To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

It wasn’t quite the first half of the year many were expecting. Bitcoin opened on January 1 at $93.5k and now, six months later, trades around $108.4k. Whilst still up 15%, which in many metrics would be multi-year gains for other asset classes, it’s felt underwhelming to say the least considering the momentum 2024 left us with. Last year gave us everything: Bitcoin pushing beyond $100k, institutional adoption skyrocketing and, of course, Donald Trump’s election win. But as we all know, the first half of 2025 has been a rollercoaster, with tariff disputes dominating headlines and, more recently, the escalation of conflict in the Middle East. These geopolitical and macro factors have hindered Bitcoin from having the start many had hoped for, while Gold is up 25%, a clear sign of where sentiment has sat for the last six months.

However, over the past week or so, sentiment has shifted firmly back into risk-on mode. We’ve not only seen the ceasefire between Israel and Iran but also further clarity on tariffs as we approach the Liberation Day tariffs 90-day pause resumption. Gold is losing ground, down 5% in just ten trading days, while traditional indices are hitting new all-time highs. As we’ve been highlighting in our recent morning notes, although the broader market has leaned risk-on, Bitcoin was yet to make its move. Now patience is beginning to pay off. We’re finally seeing some risk-on flows enter the space. Bitcoin has broken out of its consolidation range and now looks set to fulfill the bull flag pattern we identified on Saturday. Altcoins have joined the move too, with total altcoin market cap up nearly 2% in the last 24 hours and some majors outperforming that.

Bitcoin dominance has fallen for the third consecutive day but there’s nothing yet to suggest a loss of structure or momentum. It remains extremely strong, with sentiment still firmly in greed territory at a reading of 66. With flows now looking like they’re beginning to re-enter the crypto space, the US trading session tonight will confirm whether risk-on appetite is really taking hold or if we’ll have to wait just a touch longer. Either way, the signs for Bitcoin are firmly positive and all-time highs could be just around the corner.

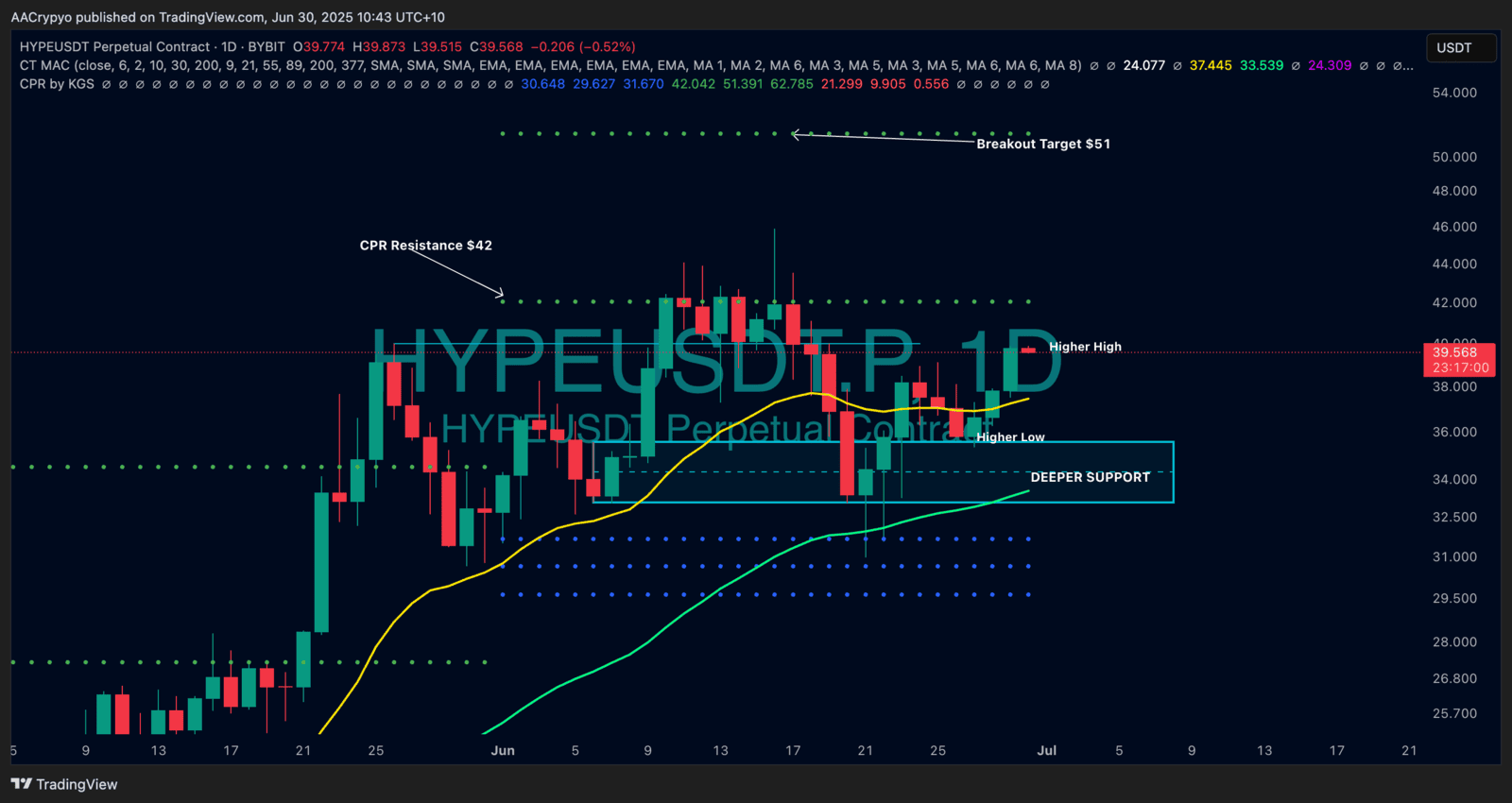

Stormrake Spotlight: Hyperliquid (HYPE) ($39.59)

Stormrake Spotlight: Hyperliquid (HYPE) ($39.59)