To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

Today is the day markets have been waiting for. The Bank of Japan’s interest rate decision is expected between 1:30pm and 3pm AEDT. Consensus points to a 25 basis point hike, lifting rates to 0.75%. Bitcoin remains under pressure, now trading below $85K as market sentiment continues to soften.

We have been covering the macro impact of a rate hike on risk-on markets, but for those who are new or catching up, here is a quick breakdown.

Japan has long been the world’s cheap credit engine. Institutions regularly borrow yen at ultra-low rates and redeploy those funds into risk-on or higher-yielding assets. This is known as the yen carry trade. The problem begins when the cost of borrowing rises, either through higher bond yields or rate hikes. Once this happens, those same institutions are forced to reduce their positions to repay the borrowed yen. This typically involves selling off risk-on assets, including Bitcoin.

Over the past month Bitcoin has underperformed, but we are now also seeing weakness in other risk-on areas. Both the S&P 500 and Nasdaq have started to pull back over the past week. At the same time, risk-off flows are building. Gold continues to push higher and silver has broken into fresh all-time highs.

Volatility Ahead as Asia Leads the Reaction

The next few hours could be highly volatile as the Asian session responds to the BOJ decision. However this is not a regional story. The US session will also respond and we expect continued market movement even if the 25 basis point hike is already priced in.

We will cover the aftermath in tomorrow’s note. For now, expect volatility to remain elevated through both sessions.

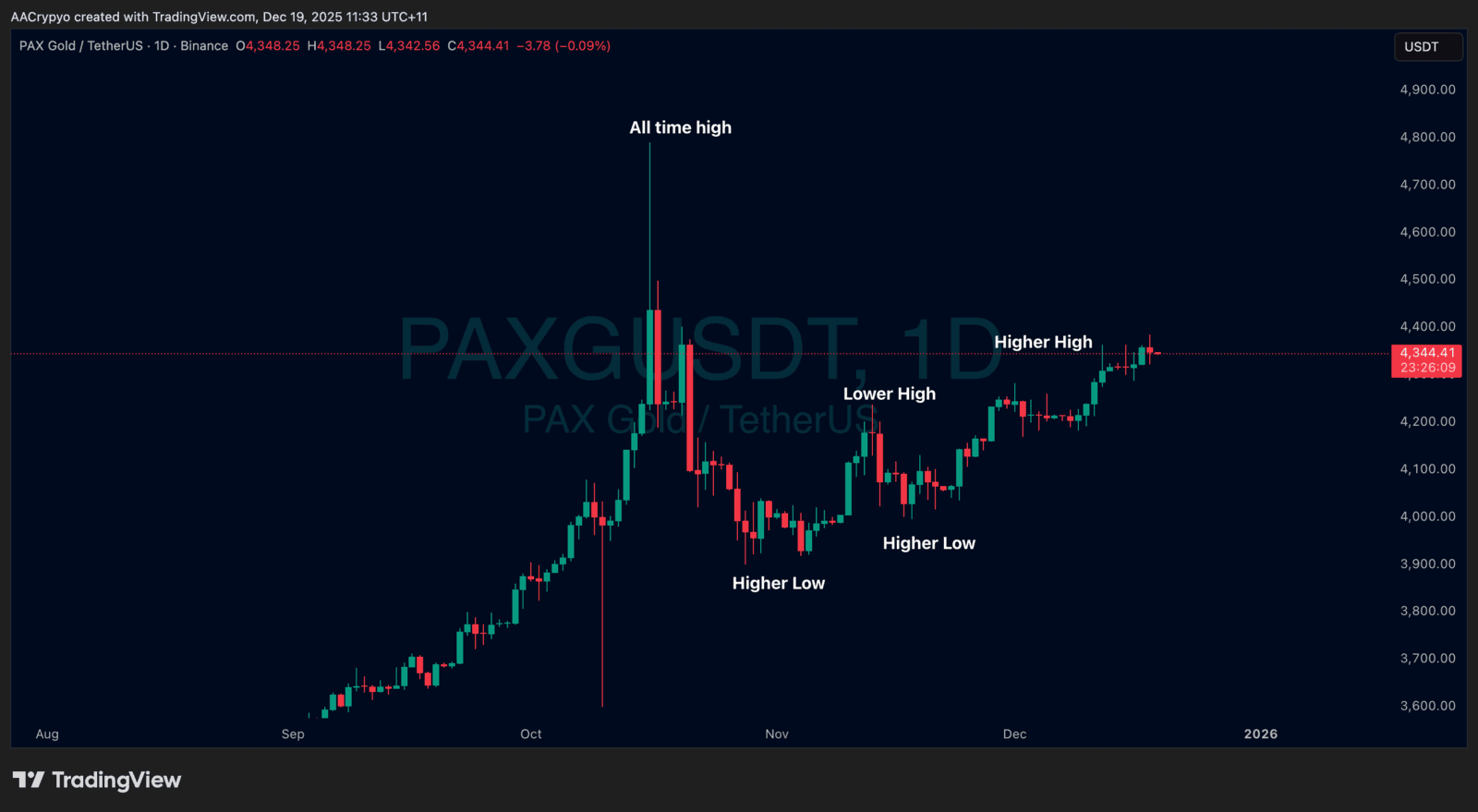

Stormrake Spotlight: Pax Gold (PAXG) ($4,344)

Stormrake Spotlight: Pax Gold (PAXG) ($4,344)