To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Yesterday we questioned whether Bitcoin’s Wednesday night rally was a genuine reversal or just a relief bounce before the next leg lower. Unfortunately, it seems to have been the latter. Bitcoin is now back below $101K and altcoins have surrendered much of the ground they gained during that move, now poised to head even lower.

Broader macro concerns continue to weigh on risk-on assets. Overvaluations in both equities and gold are becoming more evident. The S&P 500 dropped over 1% and the Nasdaq fell nearly 2%, with both indices on track to close their first red week since early October. Meanwhile, gold remains in its post-correction consolidation phase, trading below $4,000 for the seventh consecutive day.

Flows are rotating back into US bonds, with yields falling amid signs of a cooling labour market. However, with the US government shut down, investors have been forced to rely on private data rather than reports from the Bureau of Labor Statistics. It is a textbook risk-off environment.

As for Bitcoin, the near 3% loss has put pressure back on the bulls, who are once again being forced to defend the must-hold $100K level. A decisive break below could trigger panic selling and drive the price even lower. While this would present a solid opportunity for those looking to accumulate cheaper Bitcoin, it is a far less attractive scenario for altcoins, which remain under pressure and are underperforming. A deeper correction would hit them harder in what is already an unfavourable environment. Focus here should be on accumulating spot Bitcoin.

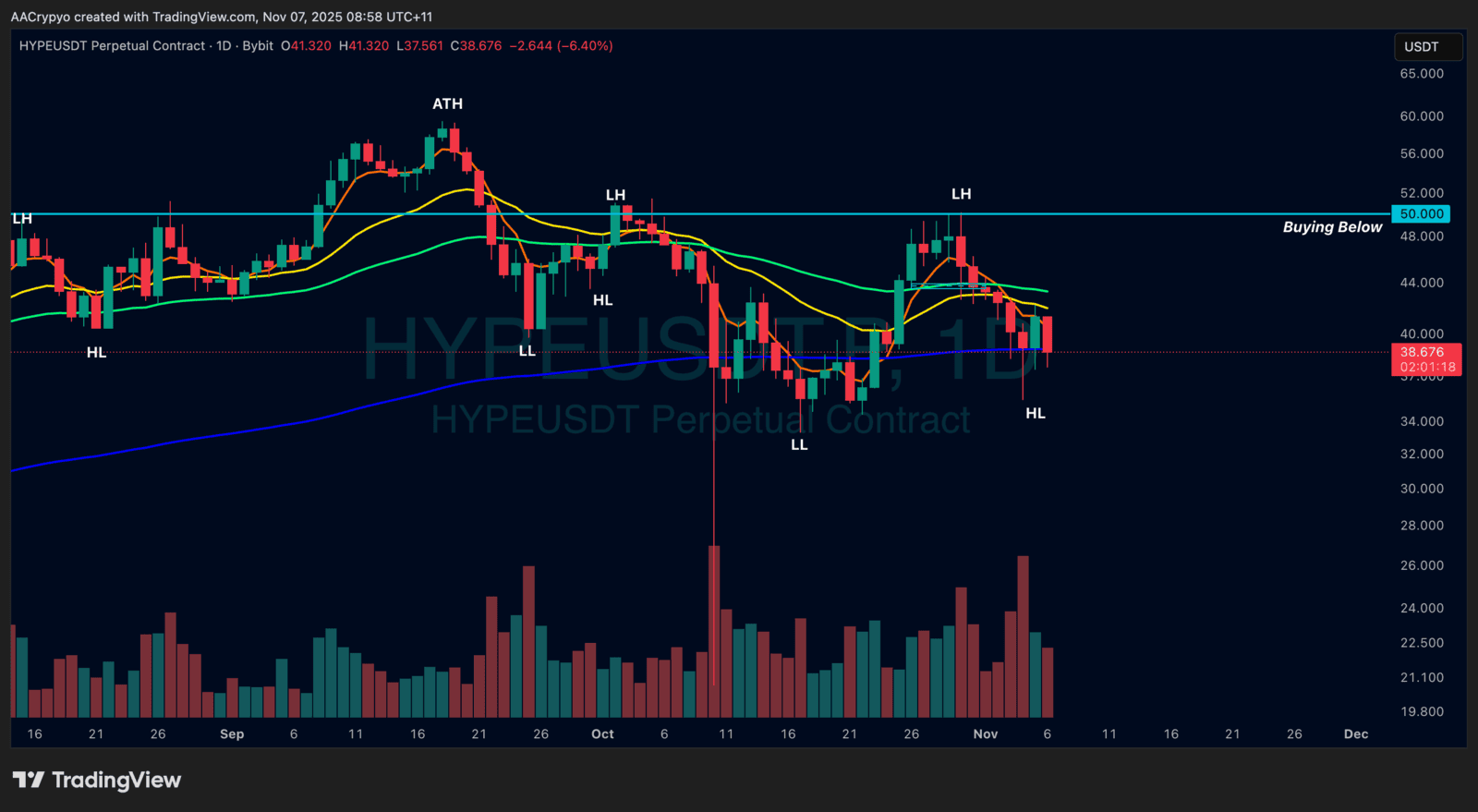

Stormrake Spotlight: Hyperliquid (HYPE) ($38.68)

Stormrake Spotlight: Hyperliquid (HYPE) ($38.68)