To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Selling pressure has intensified across the crypto space, with bears maintaining control and sending Bitcoin and the broader market lower. There was a brief moment of optimism when Bitcoin flipped a key $112K level into support, hinting at a possible move higher. But the rally lacked substance, and bears quickly stepped back in. BTC is now trading even lower than it was before the relief bounce.

Bitcoin is down over 3.5% and back below $108K, Ethereum has slipped below $4,300, and even Solana is down over 5%. Still, SOL continues to look relatively bullish despite the broader market weakness. Over $500 million in leveraged positions were liquidated across the crypto space yesterday, with the majority being longs, as fear begins to creep back in and the sentiment index drops to 39.

Bitcoin should remain the primary focus, but select altcoins like Solana and Hyperliquid have already been outperforming and may continue to do so once sentiment shifts. Q4 is historically a bullish period for Bitcoin and risk-on assets, so the seasonal tailwinds are worth keeping in mind.

More drama unfolded in the tariff space, as the US Court of Appeals ruled Trump’s global tariffs illegal. The ruling was released after the US session had closed, so it was not the driver behind the pullback in risk assets. The S&P 500 and Nasdaq both closed in the red. Shortly after the court decision, Trump posted that “all tariffs are still in effect” despite the ruling, which only adds to the confusion surrounding trade policy that has been in focus for much of the year.

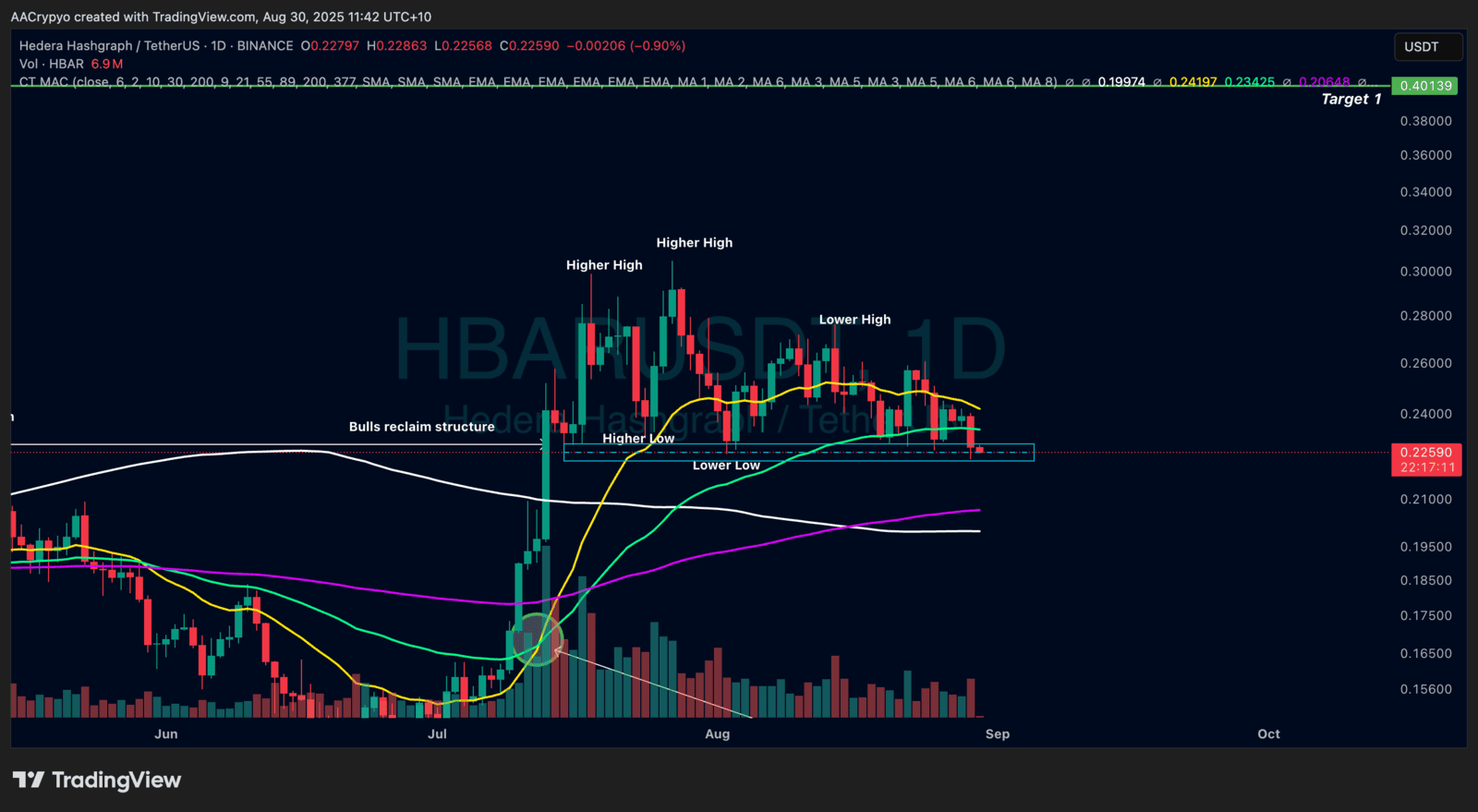

Stormrake Spotlight: Hedera (HBAR) ($0.225)

Stormrake Spotlight: Hedera (HBAR) ($0.225)