To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

We have now seen four straight days of bullish momentum across the crypto market, with Bitcoin closing out the recent run with a breakout this morning, hitting $115K off the back of positive developments in US-China relations.

Much of this year has been dominated by the ongoing tariff and trade tensions between the US and China, and October has followed the same pattern. From Trump announcing 100% tariffs on Chinese imports, which triggered a steep drop in Bitcoin and sparked mass liquidations, to this week’s turnaround driven by expectations of a deal. Just a few hours ago, Bitcoin was trading below $113K after a strong Sunday, but a statement from US Treasury Secretary Scott Bessent confirmed that a framework for a trade agreement has been reached between the two countries.

Markets reacted strongly. Bitcoin surged over $2,000 in five minutes, and altcoins followed with a sea of green across the board. US equity futures opened with strength, with the S&P 500 and Nasdaq futures both up nearly 1%. Gold opened the day down 1%, showing a clear shift from risk-off to risk-on assets as sentiment around a trade resolution improves. If Trump and Xi reach an agreement at their scheduled meeting on the 31st, we could see a broader rally across risk markets. Gold may continue its pullback, while equities push for new all-time highs and Bitcoin follows suit.

Bitcoin is now back in the green for October. After a positive start to the month and a volatile middle, this final week could be the push that sends it towards all-time high territory. BTC is just 10% away from its record high, and if bullish sentiment holds while macro and political risks ease, a new high before the end of the month is not out of reach. Even if it does not happen this month, a green October close would set the foundation for November, which is historically Bitcoin’s best month with an average return of 40%.

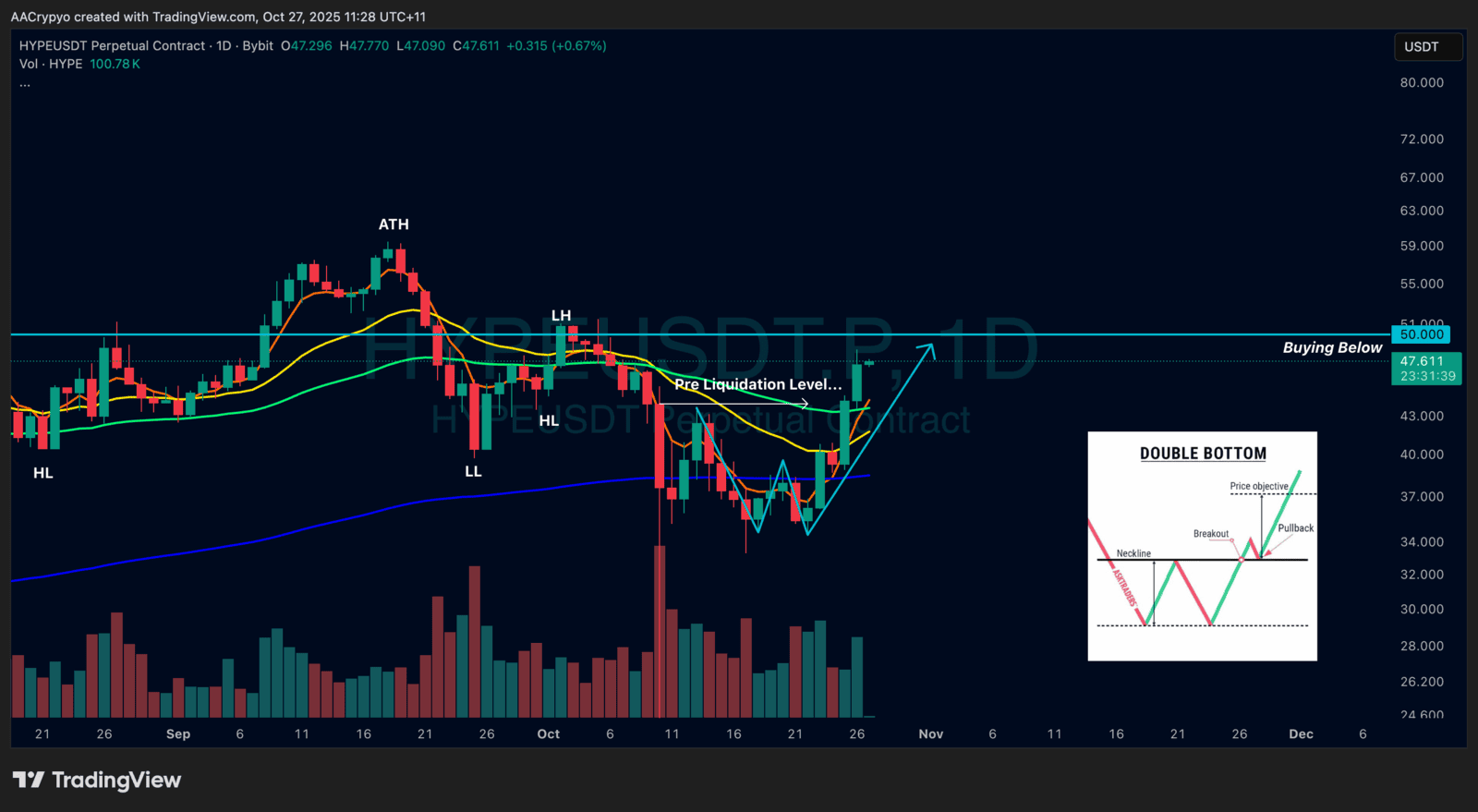

Stormrake Spotlight: Hyperliquid (HYPE) ($47.50)

Stormrake Spotlight: Hyperliquid (HYPE) ($47.50)