To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

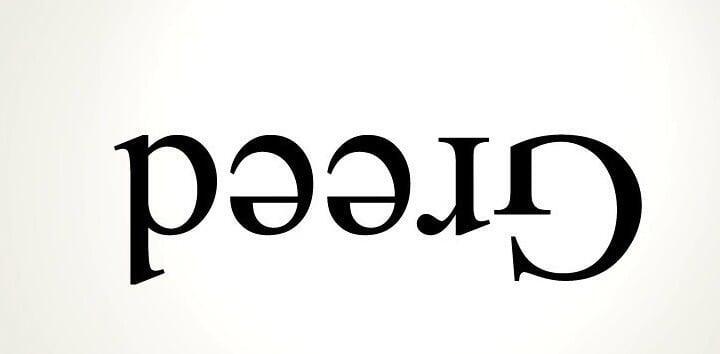

Many investors only associate greed with euphoric rallies. The famous Warren Buffett quote we often reference in Morning Notes, alongside Fear and Greed Index readings, reinforces that view. When prices are soaring, sentiment flashes extreme greed.

Yesterday we covered market psychology and what defines a successful investor. We have also discussed what to do when markets are gripped by fear or euphoria. What is discussed far less is greed at the bottom.

The greed I am referring to appears during bear markets, when an asset is already trading at a significant discount yet investors hold out for even lower prices. It is no different to seeing your favourite pair of jeans at 50% off but refusing to buy because you want 60% or 70% off. Others step in, recognise value, and the opportunity disappears.

Let us revisit November 2022. FTX had just collapsed and Bitcoin was trading just above $15,000. At that moment, greed manifested in calls for $10,000 to $12,000. Influential voices pushed for further downside even after Bitcoin had fallen 79% from its prior all time high, liquidations had ripped through the system, and sentiment was entrenched in extreme fear.