To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Quite a neutral day for Bitcoin, closing just $300 higher than yesterday’s open, although there was some intraday volatility surrounding Jerome Powell’s speech.

As expected, no cut was made. This marks six straight rate decisions with no change, closing out the first half of 2025 without a single adjustment. It’s hard to believe, especially considering that late last year, analysts were forecasting four or five cuts in 2025. But who could have predicted the chaos this year has delivered so far — tariff wars, real wars, and everything in between.

As anticipated, Powell’s presser had everyone tuned in. The market had already priced in no change, yet Bitcoin was under pressure, trading at $103.5k and having lost its $104k floor just before the conference. Powell, as expected, stayed relatively neutral. His tone remained consistent with recent months — cautious but not alarmist. He reiterated that the Fed is likely to reach a point where cuts are appropriate, but stressed there’s no urgency, noting they will make “smarter” decisions by waiting a few more months. Inflation remains the key concern. The Fed now expects a meaningful rise in the coming months and has revised its 2025 inflation forecast higher due to tariff effects. Powell also noted that unemployment remains within a reasonable range, and that it will take time to fully assess the impact of inflation. With just four FOMC meetings left this year, the market is currently pricing in two cuts totalling 50 to 75 bps, likely beginning in September. That said, there’s still plenty of time for that view to change, particularly as geopolitical tensions continue to evolve. Following the speech, Bitcoin managed to rebound and briefly reclaim $105k.

The conflict in the Middle East continues to dominate investor attention. Polymarket odds of a US-Iran nuclear deal being reached in 2025 have rebounded to 50%, up from 33% just four days ago. That suggests markets are starting to price in the chance of a short-term deal. However, the probability of US military action against Iran before July has jumped to 66% — it was just 4% on June 3. Iran is now experiencing a near-total internet blackout, with only 3% of the country online. Meanwhile, reports indicate that the White House Situation Room has convened to discuss the Israel-Iran conflict. There are also signs that Iran would accept a meeting with President Trump, potentially to discuss a peace deal. On top of this, the UK has stated it may become involved if the US intervenes.

The next few days may prove critical. Markets are in a holding pattern, waiting for clarity. A peace deal or de-escalation could see risk-on sentiment return quickly. But any escalation, particularly direct US involvement, would likely increase volatility and put pressure on risk assets.

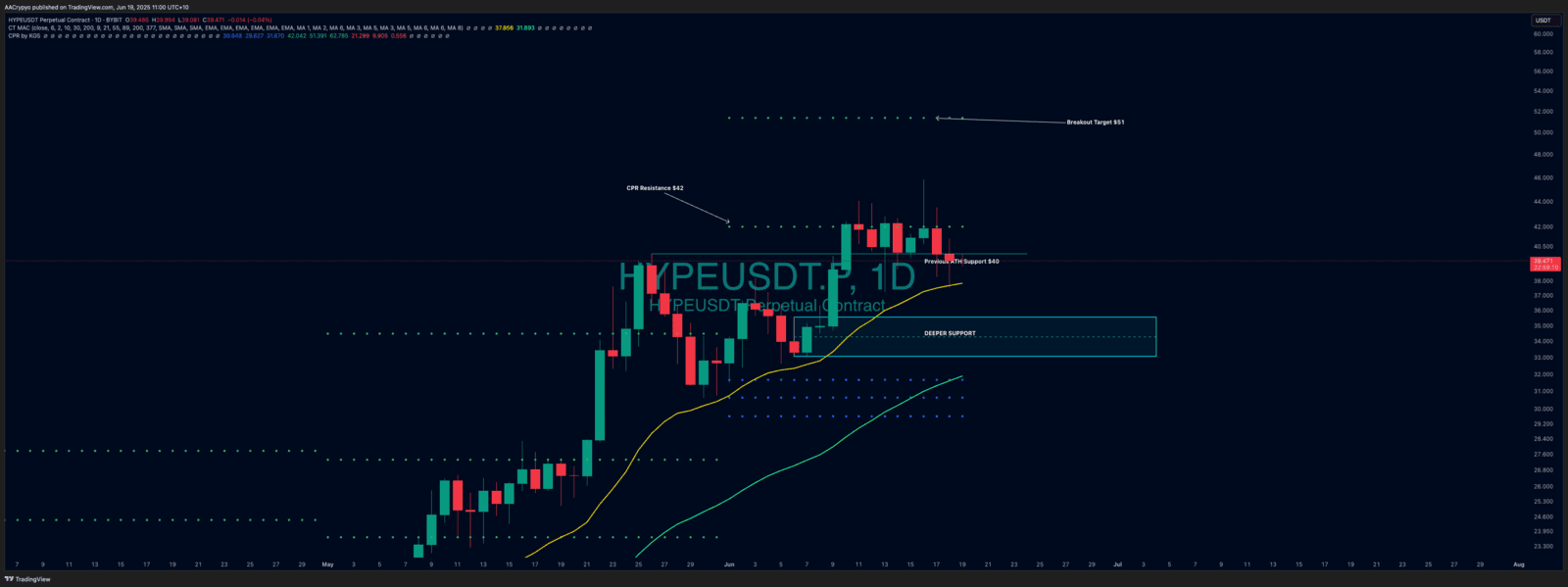

Stormrake Spotlight: Hyperliquid (HYPE) ($39.41)

Stormrake Spotlight: Hyperliquid (HYPE) ($39.41)