To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

The third and final major event we flagged as market-moving this week hit last night, and it hit hard. Earlier in the week, bullish CPI data lit the spark under Bitcoin’s rally, pushing it to new all-time highs. Then came the second set of inflation data: the Producer Price Index (PPI). Unlike CPI, this one knocked the wind out of the market.

The PPI data came in well above expectations. Both core and headline PPI month-over-month were forecast at 0.2% but landed at 0.9%. Year-over-year PPI jumped to 3.3%, far higher than the 2.5% consensus. Crypto responded instantly. Bitcoin dropped nearly 2% in the first 30 minutes after the data release, while altcoins took an even bigger hit. Traditional markets opened lower but quickly shook off the pressure. The S&P 500 and Nasdaq both closed green. Meanwhile, gold – the go-to risk-off asset – fell, and silver dropped even more sharply.

Interestingly, 12 hours on, Bitcoin and crypto markets have yet to show any signs of recovery. BTC has retraced to $118K, nearly $7,000 down from yesterday’s highs. Just an hour after the PPI data, US Treasury Secretary Bessent added fuel to the fire by stating the government is "not going to be buying" Bitcoin. He later reversed course, saying within six hours that the US government is exploring ways "to acquire more Bitcoin to expand the reserve". The back-and-forth only added to the confusion, and with over $1 billion in leveraged positions liquidated in the last 24 hours, the volatility has taken its toll.

The sharp pullback was initially attributed to fears that rising inflation could delay rate cuts. However, after markets had time to digest the data, that narrative softened. Despite the inflation print, the September FOMC meeting still holds a 92% probability of a 25 bps rate cut. Inflation remains sticky, and pressure is building for the Fed to address it. Powell is set to speak next week and should provide more clarity on their policy direction and inflation outlook.

While the past 12 hours have been brutal for crypto, there’s little reason for long-term concern. Traditional risk-on assets have already shrugged off the shock, and the rate cut narrative remains intact. In fact, this could prove to be an opportunity to accumulate Bitcoin and undervalued altcoins. Just 24 hours ago, Bitcoin was at all-time highs. Market sentiment has flipped from extreme greed at 75 to a more neutral 60. These are the moments when money moves from panic sellers to smart accumulators. Make sure you're the latter.

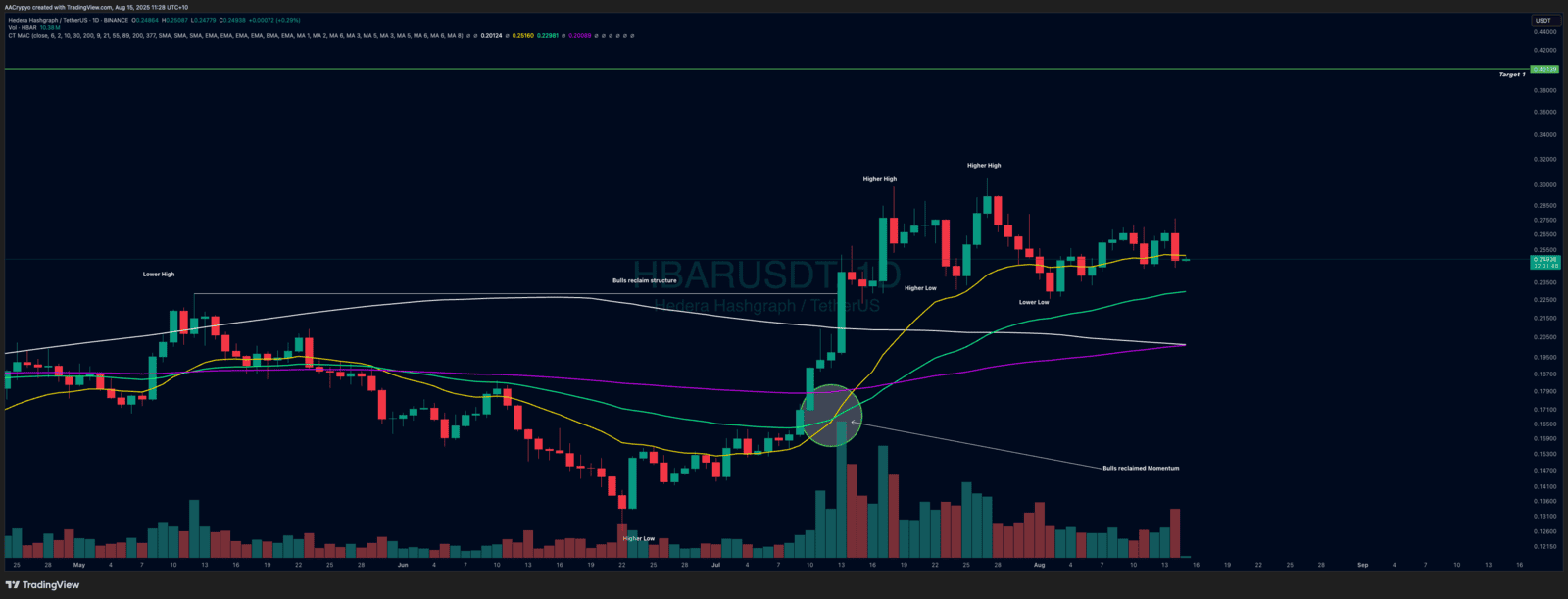

Stormrake Spotlight: Hedera (HBAR) ($0.249)

Stormrake Spotlight: Hedera (HBAR) ($0.249)