How Washington and the Middle East Shaped June’s Bitcoin Market

How Washington and the Middle East Shaped June’s Bitcoin Market

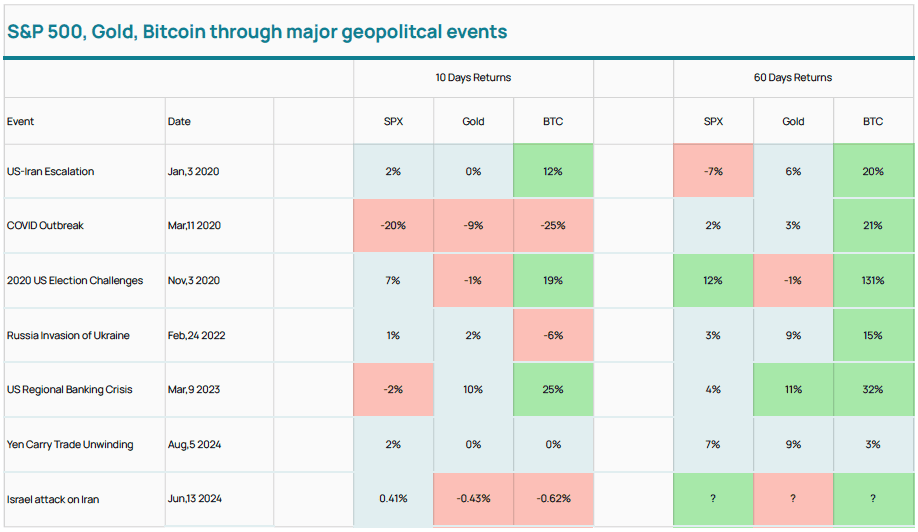

A Month Shaped by Macro Headwinds:

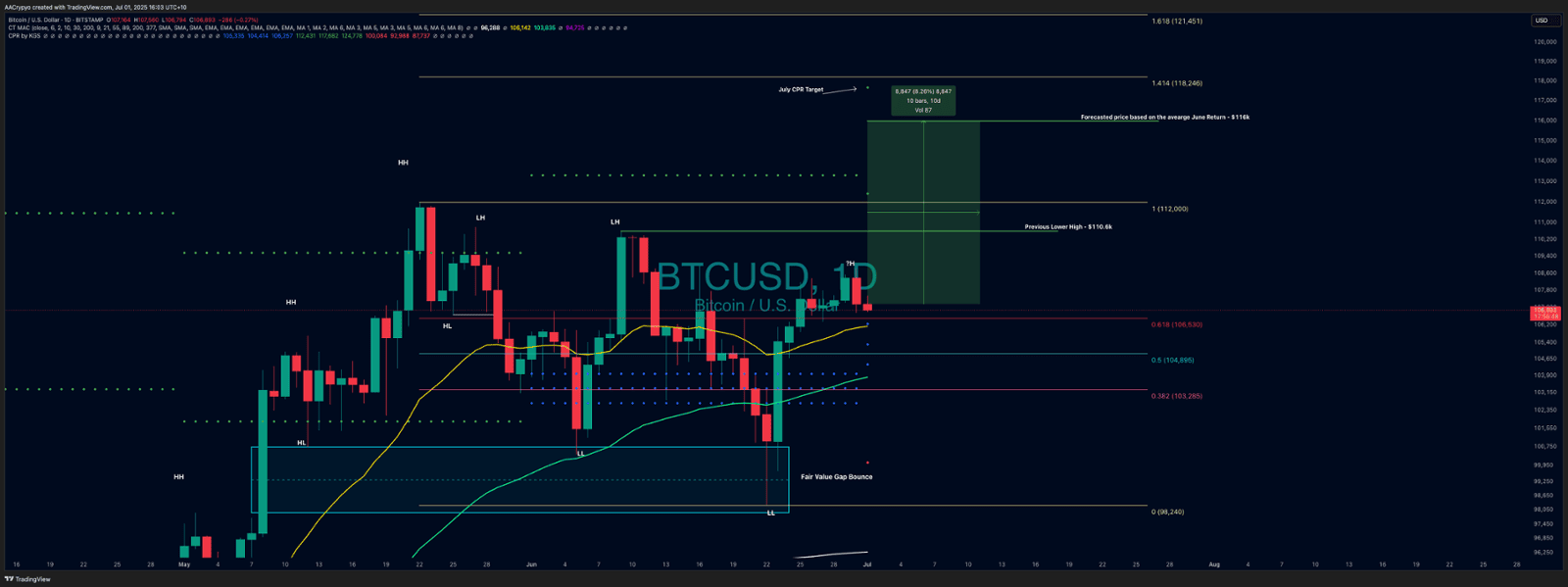

July Market Outlook: Ready for a Bullish Turn?

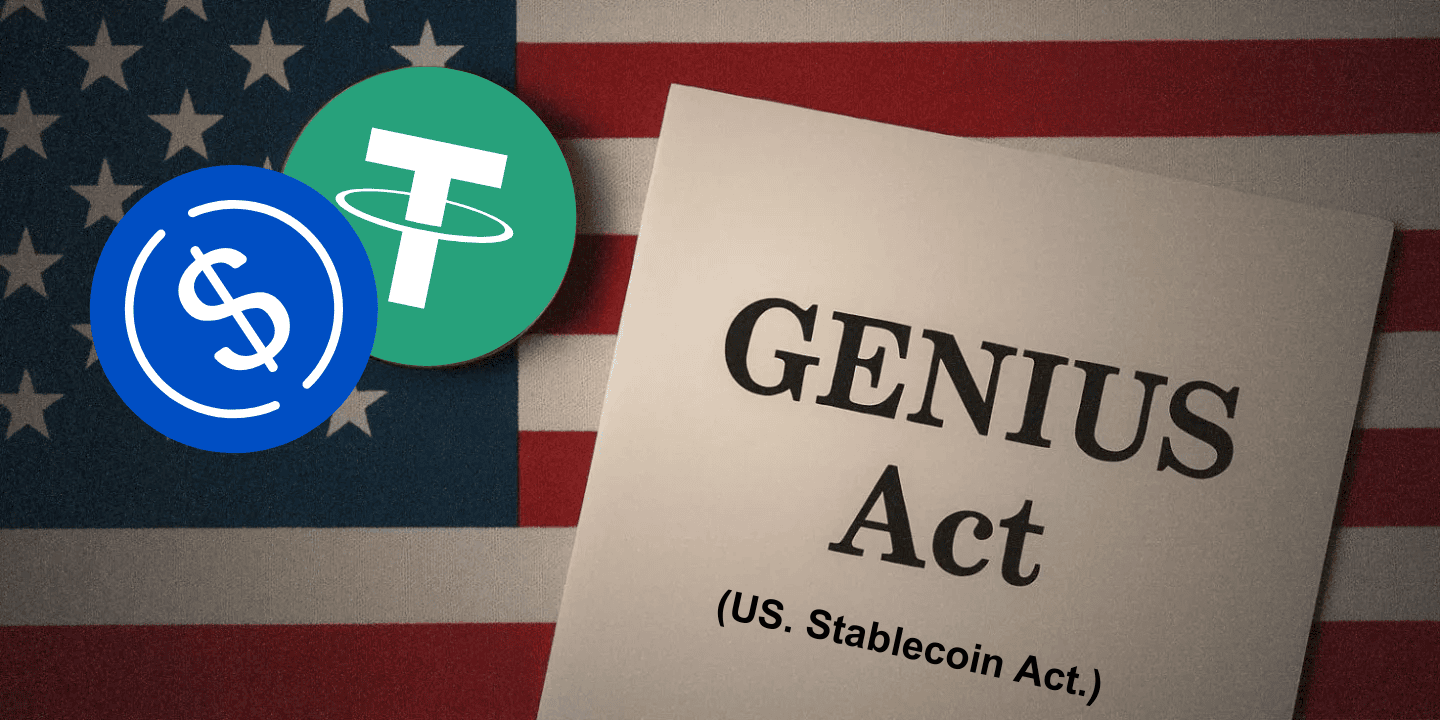

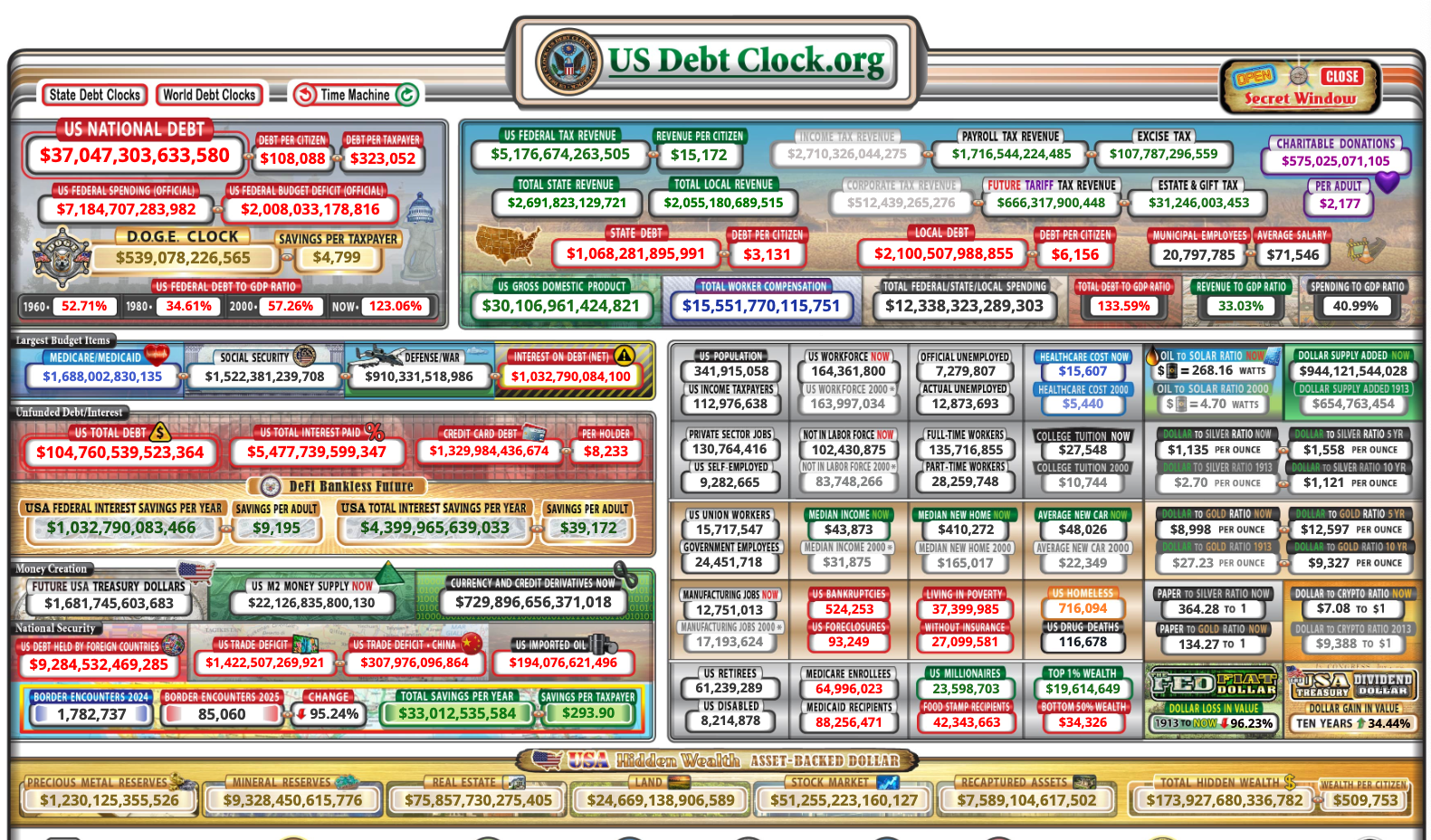

Stablecoin GENIUS Act Passed:

- A clear definition of payment stablecoins

- Reserve requirements (stablecoin issuers must hold 1:1 reserves)

- Licensing requirements

- And more

In the News:

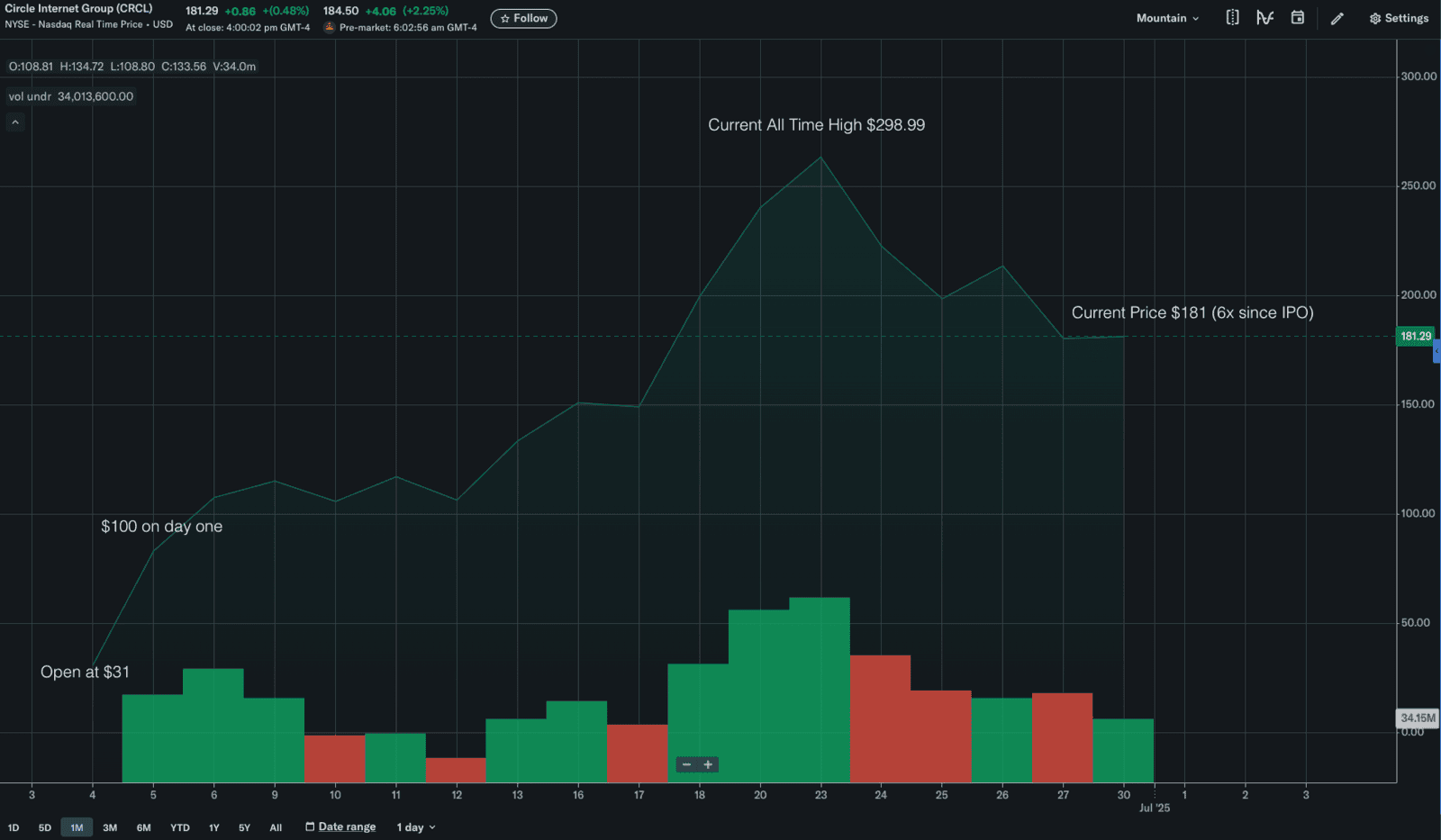

Circle IPO performance:

Big Beautiful BIll passed:

Texas officially has a Strategic Bitcoin Reserve:

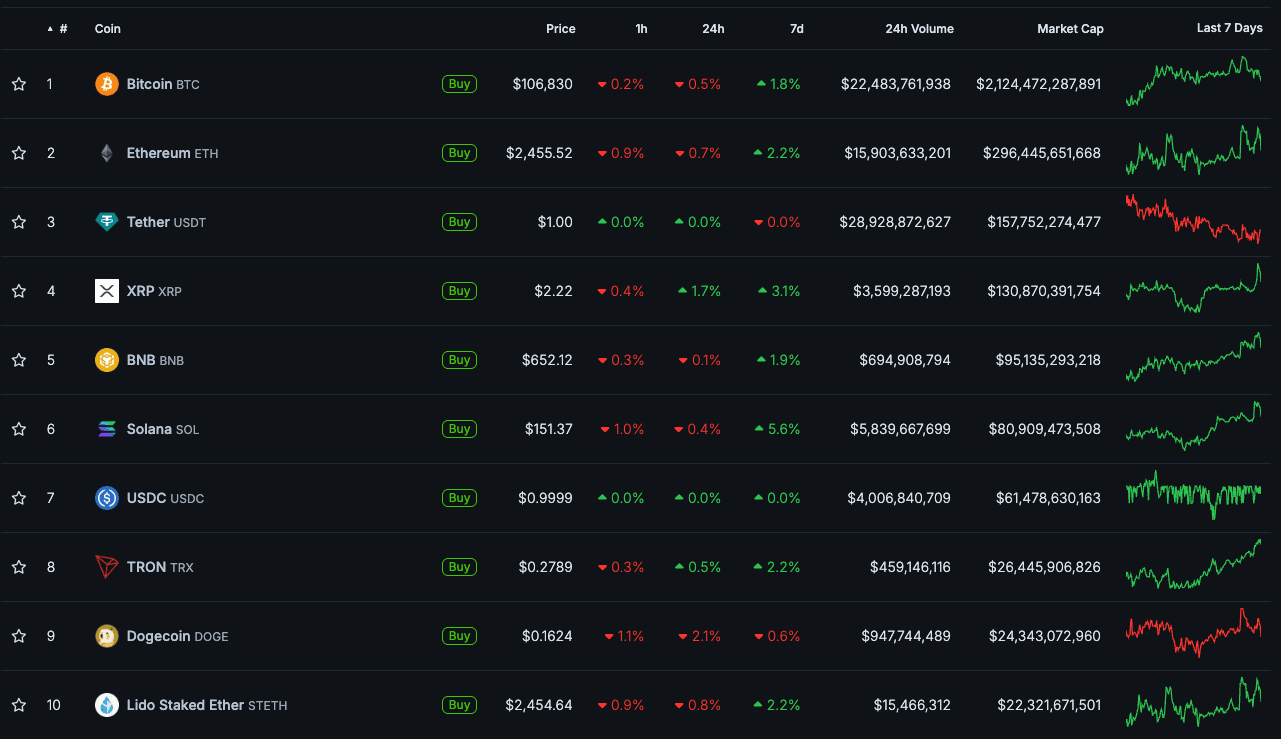

Market Update:

Here is the fast five of what you need to know about the market in June 2025:

- Bitcoin rose just 2.42% in June.

- Ethereum fell 1.62% in June.

- Cardano fell out of the top 10, replaced by Lido Staked Ethereum.

- Bitcoin dominance is at a multi-year high at 66%.

- The total crypto market cap grew by just 1.15% in June.

Video of the month:

Bitcoin & SMSFs 101 Webinar: Insights with EasySuper

DATE: 30 July 2025 at 6:00 pm AEST

If you missed the original, this is your chance — don’t waste it.

Learn how to structure your SMSF to include crypto, use strategic leverage, and stay compliant.

Register now — spots are filling fast.

https://easysuper.smsfconsulting.com.au/stormrake-easysuper

Education - How to use Bitcoin:

Means of Exchange:

Store of Value:

Collateral & Borrowing:

The True Power of Bitcoin:

Start Your Brokerage Account

If you enjoyed this Rake Review, feel free to open an account and gain access to more proprietary research and work with your very own dedicated crypto broker.

No Advice Warning

Disclaimer

All statements made in this newsletter are made in good faith and we believe they are accurate and reliable. Stormrake does not give any warranty as to the accuracy, reliability or completeness of information that is contained here, except insofar as any liability under statute cannot be excluded. Stormrake, its directors, employees and their representatives do not accept any liability for any error or omission in this newsletter or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise specified, copyright of information provided in this newsletter is owned by Stormrake. You may not alter or modify this information in any way, including the removal of this copyright notice.Copyright © 2022 Stormrake Pty Ltd, All rights reserved