To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

If you recall, earlier this month we reported that Bitcoin from the ‘Satoshi Era’, over 14 years old, had been moved, accounting for more than 80,000 BTC. At the time, there was widespread speculation around whose Bitcoin it was, and why it was suddenly on the move.

Initially, the assumption was that these funds were simply being transferred to a new wallet for efficiency and reduced network costs. When they were moved, the market reacted with a brief sell-off as traders feared the Bitcoin could be heading to exchanges. However, no sales followed, and the consensus became that the coins had just been migrated to a modernised wallet.

That movement took place more than three weeks ago. Fast forward to the last 24 hours: Bitcoin broke below $115,000 following news that Galaxy Digital had executed one of the largest notional Bitcoin transactions in history, over 80,000 BTC, valued at more than $9 billion. It was confirmed that this was the same Satoshi Era Bitcoin that had been moved earlier in the month. While the mystery of ownership remains unsolved, one thing is now clear: the Bitcoin was sold, triggering the market drop and pushing Bitcoin below its previous consolidation range.

However, the dip didn’t last long. Bulls quickly stepped in, reclaiming the range. Although the sell-off was felt across the altcoin space, many altcoins staged a stronger recovery than Bitcoin itself. Despite BTC closing the day in the red, Ethereum ended green, Solana rose 2%, Hyperliquid gained nearly 5%, and Sui jumped over 6%.

The selling pressure has now eased. The bulls have withstood a $9 billion liquidation and still hold control. Altcoins are leading the recovery, while Bitcoin gears up for the next leg higher, with fresh all-time highs now firmly on the horizon.

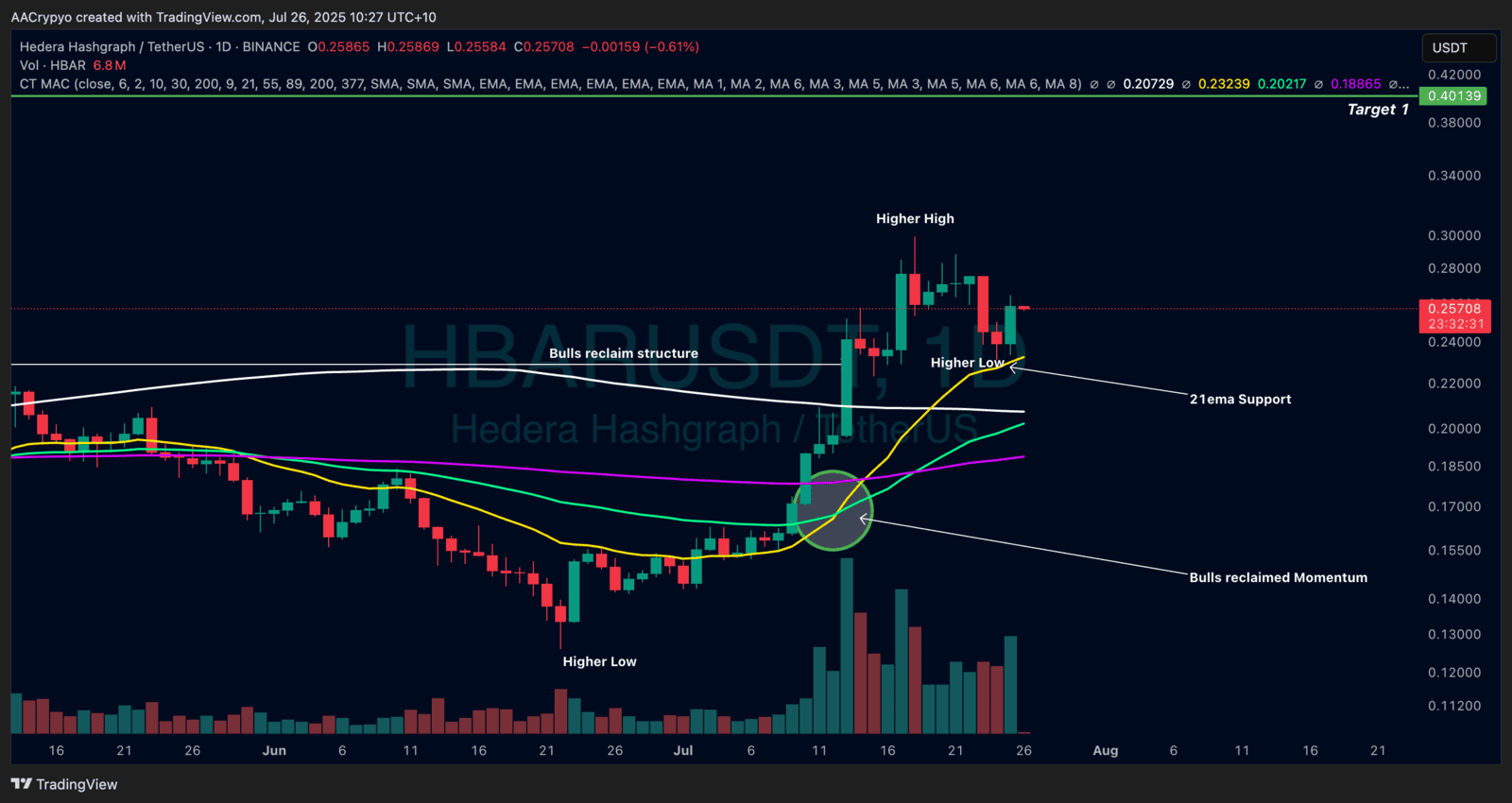

Stormrake Spotlight: Hedera (HBAR) ($0.257)

Stormrake Spotlight: Hedera (HBAR) ($0.257)