To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

We’ve just witnessed the largest single day crash in crypto history. Brutal, to say the least. Unless you were sitting in spot positions, you likely got wiped. Even spot holders are in disbelief.

Nearly $20 billion has been erased from the market in the past few hours, with over $16 billion of that in long liquidations, and that figure is still climbing as I write.

Why the sell-off?

Bitcoin opened the morning down nearly 4%, trading around $117K after Trump announced fresh 100% tariffs on China. That headline alone dragged global markets down, with the S&P 500 losing nearly 3% and the Nasdaq dropping 3.5%. But that doesn’t explain the full picture.

The real story is what happened next. Bitcoin plummeted from $117K to $102K in just 20 minutes. A full-blown liquidation cascade.

Wintermute, one of the largest market makers in crypto, appears to be involved again. They’ve been behind major market events before, including the Sonic (S) crash earlier this year when they offloaded their tokens, crushing the price while the broader market rallied.

Today, Wintermute sent over $700 million worth of Bitcoin to Binance just minutes before the crash. At the same time, several major whales opened aggressive short positions. While we don’t have concrete proof, speculation is flying that Wintermute may have sparked the sell-off, igniting panic across the board.

Adding fuel to the fire, there are now widespread rumours that one or more major players may have gone under. While nothing has been confirmed, it would explain the size and speed of the move.

Bitcoin dropped over 15%, but altcoins were obliterated

Within 20 minutes, altcoins hit levels not seen since the previous bear market. Many names saw 50% or more wiped out in minutes. XRP lost 50%. SUI was down 80% at one point, briefly trading under $0.60 before bouncing back above $2.50. LINK dropped 60%. The space was painted deep red and while some assets have rebounded from the absolute lows, they remain in heavy correction territory.

This entire event is a harsh reminder of the risks that come with leverage. Nearly $20 billion was wiped out in hours. Those in spot are still in drawdown, but they are still in the game. Now might be one of the best accumulation opportunities we’ve seen in a long time, for both Bitcoin and the altcoins hit hardest by the flush.

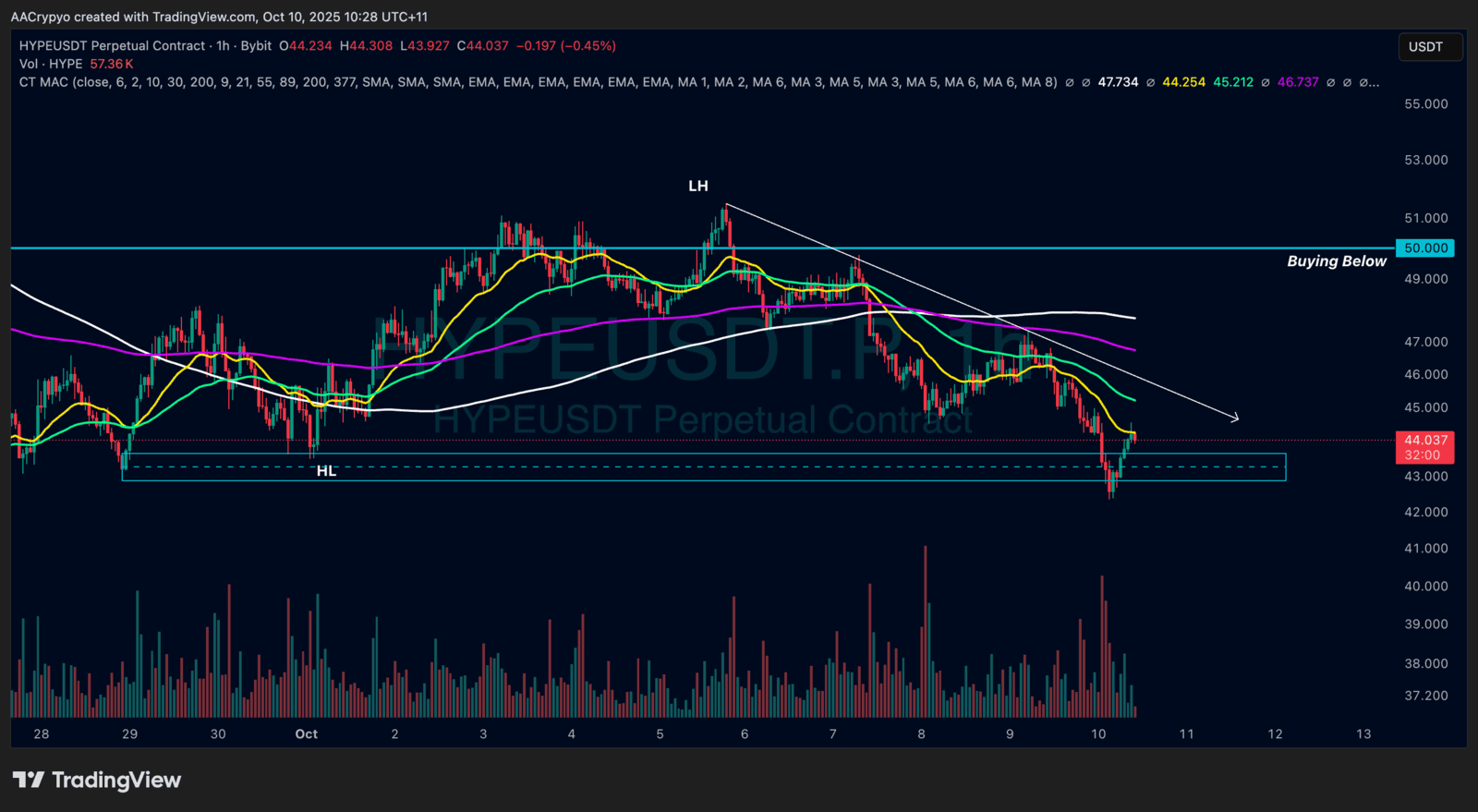

Stormrake Spotlight: Hyperliquid (HYPE) ($38.36)

Stormrake Spotlight: Hyperliquid (HYPE) ($38.36)