To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

For much of December, Bitcoin has remained pinned around $88K, despite several macro events that would usually trigger some price action. Two major central banks made rate announcements, the US Federal Reserve cut rates while the Bank of Japan raised them. Mixed signals, yet Bitcoin stayed unfazed.

Last week, we highlighted that the final Bitcoin options expiry for the year was approaching, with a large cluster of strike prices set around $96K. Bulls were hoping for a late-month move higher to offset potential losses, but that did not happen. Bears were eyeing to drag price back down below $83K to $84K, the reported average entry range for Spot Bitcoin ETFs. That also failed. As expected, Bitcoin remained steady at $88K while attention shifted elsewhere.

Silver has been the standout performer of the year. With supply short for the fifth consecutive year and demand outpacing production, it has finally gone euphoric. Last week alone it gained nearly 20 %. With fewer participants due to the holiday period and historically lower volumes, silver has captured the bulk of risk-on attention.

Google search interest for “silver” has now hit an all-time high. It mirrors the moment earlier this year when people queued for hours to buy physical gold near its local top. Despite the euphoric sentiment, this does not necessarily mark the top for silver. Moves like this often lead to capital rotation back into Bitcoin once metals begin to cool off.

While Bitcoin has been flat throughout the month and may seem disconnected, traditional indices have not exactly surged either. The S&P 500 is only up 1 % in December. It is clear where capital has been flowing, commodities. We saw this earlier in the year, though the commodity rally then was not as aggressive. The rotation tends to follow a pattern, first into commodities, then into traditional risk assets, and finally into Bitcoin.

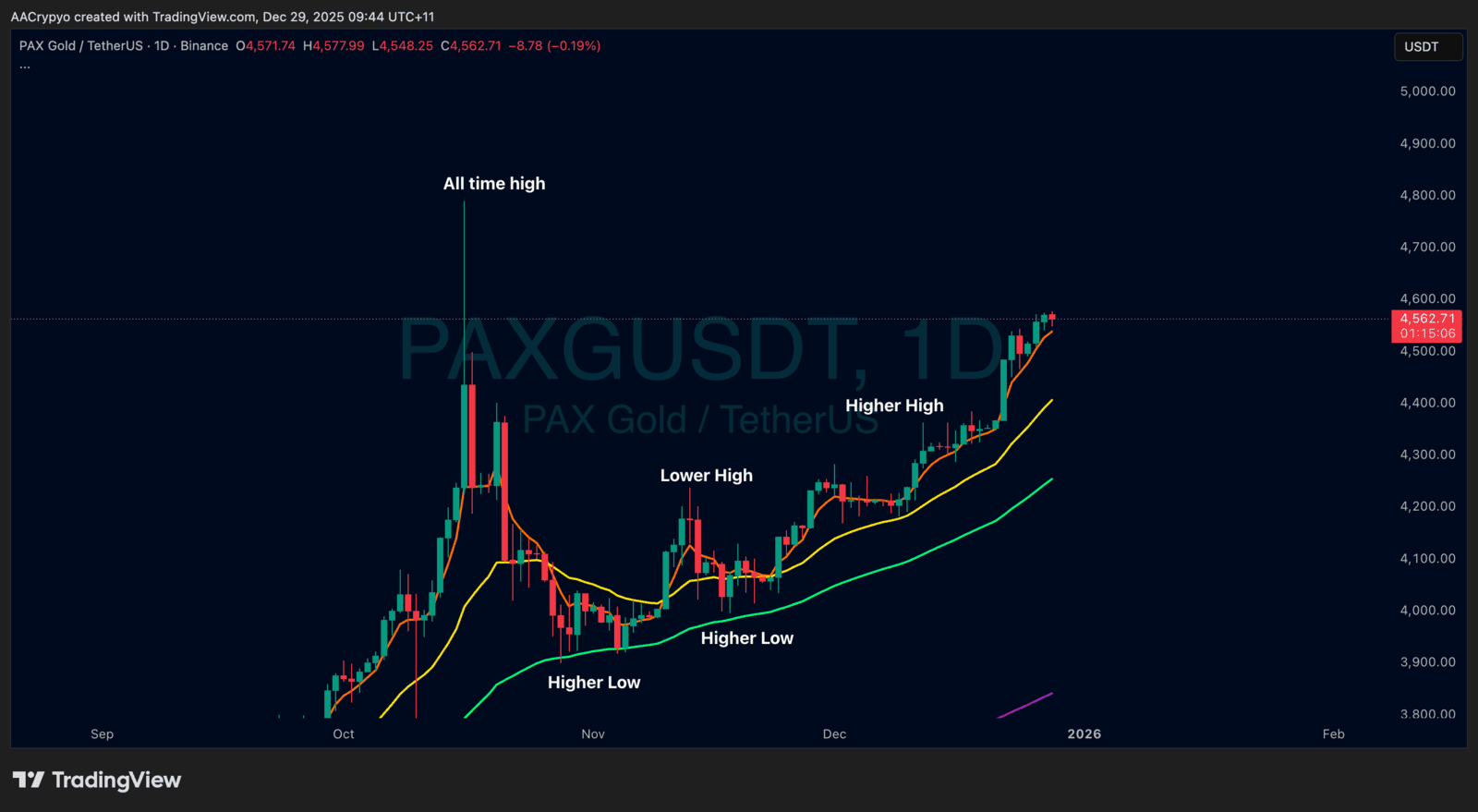

Stormrake Spotlight: Pax Gold (PAXG) ($4,562)

Stormrake Spotlight: Pax Gold (PAXG) ($4,562)