To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Bitcoin continues to prove its naysayers wrong as adoption keeps growing, and not in the way many people might expect. We have consistently covered institutional adoption through spot ETFs and government adoption through Strategic Bitcoin Reserves. Today, however, the focus is on everyday commerce and how regular businesses are beginning to adopt Bitcoin as a payment method. A clear example of this is Steak ‘n Shake.

For much of Bitcoin’s life, one of the most common criticisms has been that it cannot be used for anything practical. Phrases like “you cannot buy groceries with it” or “it has no real world use” have been repeated for years. As adoption has increased, these arguments have steadily been disproven. Today, Bitcoin can be used in more places than ever before.

Steak ‘n Shake, an American fast food chain with several locations in Europe, has shared the results of its so called burger to Bitcoin initiative after accepting Bitcoin payments for the past eight months. All Bitcoin payments are allocated directly into the company’s newly created Strategic Bitcoin Reserve. In that short period, the business has increased its Bitcoin exposure by $10,000,000 in notional value, while sales of products purchased with Bitcoin have risen significantly.

This is just one example of how businesses can successfully adopt Bitcoin. It is estimated that between 18,000 and 36,000 businesses worldwide now accept Bitcoin payments, with approximately 19% of small businesses in the United States already doing so. These businesses are not only accumulating Bitcoin through sales, but are also benefiting from lower transaction costs.

When consumers pay with debit or credit cards, they often overlook the fact that more than 1% of the transaction value is taken in fees simply for using the card. These costs are absorbed by merchants and ultimately passed back to customers through higher prices. By contrast, transacting in Bitcoin typically incurs only a fraction of this fee, allowing businesses to retain more of their revenue while offering a more efficient payment experience.

There is an even bigger opportunity for businesses that go one step further. Companies that accept Bitcoin for payments and convert a portion of their operating profits into BTC on their balance sheet position themselves for long term success. By reducing reliance on depreciating fiat currencies and holding a scarce digital asset, these businesses strengthen their financial resilience and gain exposure to Bitcoin’s long term upside.

For small business owners interested in exploring this approach, support and education are key. If you run a small business and want to learn how to accept Bitcoin payments or operate a Bitcoin treasury, Stormrake can help guide you through the process and ensure it is done securely and efficiently. Leave a comment or contact us to learn more…

Bitcoin adoption is no longer limited to institutions or governments. It is happening at the point of sale, one transaction at a time.

Bitcoin will only truly succeed when the original mission of the white paper is honoured, a peer to peer electronic payments network used by everyday people for everyday purposes, rather than existing solely inside an ETF, on a corporate balance sheet, or hoarded away in cold storage.

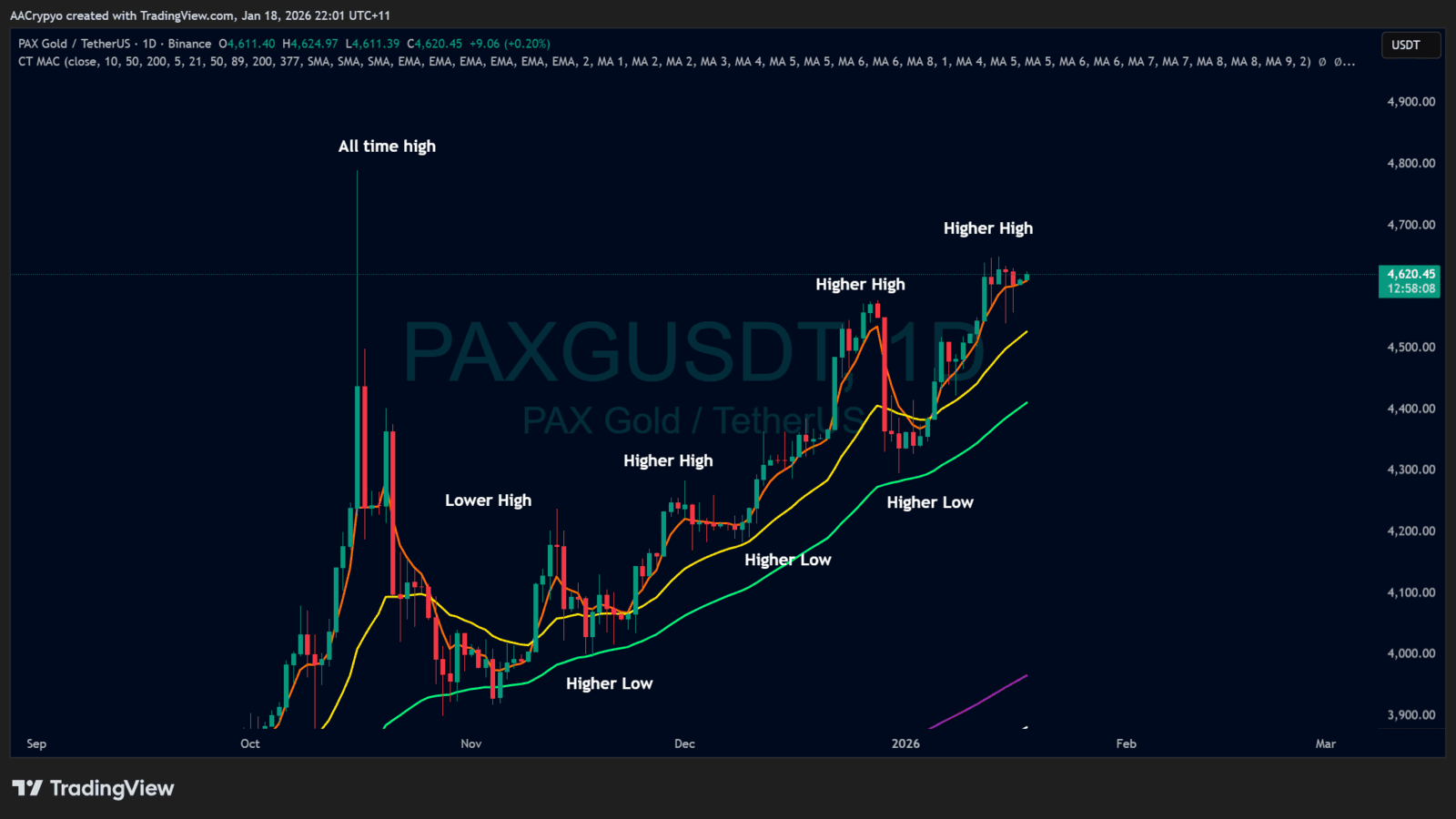

Stormrake Spotlight: Pax Gold (PAXG) ($4,620)

Stormrake Spotlight: Pax Gold (PAXG) ($4,620)