To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

It has not been an explosive week for Bitcoin, nor has there been much on the news front, but BTC has been quietly climbing, improving steadily each day since the $80K low we saw less than a week ago.

That said, it was not entirely calm across the crypto space. Altcoin performance was mixed over the last 24 hours, and more notably, there was another exchange hack. Upbit, South Korea’s largest exchange with roughly 70% of domestic market share, was exploited last night. Approximately $37 million (USD) worth of Solana-based assets were withdrawn to unknown wallets. Coincidentally, the Solana ETF saw its first day of outflows since its launch around a month ago. SOL has dropped 1.5% and is back at $140.

Bitcoin is about to close its fourth green day out of the last five trading sessions, now up over 13% from Saturday’s lows. Bears remain sidelined as consistent spot buying keeps prices climbing. Sentiment continues to improve and is now on the edge of extreme fear , with the Fear and Greed Index showing 25.

As we head into the end of November, it is no secret the month has been disappointing. Historically, November is Bitcoin’s strongest month by average returns, but this year it looks set to close in the red. October, which is usually Bitcoin’s most frequently green month, was also red. However, macro conditions into December appear more constructive. Quantitative tightening is expected to end on December 1st. The upcoming interest rate decision on December 10th has an 87% probability of a 25 bps rate cut priced in. Both are bullish for risk-on assets.

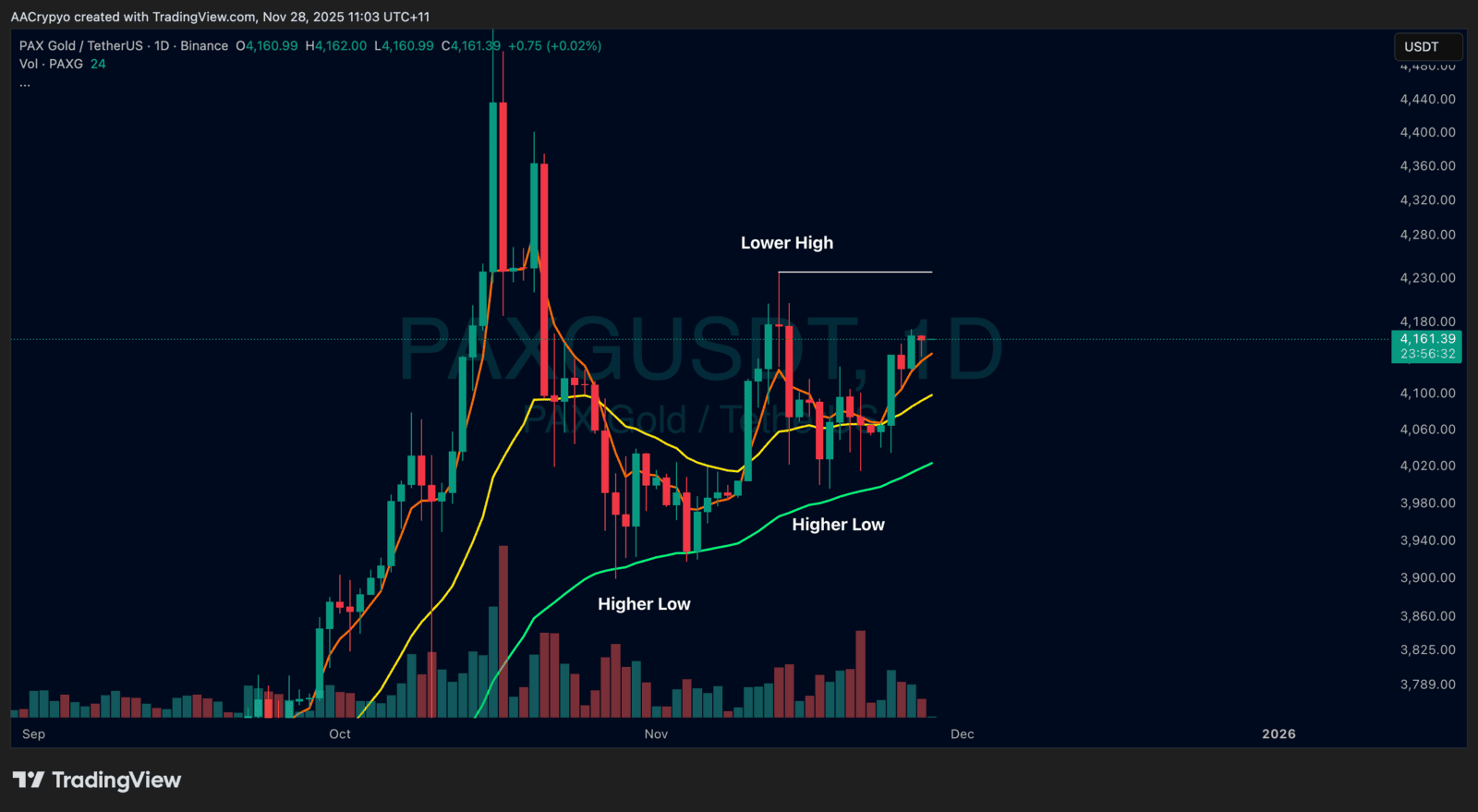

Stormrake Spotlight: Pax Gold (PAXG) ($4,161)

Stormrake Spotlight: Pax Gold (PAXG) ($4,161)