To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

As we inch closer to a potential resolution of the US China trade and tariff conflicts, the rotation continues. Gold continues its pullback while traditional risk-on assets and indices push higher. Bitcoin is also moving up, but faces some resistance.

Gold lost another 3% over the past 24 hours, bringing its total decline to nearly 10% in just a week and falling below $4,000 per ounce for the first time in weeks. Investors are also moving out of the US dollar, with the downtrend gaining strength as optimism around global trade improves.

Yesterday we saw Bitcoin pop and US futures rally after officials from the US and China released a framework outlining a potential trade deal. Last night marked the first US trading session since that news, and futures strength was confirmed at the open. Markets gapped higher from Friday’s close and carried momentum throughout the session. The S&P 500 closed up over 1% and the Nasdaq gained nearly 2%, pushing to fresh record highs.

Sentiment continues to improve as geopolitical pressure appears to be easing. While in Malaysia, Trump announced a series of trade and critical minerals deals with four Southeast Asian countries. The most anticipated moment remains the upcoming meeting with President Xi, expected later this week. Markets are not expecting a finalised deal from it, but there is optimism around further progress, particularly with China continuing rare metal exports and the US holding off on 100% tariffs.

While geopolitics take centre stage, we should not lose sight of Thursday morning’s FOMC interest rate decision. A 25bps cut is all but certain, with a 97.3% probability. However, the real focus will be on Jerome Powell’s press conference, which could offer insight into the Fed’s tone heading into the final meeting of the year. Markets are pricing in a total of 75bps in cuts before year-end, with 88% odds according to Polymarket. The question now is whether the Fed leans towards a 50bps or another 25bps cut in December.

Following Bitcoin’s breakout, price continued higher and broke above $116,000, creating a higher high and reclaiming longer time frame structure. Despite that, BTC closed red on the day. It is frustrating to see this divergence, especially with gold retreating and equities rallying while Bitcoin lags. But with the current macro and geopolitical backdrop, investors are not rushing back into crypto just yet. Tensions are easing, but not fully resolved. Once clarity returns, we can expect flows to re-enter the space and likely send Bitcoin back to all-time highs.

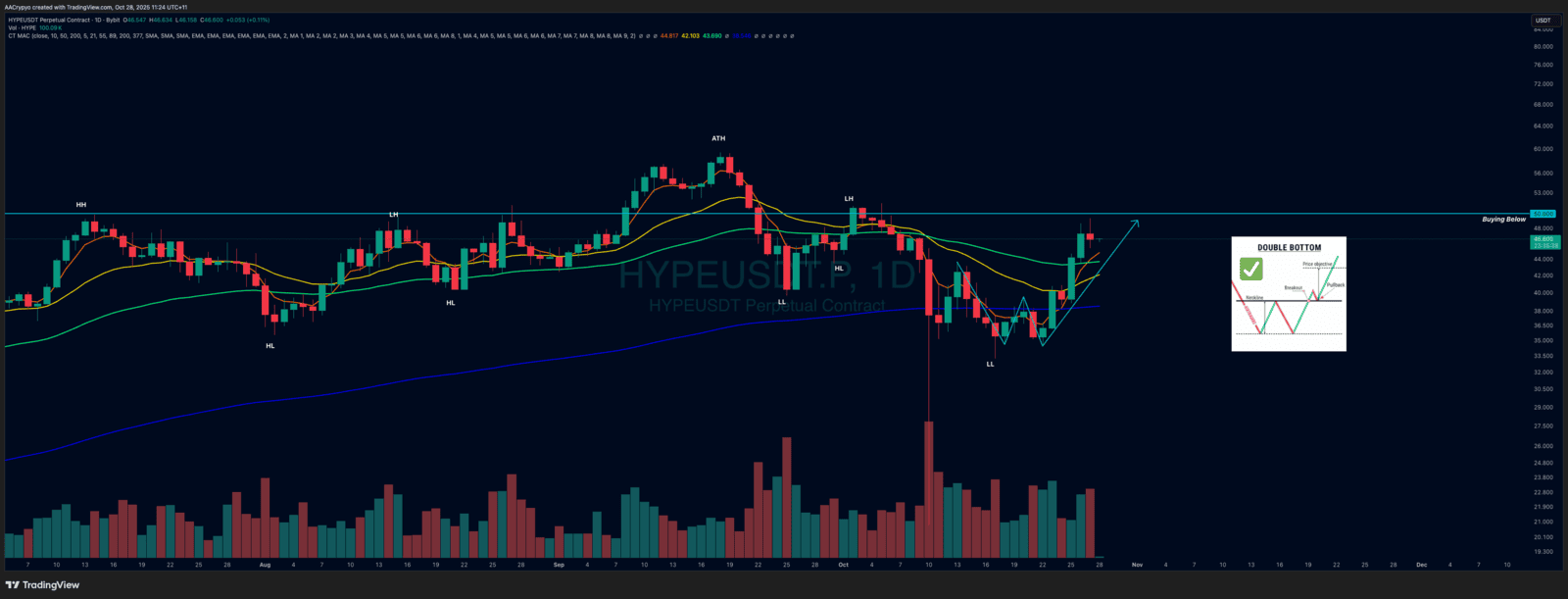

Stormrake Spotlight: Hyperliquid (HYPE) ($46.58)

Stormrake Spotlight: Hyperliquid (HYPE) ($46.58)