Blog tagged as Tokenisation

September has wrapped up. It fought through historical stigmas, liquidations, and manipulation to close green. A new narrative dominated headlines and shook the space, while fresh signs of adoption continue to emerge. Through it all, Bitcoin held firm and September has now set the stage for October.

July was a month of contrasts for Bitcoin, with decade-old coins suddenly moving, fresh all-time highs, and the first major crypto regulations landing. The back half of the year has started stronger than expected, but can this momentum carry into a full-fledged altseason?

July was a month of contrasts for Bitcoin, with decade-old coins suddenly moving, fresh all-time highs, and the first major crypto regulations landing. The back half of the year has started stronger than expected, but can this momentum carry into a full-fledged altseason?

As with much of the first half of 2025, June's price action was largely influenced by news and decisions from the White House, alongside ongoing conflicts in the Middle East, but it has set itself up for a potentially bullish second half of the year.

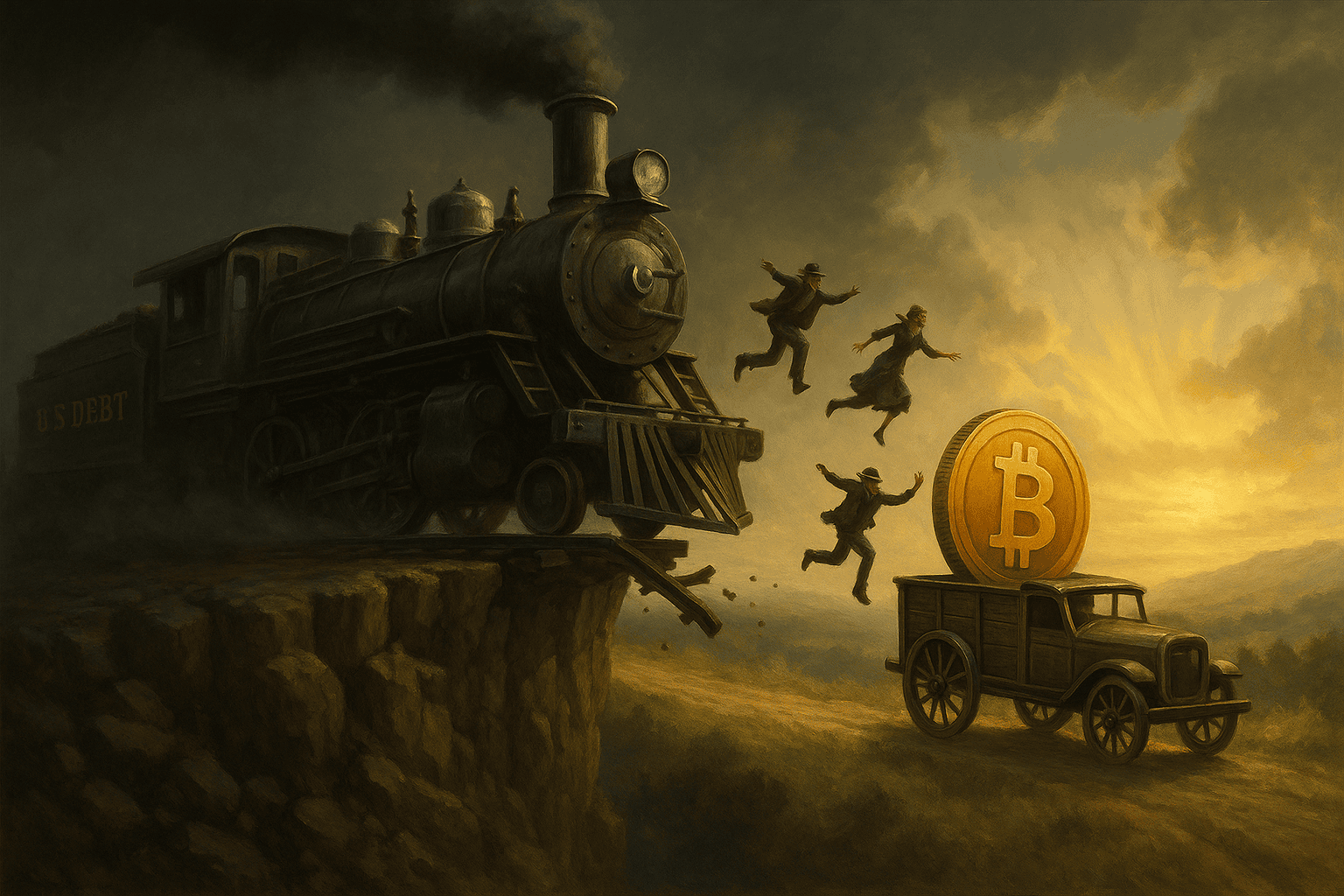

May proved what conviction looks like. As US debt soared past $37T, Bitcoin broke to new highs, reminding markets it’s not just resilient, it’s the alternative. In a system built on debt, Bitcoin isn’t reactionary. It’s the solution.

For the longest time, people have debated whether Bitcoin is a risk-on or risk-off asset. Is it a levered Nasdaq, or is it digital gold? What if I told you neither side is wrong — and that April, one of the wildest months in recent memory, proved Bitcoin is, in fact, both.

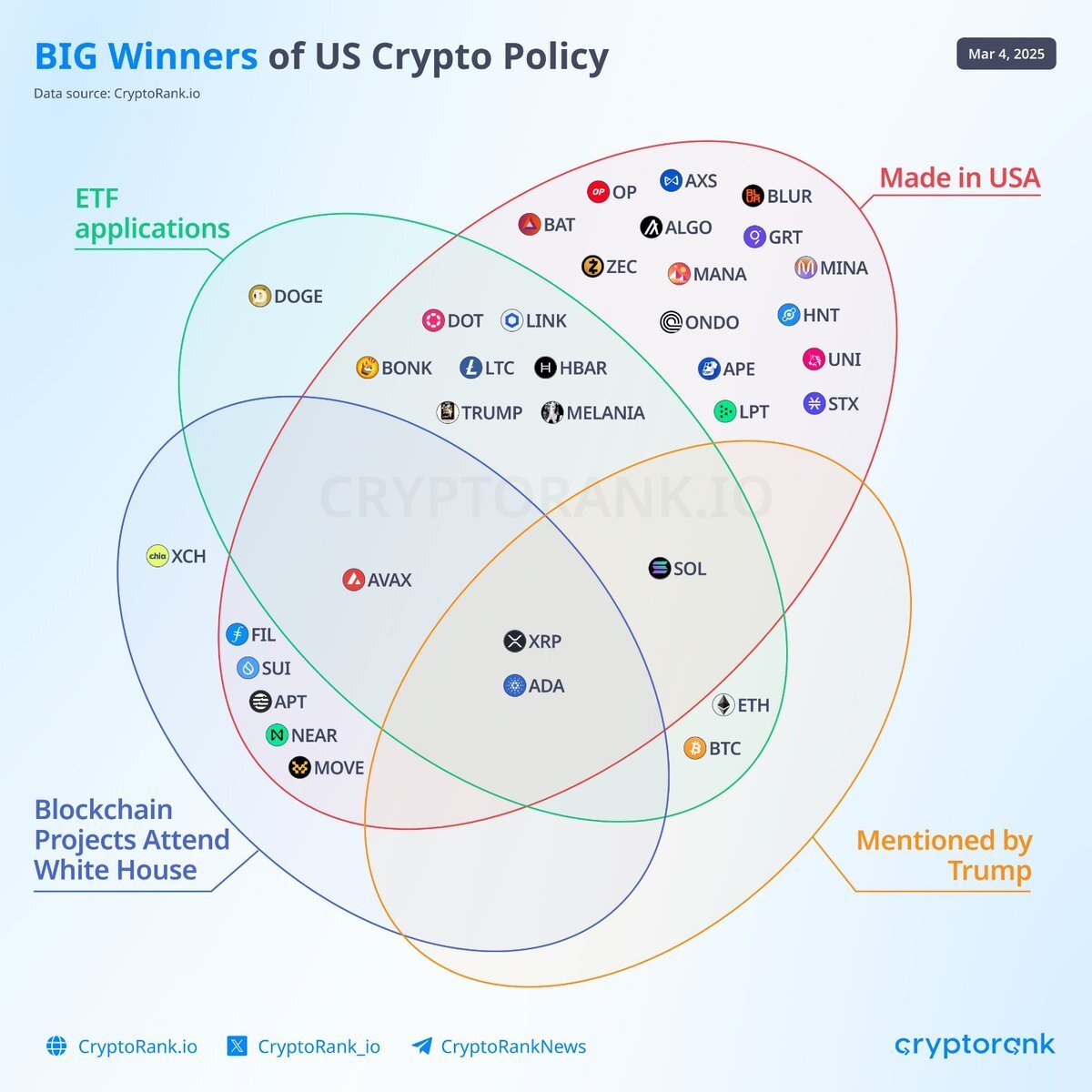

Bitcoin didn’t just move sideways in March—it moved up the geopolitical ladder. With the US formally designating Bitcoin as a strategic reserve asset, the digital currency took on a new identity: not just a hedge, not just an investment, but a tool of statecraft. Bitcoin became strategic.

Bitcoin has reclaimed $90K as the highly anticipated Crypto Summit approaches in less than 48 hours.

Progress is being made in Eastern Europe, while confusion surrounding the Trump tariffs continues to grow.

With no mention of crypto in Trump’s investment announcement this morning, all previous gains were erased.

Trump’s crypto volatility: Strategic Reserve posts and the upcoming Crypto Summit send Bitcoin to $95K.

Bitcoin bounces strong, Oval Office drama unfolds, and Solana gears up for CME Group launch.

Trump’s victory propelled Bitcoin to new all-time highs, but now his tariffs are driving a severe market correction, pushing sentiment to its lowest levels in years.

With new tariffs set to go live in a few days, market uncertainty remains high.

Trump announces EU tariffs, triggering market panic and a sell-off.

Market volatility remains high; most altcoins have rebounded, while Bitcoin struggles below $90K.

Binance began offloading ETH just as Bybit completed its accumulation, while Trump reaffirmed tariffs on Canada and Mexico, adding pressure to the markets.

The dust has settled following Bybit’s $1.4 billion hack.

Bybit, one of the world's leading crypto exchanges, has just been hacked for $1.4 billion.

Momentum is shifting as Bitcoin nears $100K, altcoins rebound, and market conditions improve.