To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Last night brought one of the week’s key events: US inflation data. June’s CPI print came in cooler than expected—typically a bullish signal for risk-on assets. Both core and headline CPI came in at 0.1% month-over-month, below forecasts of 0.2% and 0.3% respectively. Year-over-year, headline CPI printed at 2.4%, just under the 2.5% consensus. Inflation is seemingly cooling, but the likelihood of the Fed holding rates steady at next week’s decision remains near 100%.

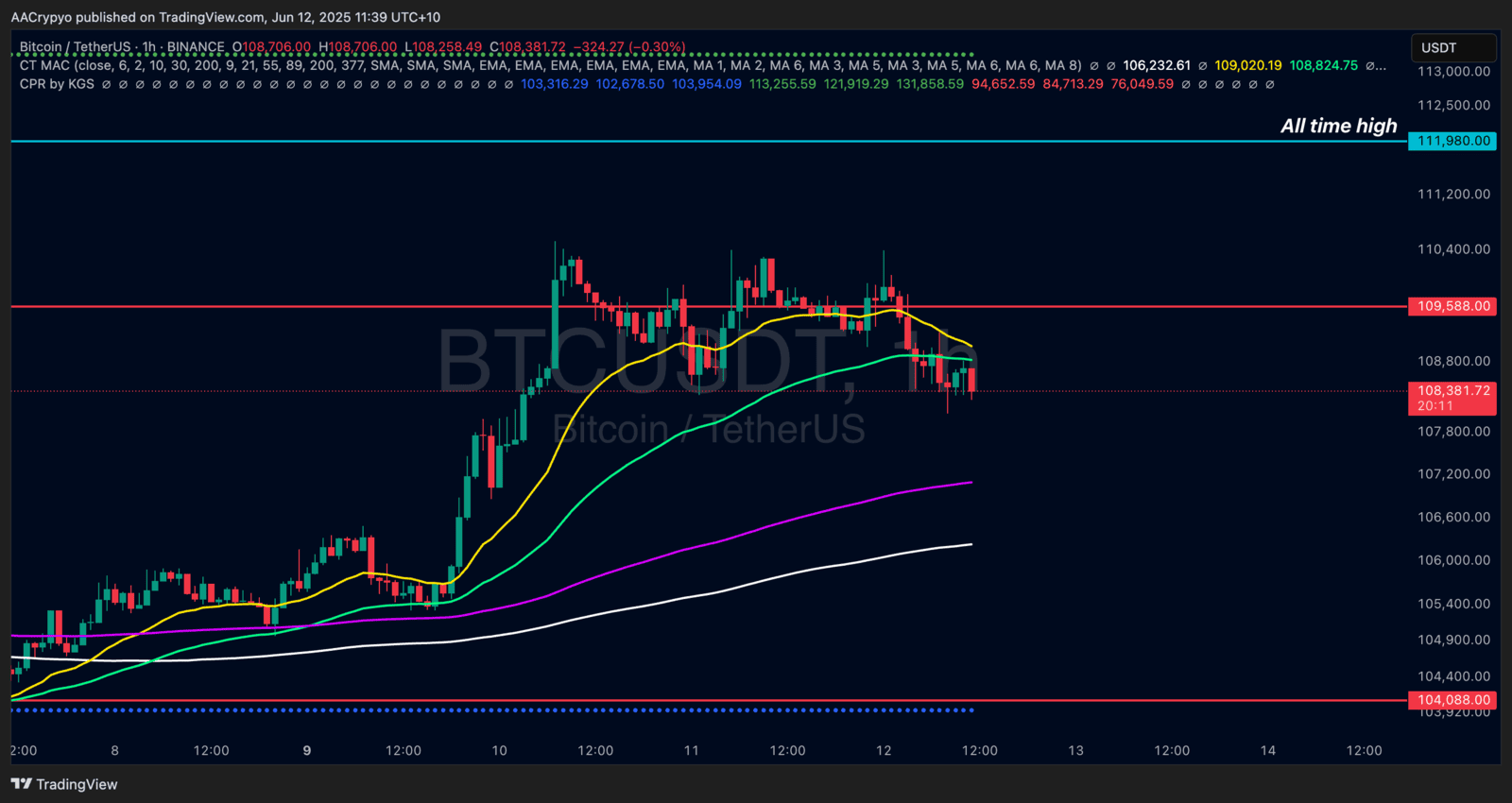

Before the release, Bitcoin was struggling to hold key levels and had slipped over 1%. Once the data hit, risk assets rallied—USD dropped and Bitcoin surged back above $110K, gaining nearly 1.3% in the two hours following the CPI release.

However, by this morning, sentiment had shifted. Bitcoin failed to build on that bullish momentum and now trades lower than it did yesterday. In contrast, Gold continued to climb even as the dollar extended its decline. This divergence signals a rotation out of USD into Gold as a safe haven, while Bitcoin is still being treated as a risk-on asset—mirroring the Nasdaq’s overnight pullback.

Bitcoin’s 1.5% drop trickled down into the altcoin market, which sold off more aggressively. Bitcoin dominance saw a reversal, closing green after being down 0.5% intraday. The risk-off tone saw capital flow out of altcoins and rotate back into Bitcoin. Structurally, BTC still looks strong—this is a consolidation phase, not a breakdown. The next move could very well be a breakout to fresh all-time highs.

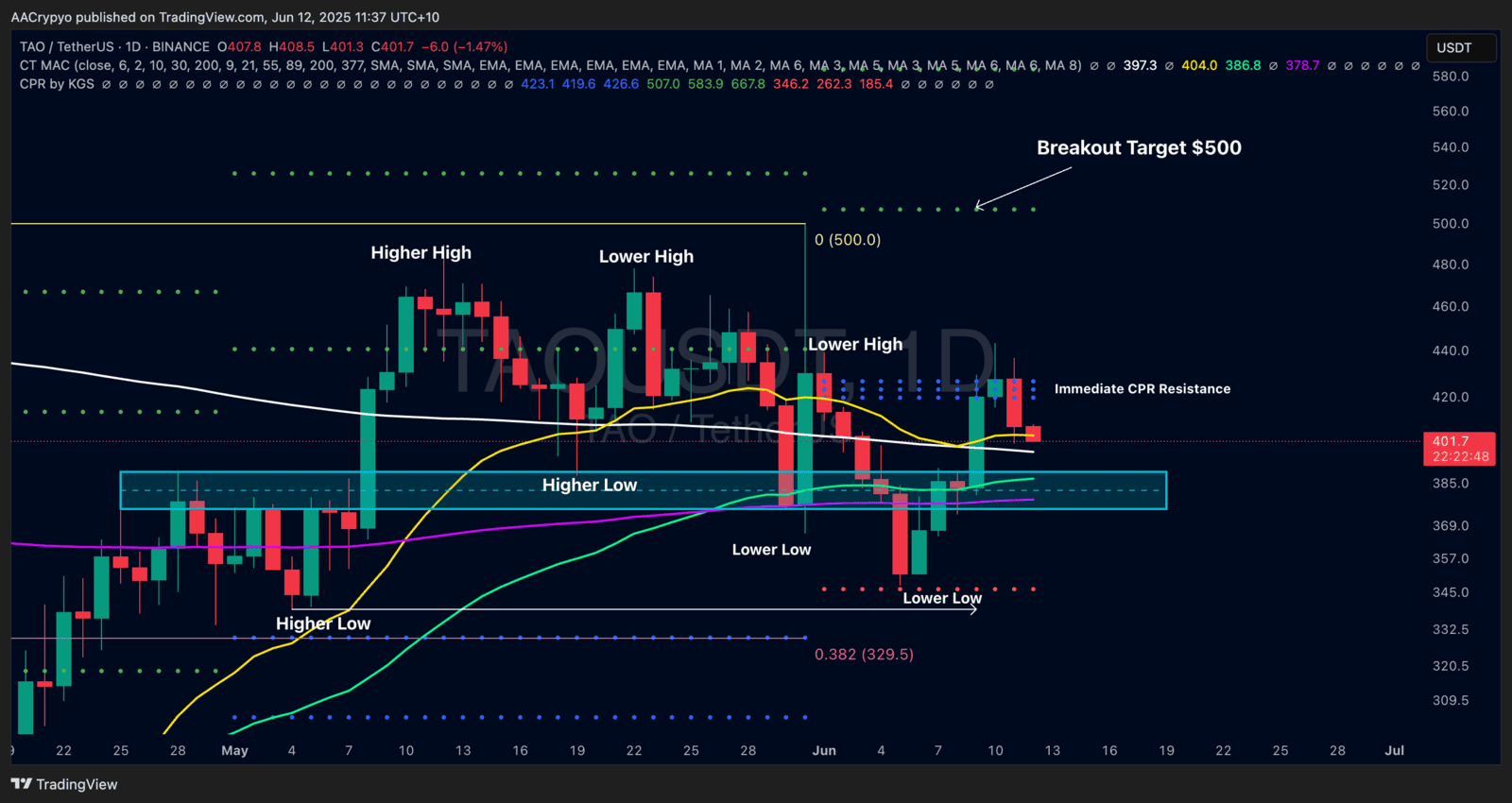

Stormrake Spotlight: Bittensor (TAO) ($402)

Stormrake Spotlight: Bittensor (TAO) ($402)

TAO faced dual headwinds: Bitcoin’s overnight weakness and resistance from its CPR level. It’s down nearly 5% over the past 24 hours and appears to have marked a short-term top. A bullish structure requires a higher low—anything above $347 would technically suffice, though confluence between $370–$390 makes that zone a more likely base for a reversal.

BTC/USD Key Levels and Price Action:

BTC/USD Key Levels and Price Action: