To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

As expected, the US Federal Reserve cut rates by 25 basis points but the real focus was on Jerome Powell’s speech just 30 minutes later. It was a volatile morning as Bitcoin briefly wicked above the yearly open and tapped $94.4K before sharply reversing. It is now trading below $91K just a few hours later.

While the traditional indices did close higher, futures for both the S&P 500 and Nasdaq have been retracing since the US session ended. A surprising reaction, considering Powell’s announcement should have been seen as bullish for risk assets.

Just 12 days after quantitative tightening officially ended, Powell took the stage and confirmed the Fed will begin purchasing $40 billion worth of Treasuries over the next 30 days. That is a clear injection of liquidity and a notable shift from the QT regime we have seen over the past year. The market’s initial spike made sense, but the subsequent volatility highlights just how uncertain traders remain in the short term. Still, moves like this have historically been extremely bullish for risk-on assets over the medium to long term.

We have seen this script before. In September 2019, a spike in repo rates forced the Fed to reverse course and inject around $300 billion into the system by buying Treasuries. The result was a 31% rally in the S&P 500 over the following 12 or so months, and Bitcoin followed with a 210% move from roughly $10,000 to $29,000 by December 2020.

Yes, this time the scale is smaller and the Fed has not been forced into the pivot, but the direction is clear. These are historically bullish actions from the Fed and typically lay the groundwork for strong performance across risk assets over the next 12 to 18 months.

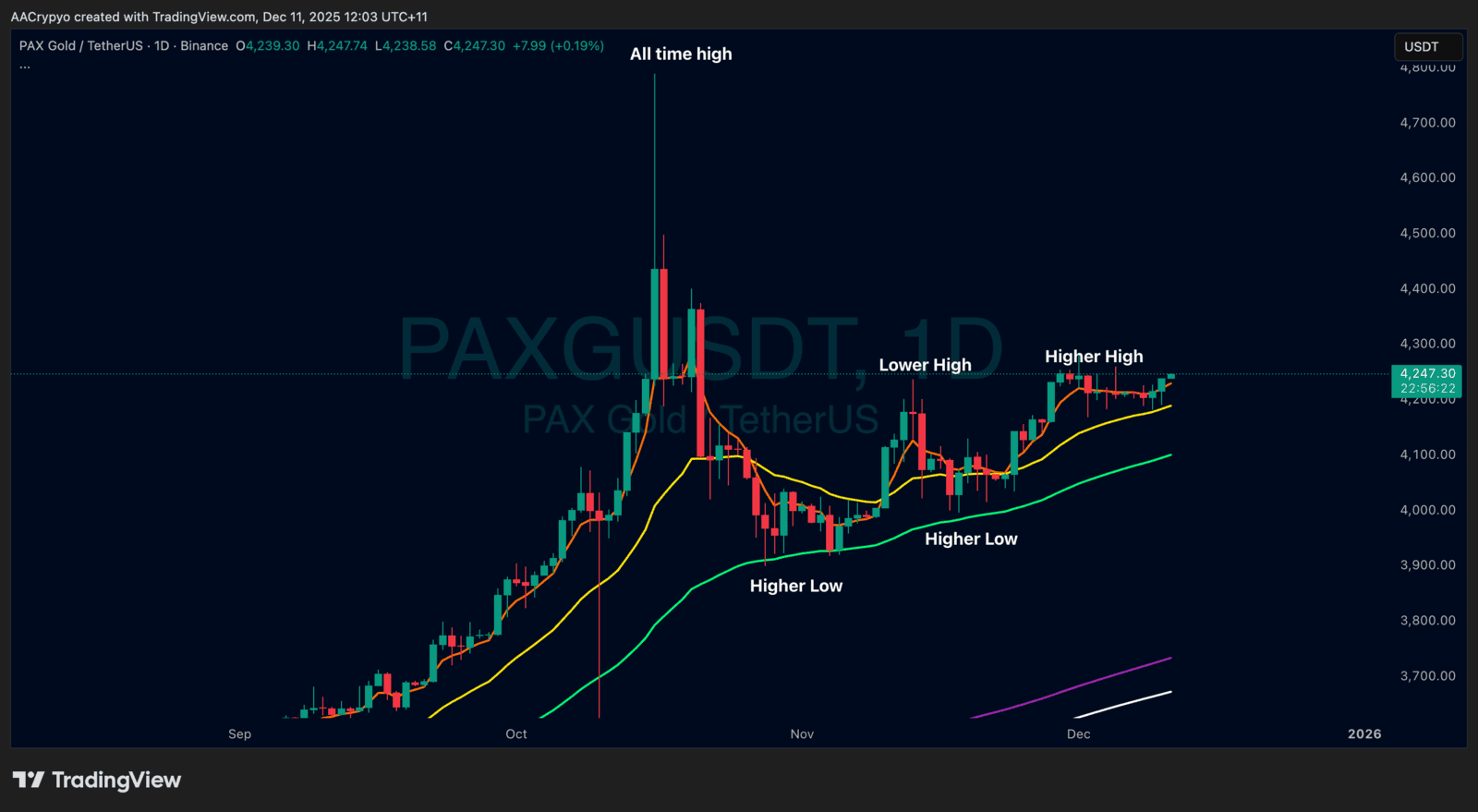

Stormrake Spotlight: Pax Gold (PAXG) ($4,247)

Stormrake Spotlight: Pax Gold (PAXG) ($4,247)