To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

It seems like every day brings fresh tensions—whether it’s tariff disputes between the US and the rest of the world or escalations on the geopolitical front. Over the past 24 hours, we’ve seen some progress between the US and China, with the pause on selected tariffs for Chinese goods extended until August 31. Still, Trump hasn’t forgotten his Liberation Day tariffs. His administration has drawn a hard line, giving countries until July 8 to finalise their trade agreements or face the reinstatement of those tariffs—just over 30 days to strike a deal.

Meanwhile, the ongoing Russia-Ukraine conflict continues to ripple through markets. A Ukrainian drone strike reportedly eliminated over 30% of Russia’s strategic cruise missile carriers. Since the news broke, crude oil is up nearly 4%, natural gas nearly 7%, gold up almost 3%, silver over 5%, and Bitcoin has also shown strength. The market’s reaction underscores the growing realisation that a peace deal remains unlikely, with risk-off conditions setting in.

Jerome Powell’s speech today offered no clarity on tariffs or the rate outlook, leaving markets adrift. Meanwhile, Trump’s proposed budget—set to add $5.1 trillion in new debt—has stoked reflation bets and revived investor concerns over fiscal excess. The Treasury’s Bessent moved quickly to reassure markets, insisting the US will “never default” on its now $36 trillion debt load. In turn, Bitcoin has rallied as a hedge against fiscal sprawl and dollar dilution, with investors rotating into hard assets amid mounting uncertainty.

In the last 24 hours, Ethereum led the crypto charge, up nearly 3% and reclaiming $2,600. Bitcoin battled through bear pressure to close just in the green—up 0.20% after being down nearly 2% intraday. Market sentiment is turning upward once again. Just four days ago, the Fear & Greed Index sat at 50; now, it’s climbing at 64, suggesting investors are regaining confidence amid the pullback.

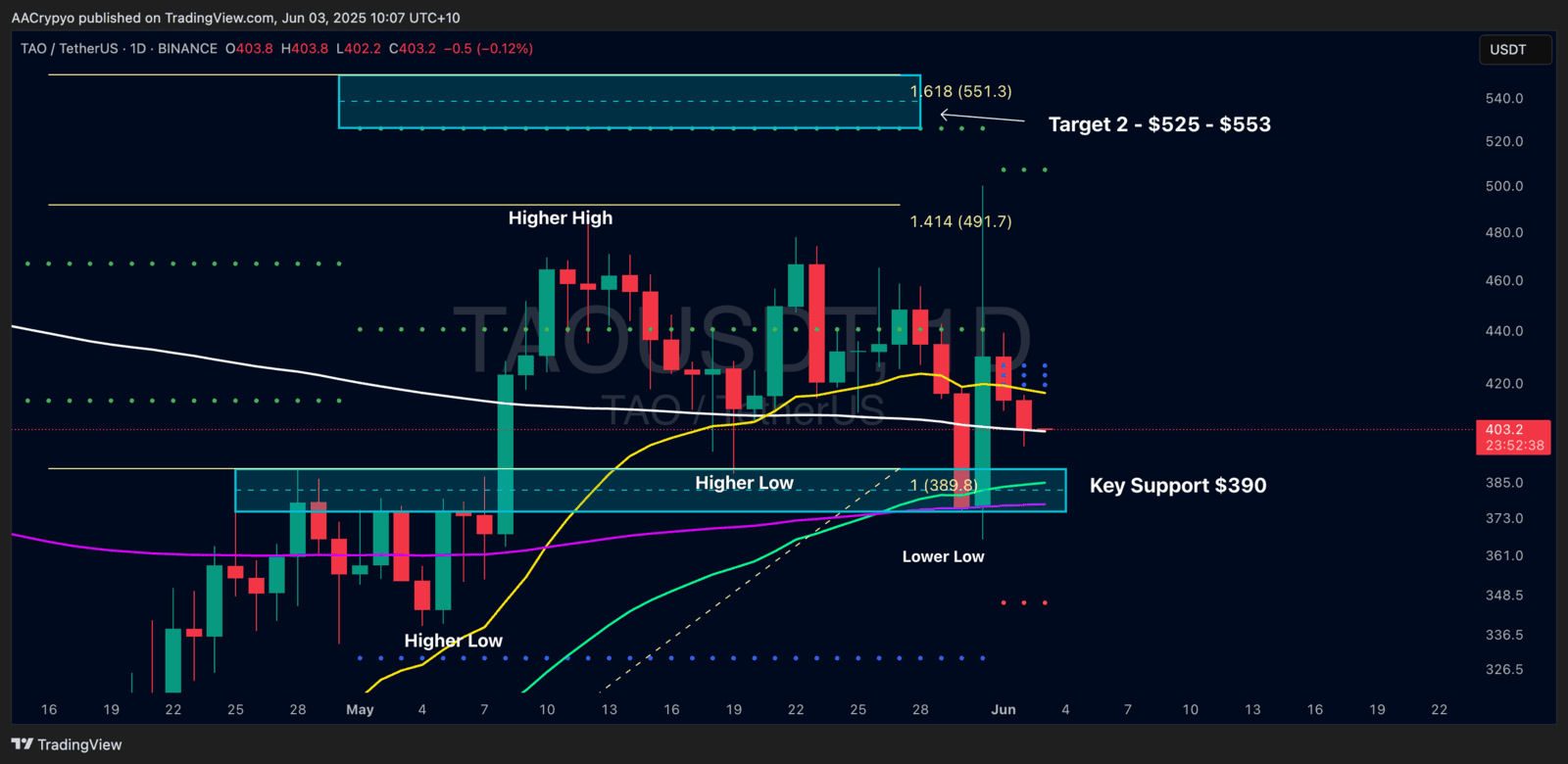

Stormrake Spotlight: Bittensor (TAO) ($402)

Stormrake Spotlight: Bittensor (TAO) ($402)

TAO bounced from key support and briefly reclaimed the 21EMA but has since slipped back below it. Immediate support now sits at the 200SMA around $400. Should this level fail, we’ll look to the $390 support zone for the next hold.

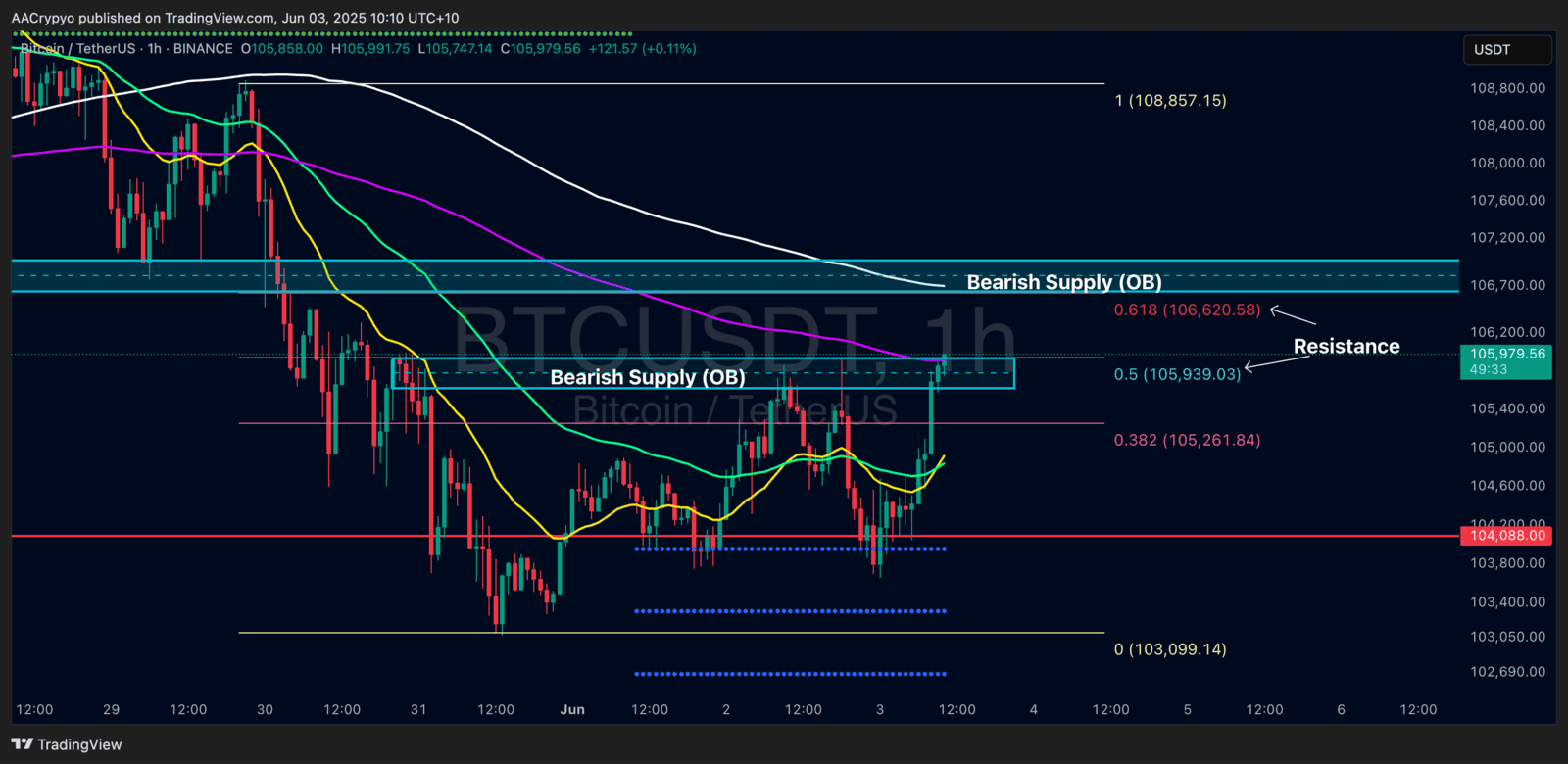

BTC/USD Key Levels and Price Action:

BTC/USD Key Levels and Price Action: