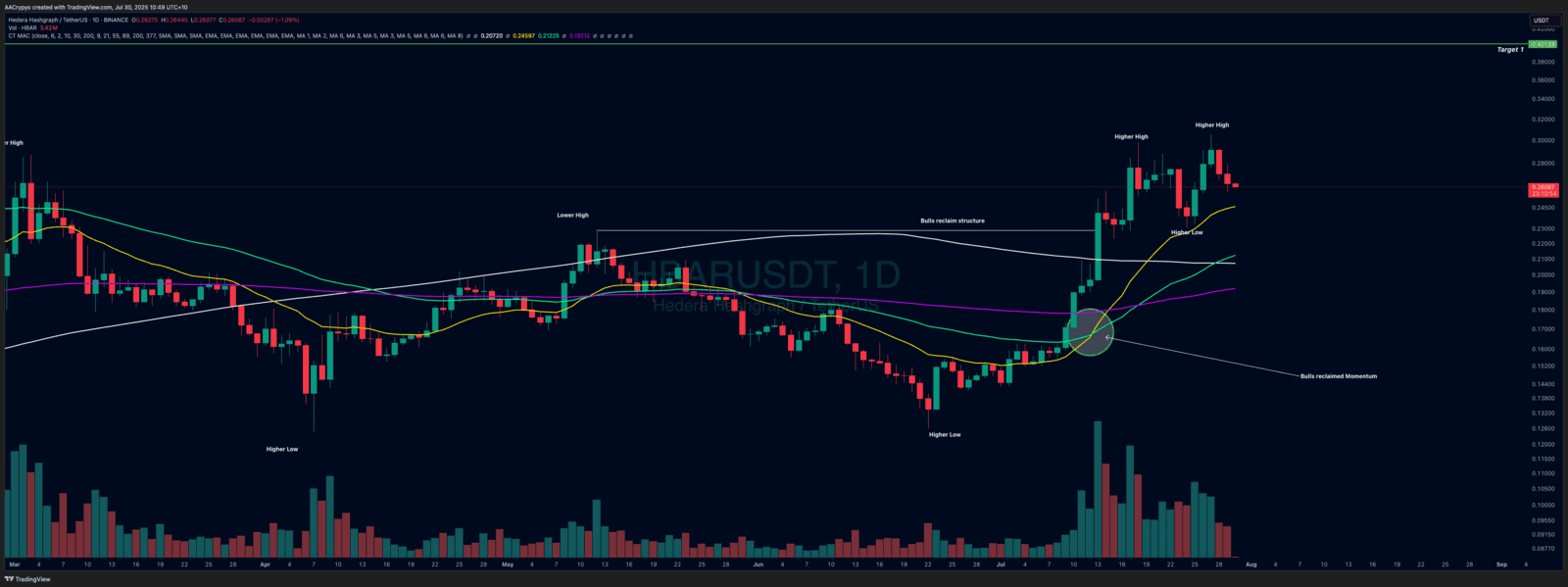

Stormrake Spotlight: Hedera (HBAR) ($0.260)

Stormrake Spotlight: Hedera (HBAR) ($0.260)