To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

We have wrapped up November, historically Bitcoin’s highest-performing month, but it failed to deliver this year. Bitcoin lost over 16%, making it two consecutive red months and pushing 2025 into the red as well.

We now turn to December, which has historically been Bitcoin’s weakest Q4 month, though still green on average. It holds an average return of 8.42%, but only seven of the last fourteen Decembers have ended positive. So while the stats favour the bulls slightly, it’s effectively a coinflip.

Q4 overall has not lived up to expectations. A red fourth quarter has only happened four times in the past fourteen years. Based on historical probabilities, that leans the odds in favour of a green December.

Over the past 24 hours, Bitcoin has reclaimed $91K after a relatively slow weekend that had little significance. The week ahead, however, could bring some much-needed movement as two major central bank heads take the stage. Bank of Japan Governor Ueda speaks today, followed by US Federal Reserve Chair Jerome Powell tomorrow.

All eyes will be on Ueda following the recent spike in Japanese bond yields, which sparked panic and early signs of the yen carry trade unwinding. Investors will be looking for clarity on whether the BOJ may intervene to reduce yields again, and any hints on their upcoming interest rate decision. Expect volatility either way.

As we move into December, another important development comes into play. Quantitative tightening is officially ending. This is likely to be a focus of Powell’s speech tomorrow, and it should be viewed as a bullish catalyst for liquidity and risk-on markets heading into the rest of December and 2026.

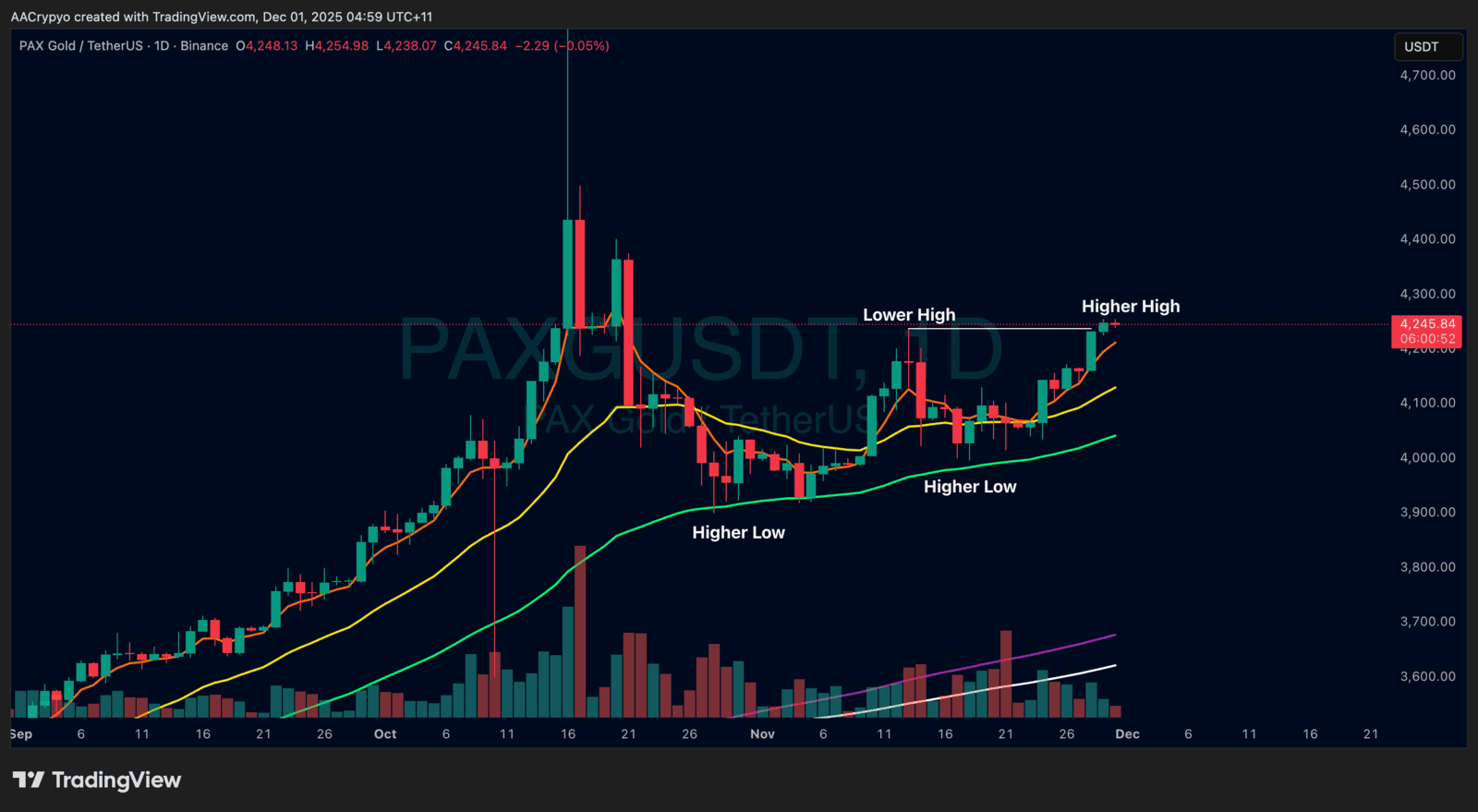

Stormrake Spotlight: Pax Gold (PAXG) ($4,245)

Stormrake Spotlight: Pax Gold (PAXG) ($4,245)