As we approach the end of the month, we are set to see a massive volume of Bitcoin options expire, with $22.6 billion worth of contracts due this Friday (6pm AEST). The battleground is set at $112K.

Why do options expiries matter? Options are basically bets on where investors think Bitcoin will be trading on a certain date. Most of these contracts won’t pay out, but with this much money on the line, price swings often pick up as traders try to push Bitcoin toward the levels that make their bets profitable.

Across the board, call options (buy-side) are outpacing puts (sell-side), with total call open interest sitting 20% higher than puts. That’s $12.6 billion vs. $10 billion. Bullish sentiment is clearly in control for now, but the edge only holds if Bitcoin stays above $112K.

Here’s where things currently stand:

Between $107K and $110K, there are $1 billion in calls versus $2 billion in puts. That setup benefits the bears.

Between $110.1K and $112K, calls and puts are balanced at $1.4 billion each.

Between $112.1K and $115K, there are $1.66 billion in calls against $1 billion in puts, favouring the bulls by $660 million.

Around 81% of put options are set at $110K or lower, meaning most downside bets are now unlikely to play out. On the flip side, $6.6 billion in call options are stacked above $120K, which looks out of reach unless we see a sharp rally before Friday.

This makes $112K the key level to watch. If Bitcoin holds above it, bulls are set to come out ahead on expiry. If it drops below, bears may regain some control.

Looking ahead, macro data on Thursday could move markets. We’re expecting fresh US GDP numbers, jobless claims and Treasury auction results. A weaker economy may increase the chances of Fed rate cuts, which would be bullish for crypto. But ongoing concerns about the jobs market could still weigh on investor confidence.

For now, bulls have the upper hand. The question is simple: can Bitcoin hold the line at $112K

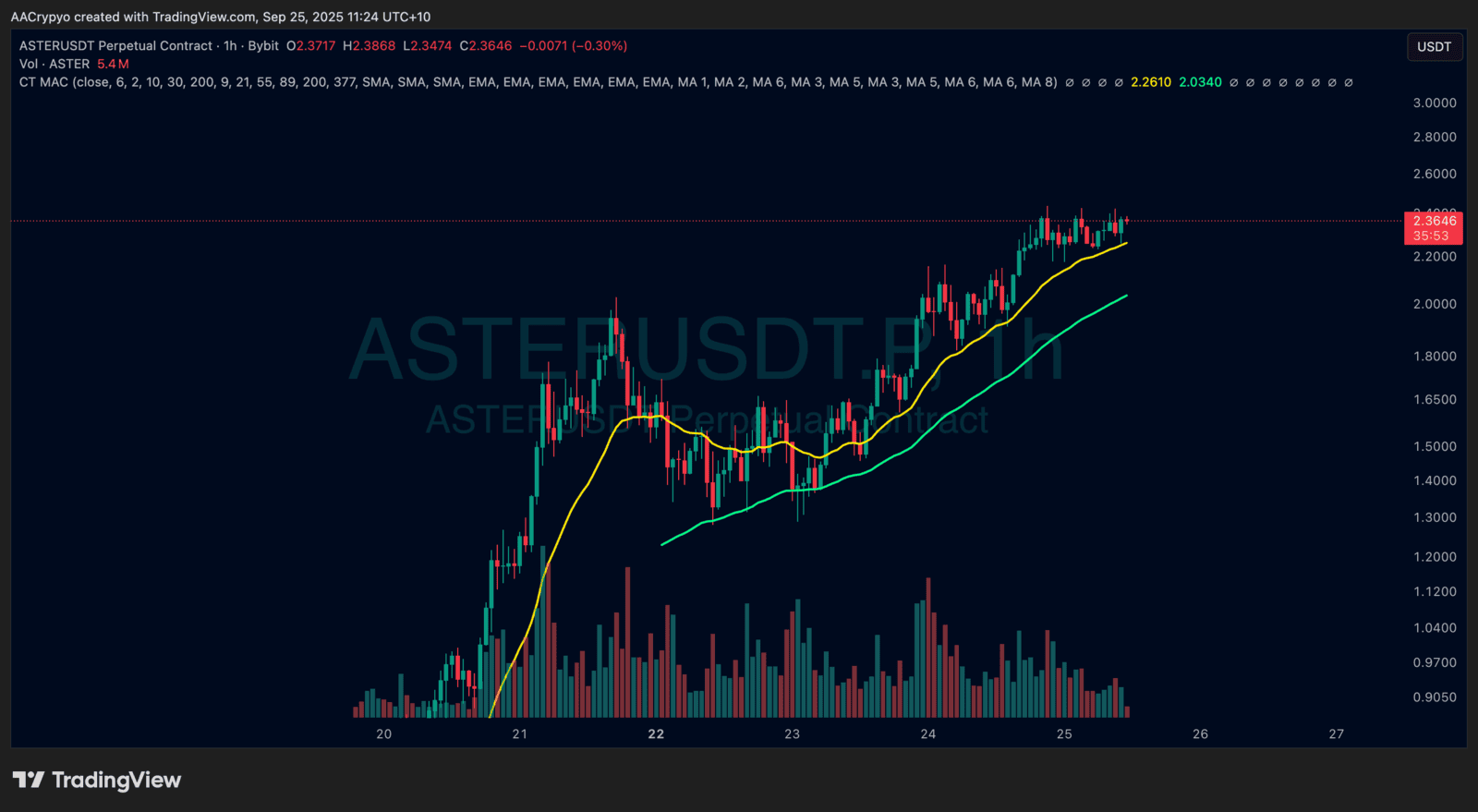

Stormrake Spotlight: Aster (ASTER) ($2.36)