To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

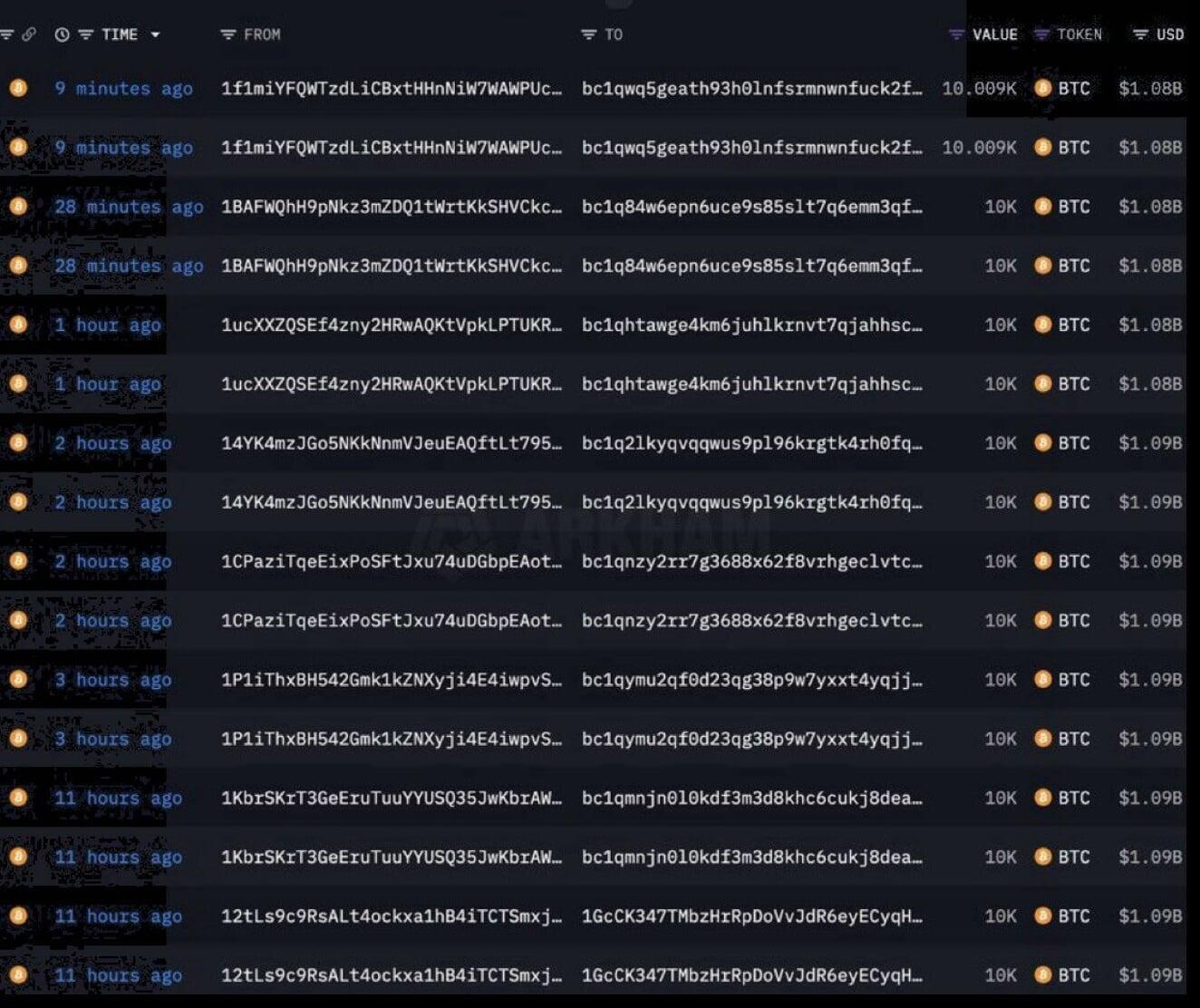

Bitcoin has seen a slight pullback following the unexpected movement of coins from eight specific wallets. Bitcoin is moved constantly, so what makes these eight wallets so significant? The last time any of them showed any activity was 14 years ago during the so-called ‘Satoshi Era’ back in 2011.