To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

As expected, US interest rates were left unchanged at 4.25%–4.50%. Markets largely brushed off the decision itself and focused instead on Powell’s comments. Heading into the meeting, consensus was for no change this time, with the first rate cut expected in September and another before year-end.

Powell, however, threw that outlook into doubt. He stressed that no decision has been made for the September meeting and repeated that the Fed will “wait and see” how tariffs affect inflation. This language pushed market pricing to now favour no cut in September, souring investor sentiment.

His comments triggered an immediate risk-off move. Equities and other traditional risk assets dipped into the red, while Bitcoin and the broader crypto market also slid. However, the dip was short-lived. Both stocks and crypto have since bounced, with the initial bearish reaction already starting to fade.

With over a month until the next FOMC meeting, there is still time for sentiment to swing back in favour of a September cut. Two key CPI prints and the rollout of new tariffs are due before the next decision, both of which will provide much-needed clarity on the Fed’s path.

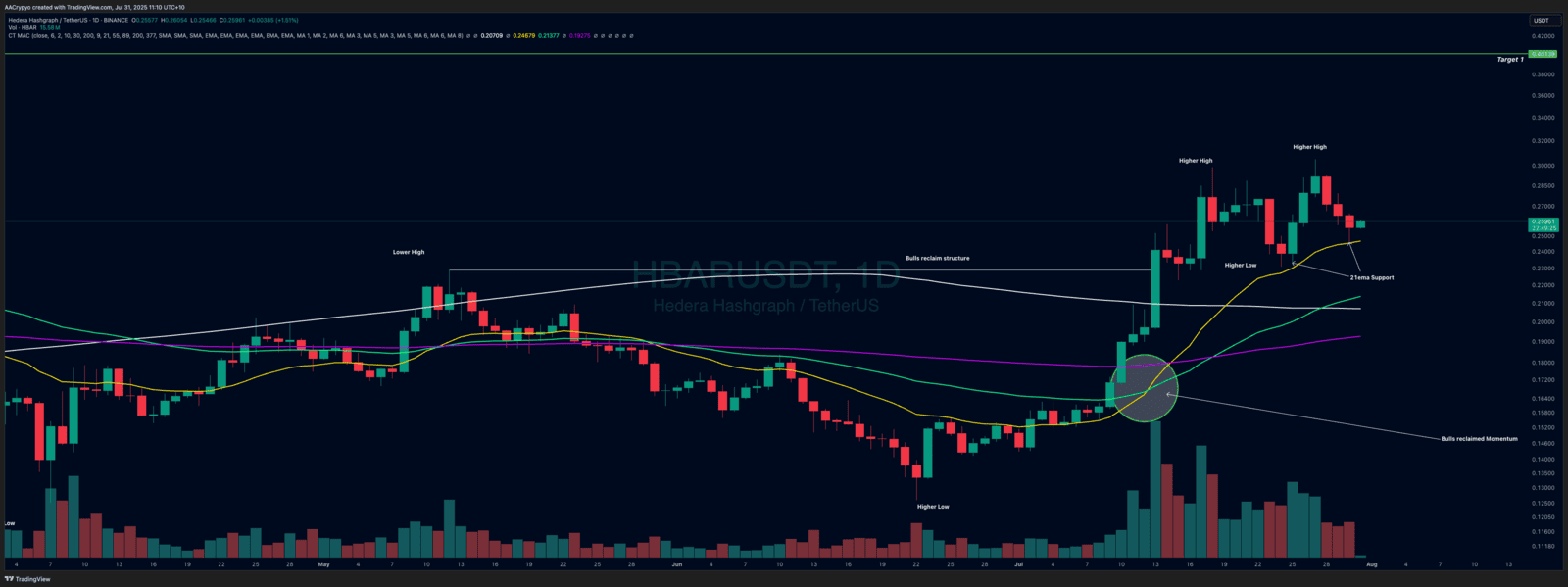

Stormrake Spotlight: Hedera (HBAR) ($0.259)

Stormrake Spotlight: Hedera (HBAR) ($0.259)