To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Risk-on markets took a slight step back overnight as Trump and Putin met yesterday but failed to reach a ceasefire agreement in Ukraine. The conflict in Eastern Europe has dominated geopolitical headlines throughout August. Earlier this month, we saw markets dip when Trump threatened tariff escalations and sanctions on Russia. That move was quickly reversed as risk appetite returned, with markets pushing higher.

The two leaders met with claims of progress, but as Trump said, “there’s no deal until there’s a deal.” He’s set to speak again soon on the outcome of the summit, and we may get further clarity on the current situation.

Crypto markets continued their pullback, with Bitcoin slipping back below $118K and Ethereum dropping over 2% yesterday. Traditional risk-on indices like the S&P 500 and Nasdaq were also red, as was gold.

As has been the case with many of the pullbacks this year, it appears driven by short-term panic sellers reacting to headlines, while those with long-term conviction continue to benefit. Once again, this looks like another healthy transfer of coins from weak hands to strong. We’re still just below all-time highs. Traditional markets remain at record levels, rate cuts are still on the table, and there’s little to suggest the broader bull trend has ended. These dips offer solid opportunities to accumulate Bitcoin and high-conviction altcoins like Ethereum and Solana, both of which led the market over the past week and are now pulling back into key demand zones that smart money is targeting.

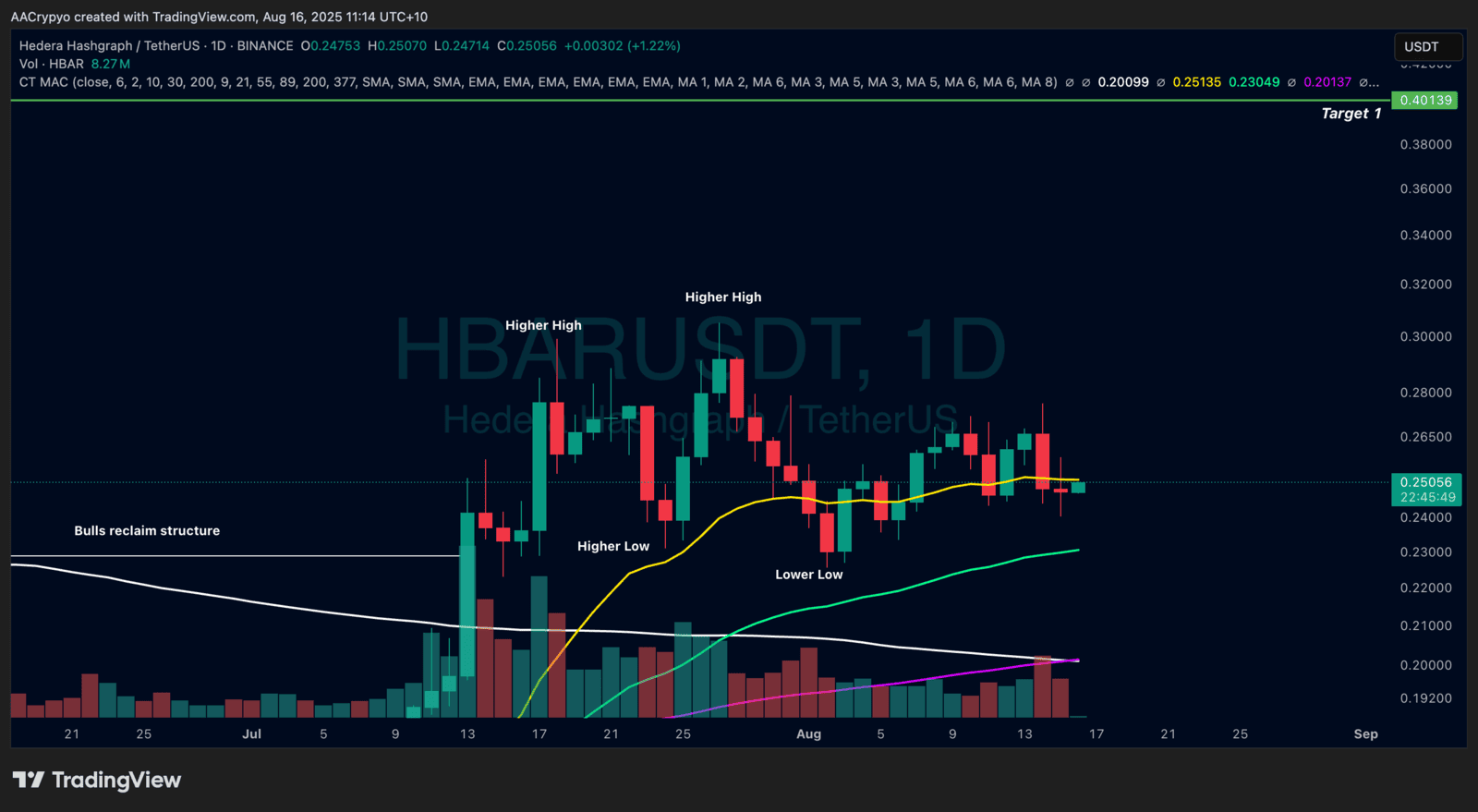

Stormrake Spotlight: Hedera (HBAR) ($0.250)

Stormrake Spotlight: Hedera (HBAR) ($0.250)