To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Powell testified once more, and markets barely reacted as it turned out to be a mixed day across the crypto space. Jerome Powell took the stage at the Senate Banking Committee for the second part of his testimony. Two days' worth of speeches ultimately did little to shift investor expectations. He stuck to script, warning that while tariffs could result in a one-time price jump, the risk of more persistent inflation is enough to keep the Fed cautious. With rate cuts still expected this year, the central bank remains in wait-and-see mode, holding steady until there’s more clarity on inflation trends. Markets continue to price in two cuts for the second half of 2025, with the first likely in September. Powell remains resolute in his stance: the Fed will not rush into easing policy, even under pressure from President Trump.

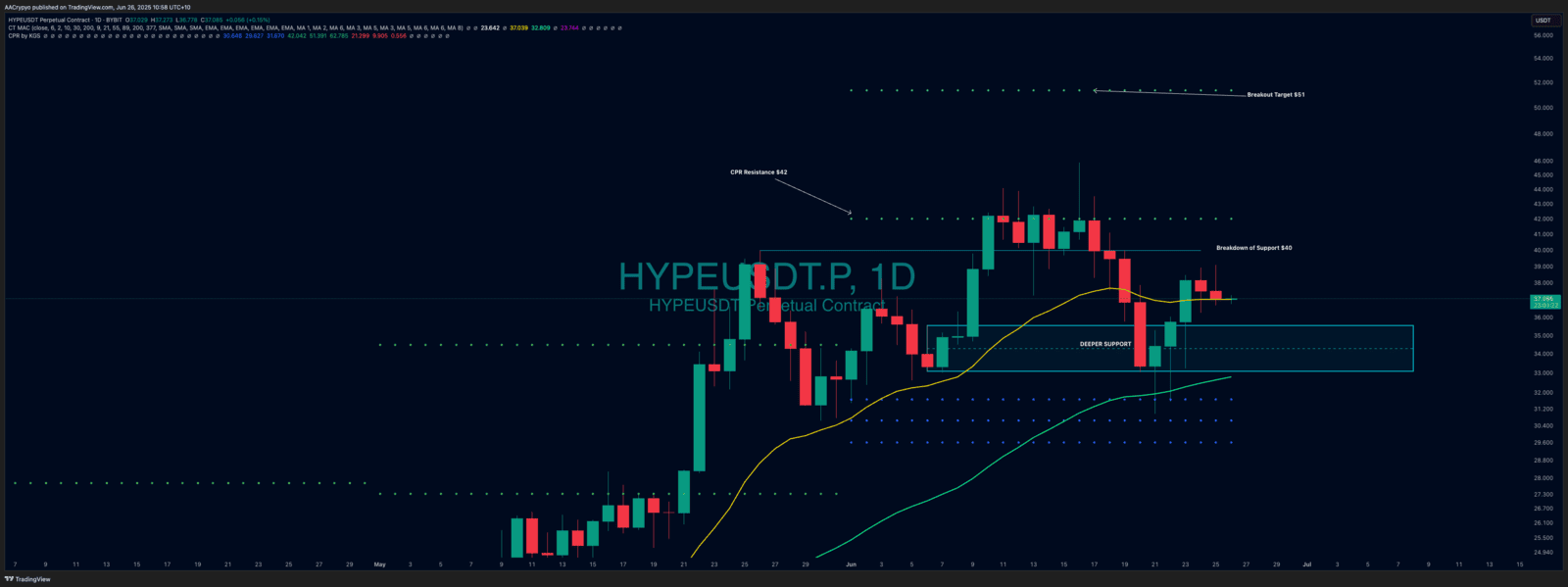

A strange day for crypto. Markets were predominantly red despite Bitcoin holding above $107K and up over 1% on the day. Ethereum fell over 1%, Solana dropped nearly 2%, and the total altcoin market cap slipped 0.88%, while Bitcoin dominance continued to push higher, rising 0.67% and nearing 66%. With 2025 halfway done, Bitcoin dominance shows no signs of slowing. The 2021 high of 73.63% could well be within reach. This cycle is different. It is a Bitcoin-dominated run, driven by institutional interest that is clearly focused on BTC over altcoins. That reinforces the importance of maintaining a Bitcoin-heavy portfolio and not rotating too early into alts. That said, it does not mean altcoins will not have their moments. We have seen standout performances from spotlighted names like XRP, SUI, and HYPE—each offering strong returns when bought during periods of correction. Timing will be key. If Bitcoin dominance genuinely breaks down, that is when it will make sense to rotate. Until then, stay focused on BTC and accumulate quality alts during periods of weakness.

Stormrake Spotlight: Hyperliquid (HYPE) ($37.09)

Stormrake Spotlight: Hyperliquid (HYPE) ($37.09)