To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

After nearly a month of consolidation between the range low at $88,888 and the yearly open at $93,500, the bears may have taken control. Bitcoin is now struggling to hold $88K after losing more than 2% overnight.

Over recent weeks, we have seen multiple moves outside this range. Brief rallies to $94.5K and dips to $87.6K prompted both sides to claim either victory or defeat. But each time, Bitcoin found its way back into the range. So what makes this current move below $88,888 different?

Last week, Bitcoin made three consecutive attempts to break through the yearly open. Each time, the bears held firm. At the same time, US indices were printing new all time highs and Powell announced that the Federal Reserve would begin purchasing $40 billion worth of treasuries. This is historically bullish for risk assets, which was reflected in equities closing at new highs. Yet Bitcoin failed to follow through and has since broken down below the lower bound of its consolidation.

That repeated rejection at the yearly open gave bears the opening they needed. Now Bitcoin is facing a proper close beneath $88,888. If this level does not get reclaimed soon, we could be looking at a structural breakdown.

Adding to the pressure is the likelihood of a Bank of Japan rate hike later this week. Historically this has been a bearish trigger for Bitcoin and other risk assets. The decision is expected on Friday, but fear is already moving the market. On chain data shows that several whales have collectively sold more than 1,000 BTC at losses of 11% to 16% due to expectations of further downside tied to the BOJ move.

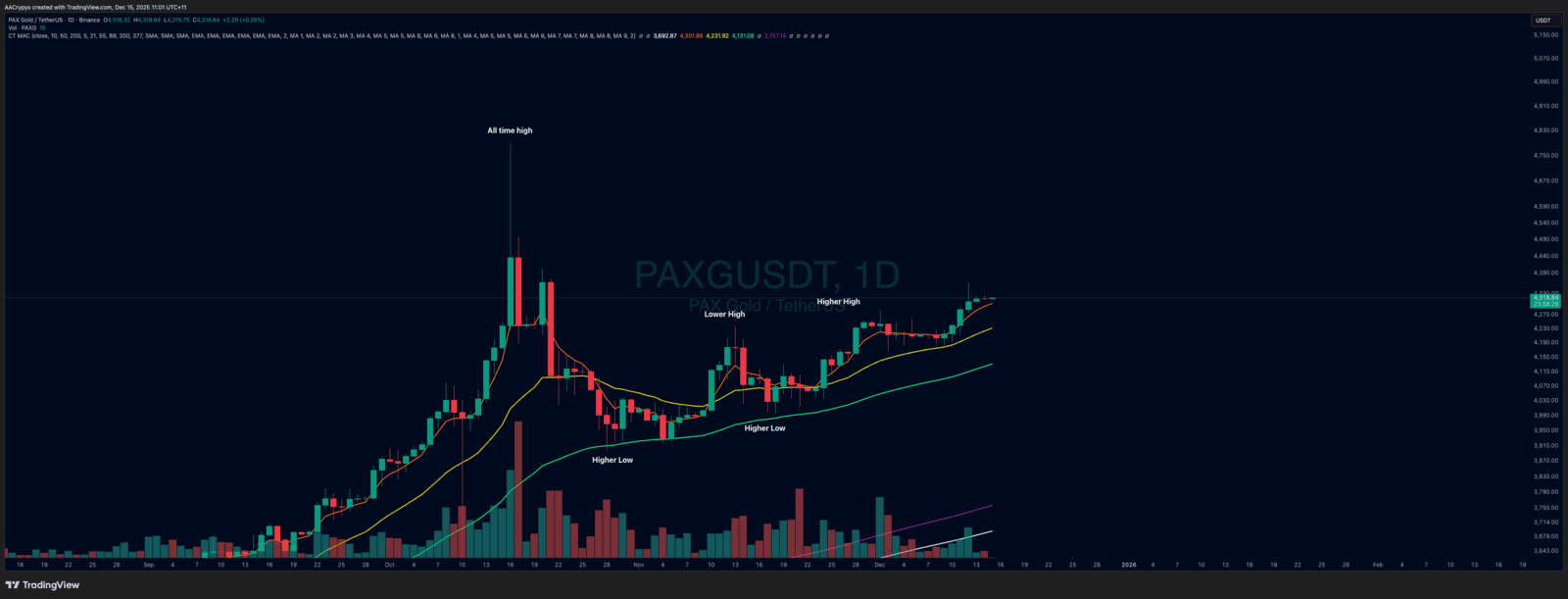

Stormrake Spotlight: Pax Gold (PAXG) ($4,317)

Stormrake Spotlight: Pax Gold (PAXG) ($4,317)