To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

2025 has been a year of ups and downs but with 11 months in the book, price action remains largely flat. $93.5K is the decisive level that will determine whether this year ends green or not. Bitcoin continues its bullish recovery, up nearly 2.5% in the last 24 hours and now more than 10% higher from the recent higher low set three days ago.

The macro spotlight remains on Japan. Thirty-year bond yields continue to climb and the likelihood of a rate hike remains high, just days after the government announced a $135 billion stimulus package. A rate hike is contractionary, aimed at reducing liquidity, while stimulus is expansionary, injecting fresh cash into the system. Japan is effectively pushing the accelerator while slamming the brakes. It is a clear signal that something may be broken.

Japan is in a tough position and how the Bank of Japan handles it will carry consequences for global markets. Investors will be watching closely.

In the US, the Treasury has just completed the largest buyback of its own debt in history, totalling $12.5 billion. While primarily a cash-management move due to excess reserves, it acts as a liquidity injection into the system. Financial conditions remain supportive and this is helping to fuel risk-on sentiment. Bitcoin’s ongoing recovery is benefitting from this backdrop.

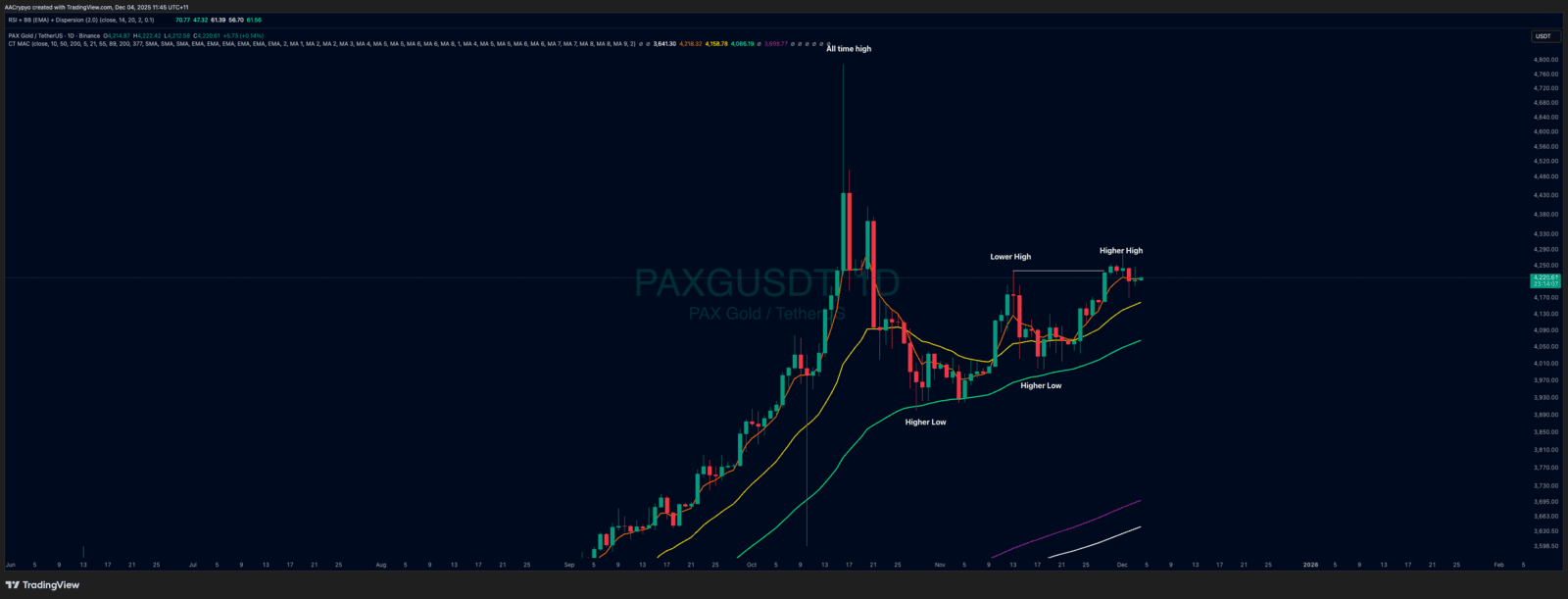

Stormrake Spotlight: Pax Gold (PAXG) ($4,220)

Stormrake Spotlight: Pax Gold (PAXG) ($4,220)