To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Bitcoin extended its Monday momentum into yesterday, rallying after 11pm and again into the first US session of the week. BTC now trades above $114K, climbing nearly 2%. The altcoin market moved in step, with BNB leading the way, up nearly 4%, while Ethereum and Solana also closed green but gained less than 2%.

It has been more of the same in the broader market, with precious metals continuing to rally. Gold was up nearly another 2% and now trades above $3,800 per ounce for the first time in history. Silver matched gold’s move, rising just under 2% and pushing above $46.80. Meanwhile, traditional indices had a relatively flat session, both moving less than 0.5%.

Is this the beginning of a risk-on rotation?

We have been stressing that Bitcoin’s time will come. While it has been frustrating to see other assets rally to new all-time highs as Bitcoin and altcoins pulled back, capital will eventually find its way back into crypto. Those who used the recent pullback to accumulate will benefit. When funds return, they often do so quickly and with price already much higher, triggering FOMO from sidelined investors.

The next 24 hours should bring volatility. The third round of FTX creditor repayments is set to go live, with $1.6 billion to be returned to users. These repayments will be based on the 2022 dollar value of the lost assets, plus interest. To put it into perspective:

- Bitcoin: $30K per BTC

- Solana: $30 per SOL

- Ethereum: $3,900 per ETH

If you lost 1 Bitcoin, you receive $30K rather than today’s market value. That is a big haircut for Bitcoin and Solana holders. Ethereum users are in a slightly better position, considering ETH’s lack of movement over the past three years.

The key focus is the potential injection of liquidity into the crypto market. Whether these investors re-enter or remain in cash, the repayments could provide another spark that adds to Bitcoin’s current momentum and pushes price closer to all-time highs.

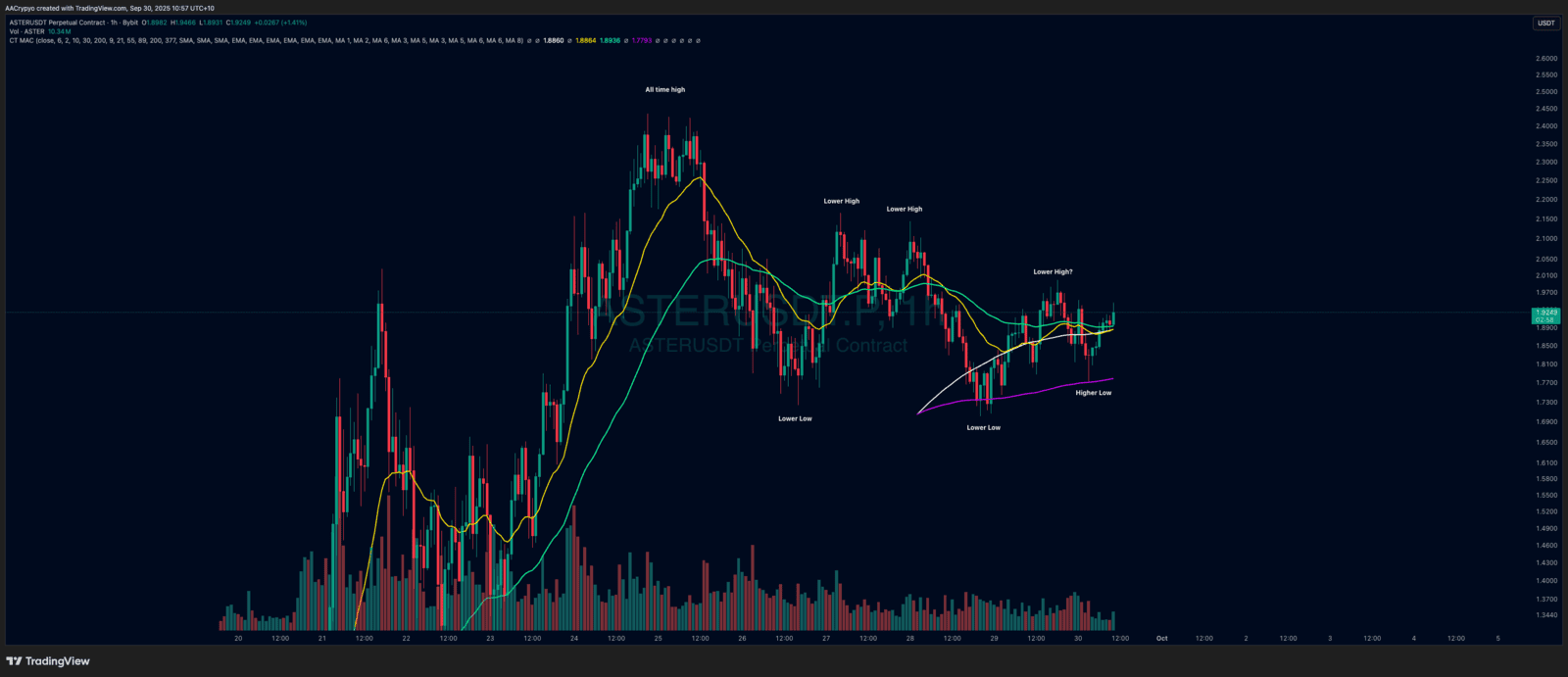

Stormrake Spotlight: Aster (ASTER) ($1.92)

Stormrake Spotlight: Aster (ASTER) ($1.92)