To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Bitcoin is flying, Ethereum is up nearly 15% and finally at new all-time highs, and the rest of the market is looking very green and bullish. But why? One final key event overnight changed everything.

Jerome Powell spoke at the Jackson Hole Symposium. We expected this to provide some clarity on next month’s interest rate decision, but clarity might be an understatement. Powell said that a “shifting balance of risks may warrant adjusting Fed policy.” That one line was all the markets needed. Rate cuts are now being priced in, and risk-on sentiment is back. Every major risk-on asset is up, reversing the bearish price action we’ve seen all week.

It came at the perfect time for Bitcoin. The bears were in control and threatening to break the longer-term bullish structure with BTC trading under $112K. But this rally has flipped the narrative. Bitcoin is now back in the driver’s seat at $117K, shaking off bearish sentiment and the flood of bear market calls that have dominated timelines over the past week.

Ethereum has broken out to a new all-time high for the first time in four years and now has its sights set on $5,000. The bears have paid the price, with nearly $500 million in leveraged short positions liquidated. The Fear and Greed Index has shifted firmly back into greed territory.

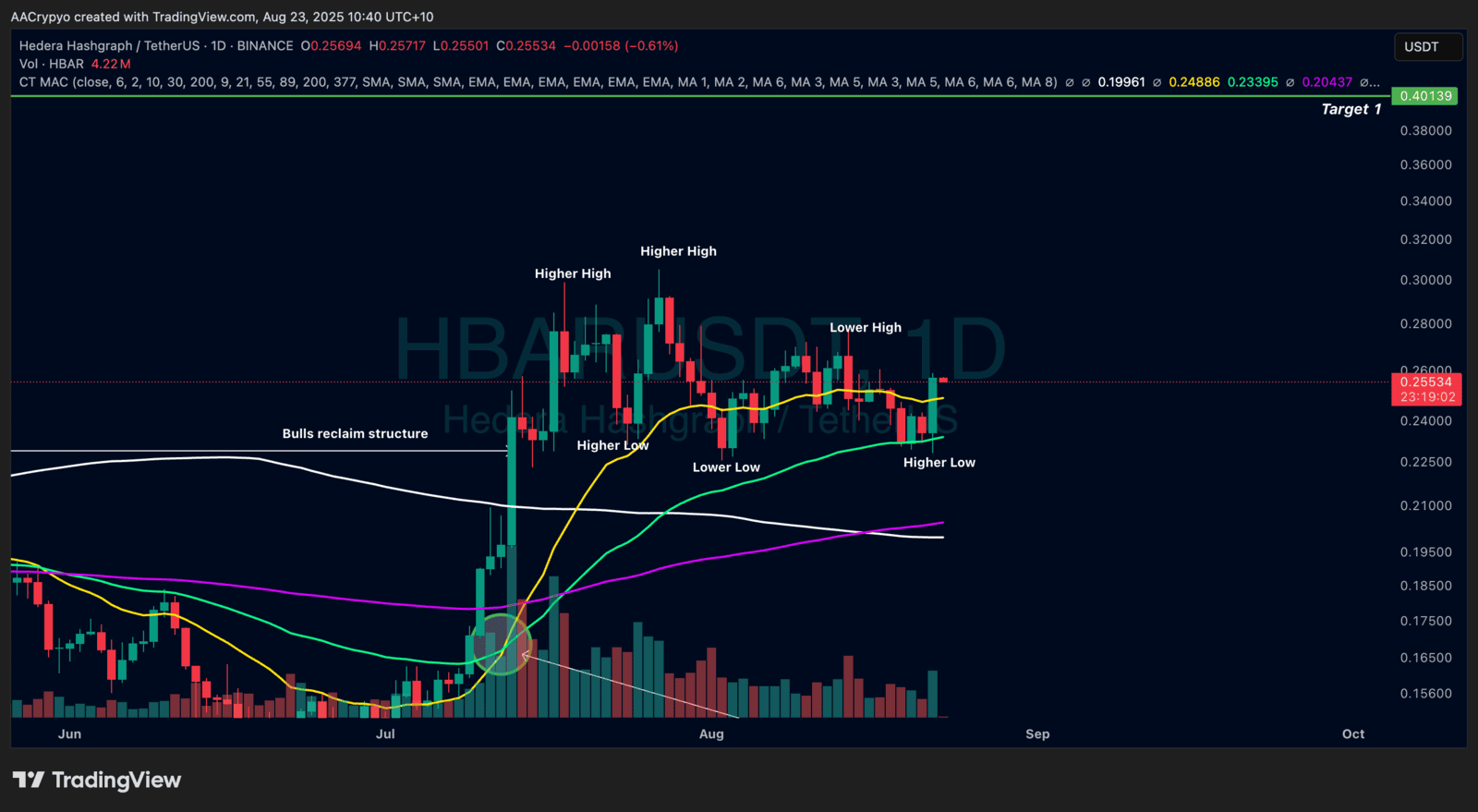

Stormrake Spotlight: Hedera (HBAR) ($0.255)

Stormrake Spotlight: Hedera (HBAR) ($0.255)