Middle East Power Play: Abu Dhabi Buys Bitcoin

Moody’s Downgrades the US: A Warning Shot

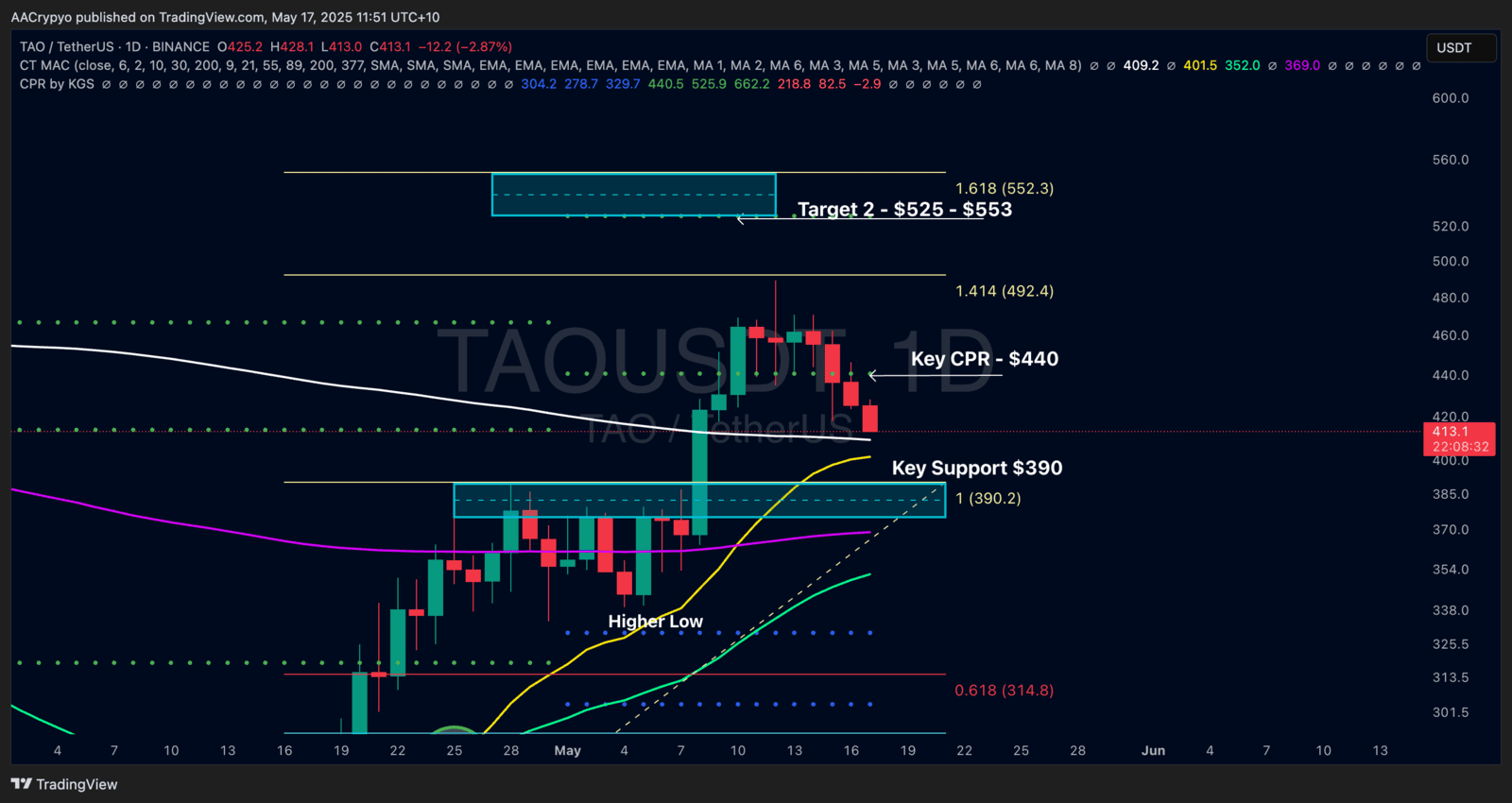

Stormrake Spotlight: Bittensor (TAO) ($413)

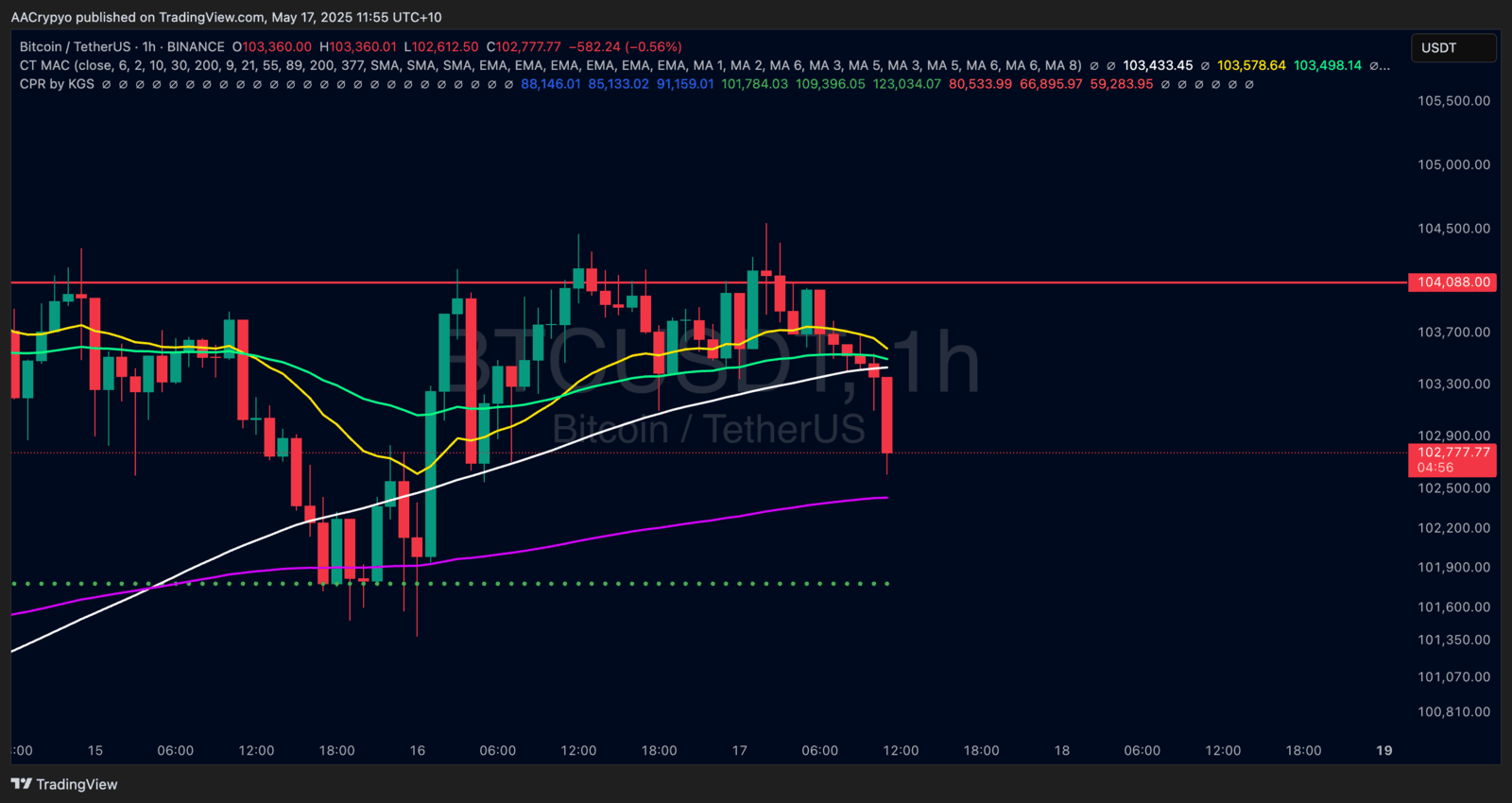

BTC/USD Key Levels and Price Action:

Written by Alexandar Artis

Create a brokerage account today

No Advice Warning

Disclaimer

All statements made in this newsletter are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.Copyright © 2024 Stormrake Pty Ltd, All rights reserved