To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

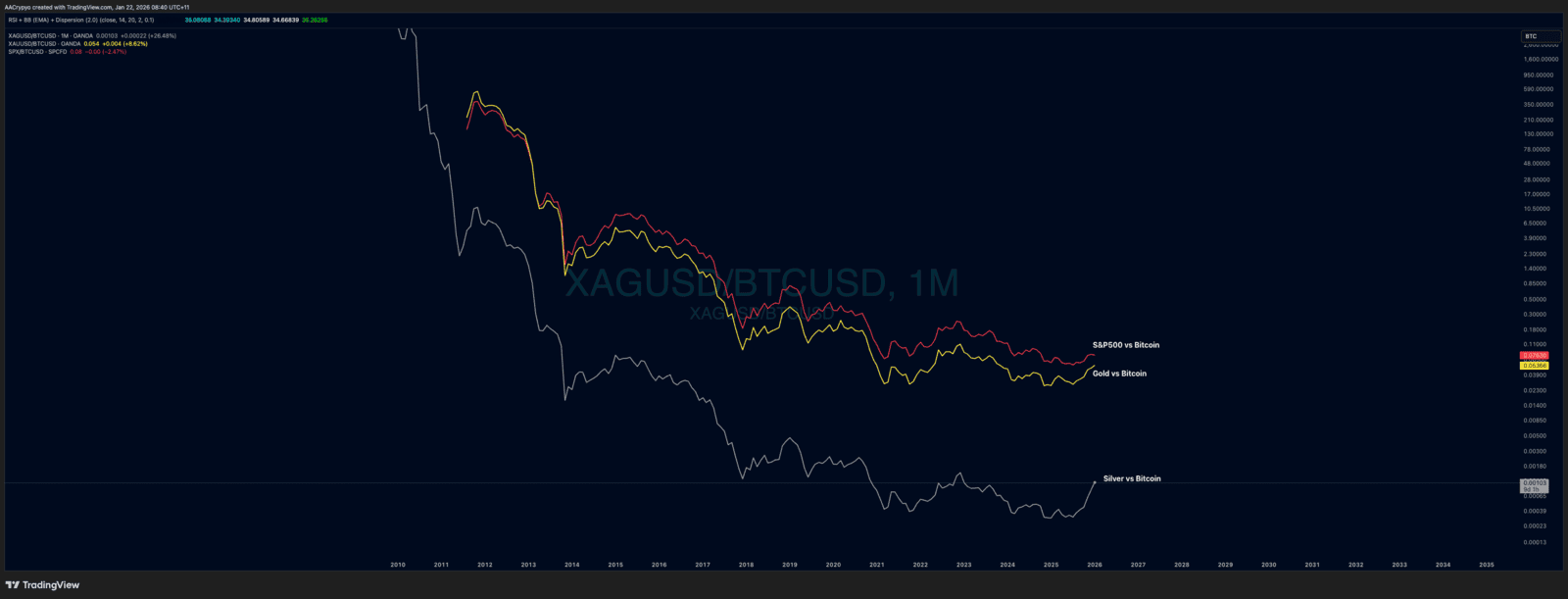

When measuring wealth and asset performance, most default to fiat currencies as the benchmark. But in reality, what matters more is how assets perform relative to alternative investment options. That’s the lens many Bitcoiners have adopted, commonly referred to as the Bitcoin Standard. We already know how Bitcoin has performed against fiat currencies, there’s been no competition. But what happens when you flip the script and measure other assets with Bitcoin as the denominator?

It’s a perspective worth considering, particularly given Bitcoin’s underperformance since the October 10 liquidation event. But as always, when in doubt, zoom out.