To receive the Morning Note in your inbox, subscribe here: https://stormrake.substack.com/

When banks show signs of fragility, whether that is a lack of trust in them or in the fiat assets they hold, it is exactly when assets like gold and ideally Bitcoin should be running. These are alternative stores of value, sovereign in nature and free from the control of banks.

Last night’s US session was a textbook example. Bank weakness dragged down risk-on assets and the US dollar, while gold pushed higher to fresh all-time highs, now trading above $4,300 an ounce. It feels like gold is climbing by $100 a day. To put that into perspective, every $100 move in gold’s price adds around $669 billion to its market cap. That is roughly 31% the size of Bitcoin’s entire market cap, highlighting just how much larger gold still is as an alternative asset.

With markets already on edge from US and China tensions, which may be easing slightly but remain unpredictable, there was some relief on Thursday morning from strong earnings across major banks. That saw risk-on markets bounce. But this was short lived, as fresh data released Friday morning reversed the mood quickly.

Regional US banks showed surprising weakness, with Zion Bancorporation front and centre. While not a large institution, it fell 13% after revealing unexpected losses on two loans in its California division. This was enough to rattle investor confidence further, raising fresh concerns around hidden credit stress as lenders navigate an uncertain macro backdrop.

The ripple effect hit traditional indices like the S&P 500 and Nasdaq, as well as the US dollar, with the DXY falling for a third consecutive day. Given Bitcoin’s current correlation to risk-on equities, it also fell over the past 24 hours and now trades below $108,000.

With everything else under pressure, investor attention has turned back to one asset class that continues to deliver: gold. It has not only held its ground but has continued setting new all-time highs throughout the last 24 hours. Gold is fulfilling its role as a store of value in times of stress. Demand for physical bullion remains extreme, with investors even queueing for hours to get exposure.

Once gold begins to stall and profit-taking sets in, there is a strong probability of rotation into Bitcoin. Smart money is already positioning ahead of this move, knowing that if Bitcoin starts catching flows from gold, the rally could be sharp and fast. Those waiting on the sidelines will then be forced to choose whether to buy in at higher prices or miss the move entirely.

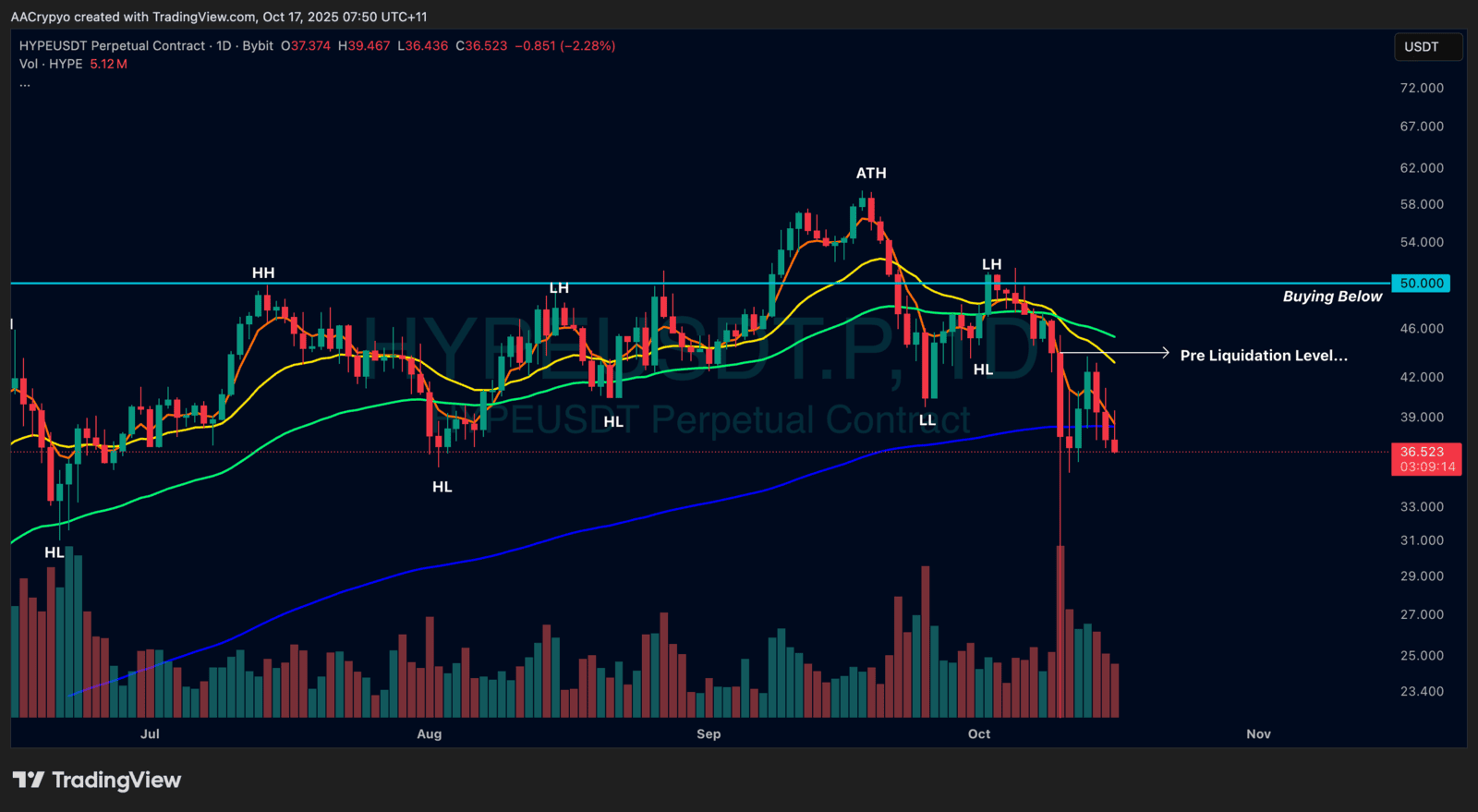

Stormrake Spotlight: Hyperliquid (HYPE) ($36.58)

Stormrake Spotlight: Hyperliquid (HYPE) ($36.58)